- English

- 中文版

Calmer Conditions Prevail Ahead Of Busy Start To Q4

WHERE WE STAND – Let’s be honest, a Friday with nothing of any particular note on the data docket, which also happened to be day 1 of the Ryder Cup (the result of which was never in doubt last night!!), never looked like a recipe for a highly volatile and exciting end to the week.

So it proved, as the week wrapped up with, frankly, very little to write home about, with markets meandering across the board, and with the minimal moves we did get distinctly lacking conviction, as the dollar softened just a touch (likely on EoM/Q flows), stocks rebounded a bit after a tough week, and Treasuries trod water across the curve.

As mentioned, fresh fundamental catalysts were very thin on the ground indeed. Last month’s core PCE deflator, the Fed’s preferred inflation metric, printed bang in line with expectations at 2.9% YoY, and in any case matters relatively little right now given the FOMC’s characterisation of inflation, especially that stemming from tariffs, as a ‘one-time’ shift in the price level, and the reaction function being almost solely driven by labour market developments at this stage. The same goes for the latest UMich sentiment data, which was revised modestly lower to 55.1, though again I question what 500-odd people in a politically-skewed survey can tell us about the US economy at large.

We look ahead, then, to Friday’s US jobs report for more of a steer on where things may be headed, particularly for signs that the labour market might’ve started to bottom out in September, given my view that recent softness is more a reflection of an adjustment to the tariff uncertainty seen earlier in the year, as opposed to a sign of more worrying, structural weakness.

Of course, there is actually a question of whether we’ll even get that jobs data. Given the risk of a US government shutdown mid-week, and a distinct lack of progress being made on even a stopgap spending bill to keep things open for the time being, there seems a relatively high chance that the September jobs report isn’t released on Friday. I doubt that would alter the near-term Fed outlook too much, as plenty of other private sector data is available, hence my base case remains 2x 25bp cuts, at the October and December meetings, to round off the year. Still, at least if the jobs report is delayed, we all have a decent excuse for a long lunch on Friday…one can dream!

Back to markets, and I must admit to being pleased to see equity bulls having emerged from the shadows as the week drew to a close, with dip buyers having emerged once more. My firm view is that the path of least resistance continues to lead to the upside, amid strong underlying growth, solid earnings growth, and a looser policy backdrop stemming from the Fed’s ‘run it hot’ approach. Frankly, some of the bearish hyperbole doing the rounds last week was laughable, especially with spoos less than 1% off the highs printed last Monday.

On a similar note, September is supposedly the worst month of the year for the equity market, yet the SPX is on track to end the month with a 3ish% gain – if that’s how the market trades in a typically negative month, imagine how much better things could be when seasonality becomes a tailwind in Q4. Add on top further tailwinds from the monetary side of things and, soon, the effects of the ‘One Big Beautiful Bill Act’ being felt as well, and the bull case looks solid not only in the here and now, but moving forwards as well.

Those equity tailwinds should also be tailwinds for the dollar, which last week chalked up its best performance since the start of August. I’d expect markets to look through the Fed’s relatively more dovish stance compared to G10 peers, and instead focus on how that approach, coupled with the aforementioned fiscal stance, combine to now tilt risks to the US economic outlook to the upside for, probably, the first time this year. Now that the DXY has taken out its 50-day moving average to the upside, the top of the recent range at 99.20 is the next target for the bulls – per some back of a fag packet maths, that would take cable to 1.33, the EUR to 1.1550, and the JPY to approx. 151.

Elsewhere, I continue to like gold, not only as the bulls have momentum firmly on their side, but also as the risk of un-anchoring inflation expectations, runaway govt. spending across DM, and huge physical demand from reserve allocators all continue to drive the market higher. Interestingly, the rally in gold has finally started to broaden out to other precious metals (e.g. silver, platinum, palladium) in recent sessions. The bull case for all 4 remains a solid one, with $4,000/oz in gold and $50/oz in silver reasonable medium-run targets in my mind.

