Analysis

Last week alone, US share CFDs markets wiped all gains made since early October in the biggest weekly decline since the 2008 Global Financial Crisis (GFC).

China’s official manufacturing PMI printed in contraction at a record low 35.7 - yes, that’s lower than any point during the GFC. China’s economy, which makes up 18% of the global economy, is virtually at a standstill and markets are now expecting central banks to come to the table and ease financial conditions.

Just one week ago, investors were seemingly unphased by the novel coronavirus, pricing only a 7% probability of the RBA cutting rates at all. Today, markets are pricing a 100% chance of a 25bp rate cut and a 25% chance of a 50bp cut.

So we ask what this means for Australia if its biggest trading partner has so deeply contracted.

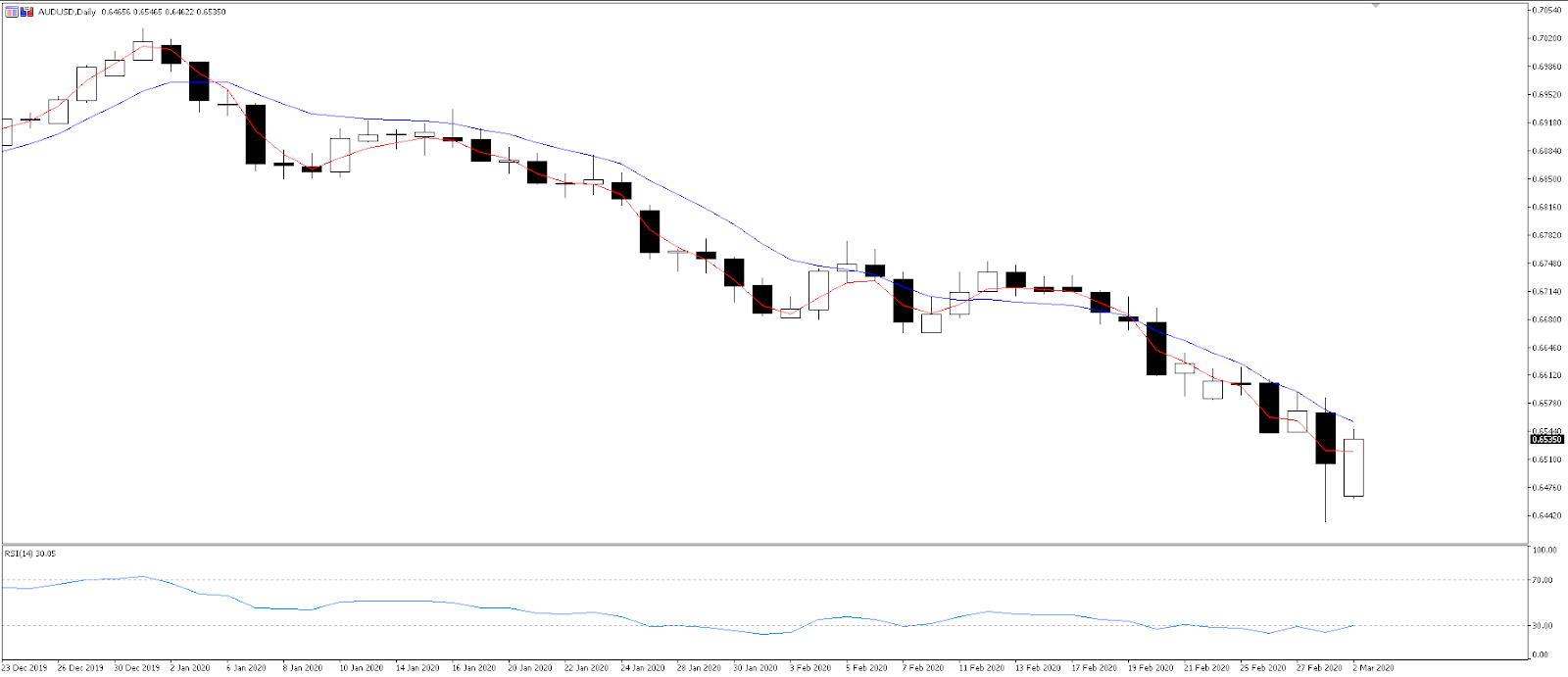

Well it’s bad news for its currency and its share CFDs market, especially considering the Australian economy seemed to be at a gentle turning point with inflation expectations and unemployment cooling. Since the outbreak, AUDUSD has been traded as a global risk proxy, driving the Aussie to lows not seen since the GFC.

What happens if the RBA does not cut tomorrow?

It is unlikely rate cuts will mitigate the effect of the novel coronavirus, which threatens supply and demand on a global scale. Rate cuts won’t get people outside and spending if they are quarantined to their homes, and companies can’t invest to produce more product if they can’t access crucial materials disrupted by global supply chains.

The other side of the argument though is that coordinated rate cuts will encourage a rebound once the virus is controlled.

Wherever the central banks stand on the matter, global central banks, including Governor Lowe and his RBA colleagues, have had their hands forced by market pricing here.

If the RBA did not cut rates given the circumstances, we would see a massive AUDUSD rally, higher volatility, and more unstable market conditions.

Across the Pacific, Governor Lowe’s US counterpart Jerome Powell has said the Federal Reserve will use monetary policy tools to support markets as appropriate.

We expect the RBA to cut rates

The question though, is by how much? Markets are pricing in more than one full rate cut - a sort of frenzy not seen since the GFC. The RBA can cut by either 25bp or a more drastic 50bp.

A regular sized 25bp cut could cause AUDUSD to snap higher, although their forward guidance will be key here.

A one and done rate cut seems unlikely given the turmoil. If they did shut the door to an additional rate cut at the following meeting, AUDUSD would rally as that second rate cut gets priced out. Most likely though is the RBA leaving the door open to an additional rate cut at the April meeting, which would give way for further AUDUSD downside.

Of course, the RBA could take a crisis-level measure and slash the cash rate by 50bp, taking it to a record low 0.25%. This would further weaken the AUD, especially if forward guidance leaves markets expecting more cuts, taking it to yet another post-GFC low. This move would take the RBA closer to the lower zero-bound and open the door to quantitative easing, a move the central bank has been reluctant to pursue.

However big the rate cut, we would expect RBA policymakers to leave the door open for further rate cuts, providing AUDUSD some stability in uncertain times.

AUDUSD rallied some 500 points in early Asian trading as news of central bank coordination provided relief to concerned markets. As the virus continues to spread across the globe and China’s economy halts to a standstill, the long-term trend for AUDUSD does feel further to the downside.

AUDUSD has rebounded in early Asian trading. Rate cut guidance will forge the path forward.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.