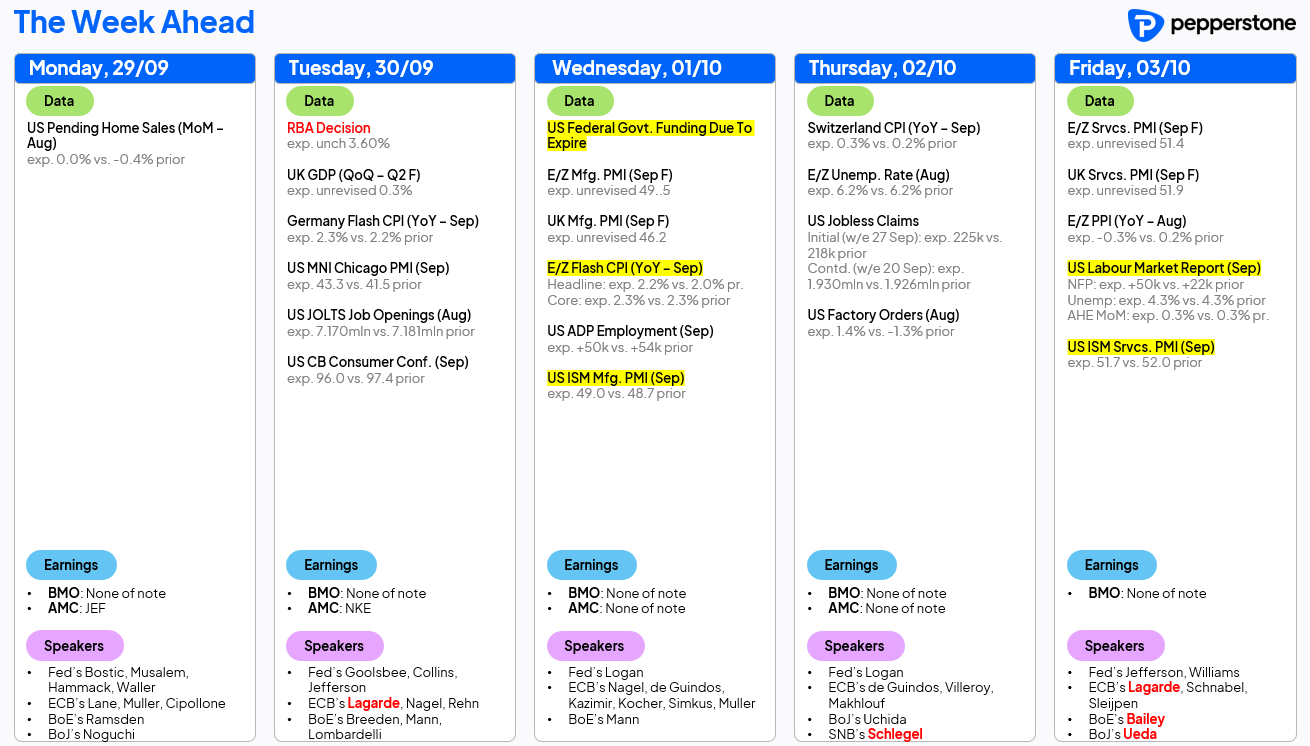

LOOK AHEAD – A busier data docket awaits, as Q3 wraps up, and we enter the final stretch of 2025.

As mentioned earlier, the latest US labour market report, due Friday, highlights proceedings, though there are some question marks over whether we will actually get to see the data. Assuming the current impasse on Capitol Hill continues, and given that no appropriations bills have made it into law, it is likely that releases from the BLS, BEA, Census Dept, etc. will cease in the event of a shutdown, until government funding is restored. That means that Tuesday’s JOLTS report might be our last ‘official’ look at the US jobs market for some time, though we will in any case receive the latest ADP employment figures, plus the two ISM surveys, during the week ahead.

Elsewhere, September’s ‘flash’ eurozone inflation data should reinforce the idea that the ECB are done and dusted with rate cuts for the cycle, while the RBA are set to stand pat on policy tomorrow morning. On the subject of central banks, a slightly ridiculous number of G10 policymakers are due to make remarks this week, with this deluge of speakers very much being the definition of ‘all noise, no signal’.

Besides that, notable corporate reports are relatively thin on the ground, with only Nike (NKE) of note on Wall St, as we remain a fortnight or so away from the ‘proper’ start of Q3 earnings season in mid-October. Meanwhile, developments on the trade front will remain in focus, as will geopolitical headlines, as well as any potential movement in the ongoing legal case surrounding President Trump’s efforts to fire Fed Governor Cook.

As always, the full week ahead schedule is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.