- English

- 中文版

Bitcoin Falls Below $100K: Multiple Headwinds Trigger Sell-off, Setting Stage for Potential Rebound?

.jpg)

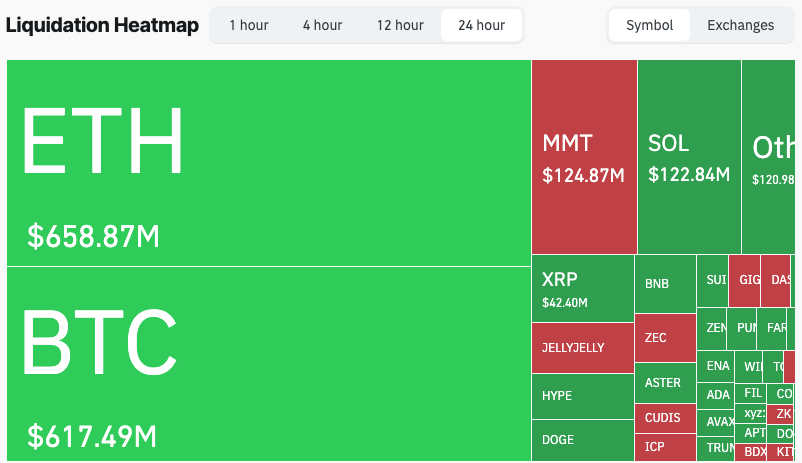

Breaking a seven-year streak of the “October rally,” Bitcoin suffered another sharp decline this week. Within the past 24 hours, the price briefly fell below $100K, hitting a new low since June and marking a cumulative drop of over 20% from the all-time high reached in early October. Liquidations escalated rapidly, totaling around $1.8 billion, with longs accounting for over 85% of the wiped-out positions.

Beyond Bitcoin, Ethereum plunged 10% on Tuesday, while other major tokens including BNB, Solana, and Dogecoin also faced broad losses. The widespread bullish expectations and “buy the dip” logic that had previously supported the market are now being severely tested, putting trader confidence under significant pressure.

Triple Headwinds Weigh on Market Sentiment

This round of sharp Bitcoin declines is not merely a routine technical correction but the result of multiple macroeconomic factors converging. Global liquidity tightening, cascading liquidations, and a noticeable cooling of institutional buying have together created a “perfect storm.”

At the macro level, a sudden shift in Federal Reserve policy expectations acted as the initial trigger. Last week, Powell indicated that a December rate cut is not guaranteed, prompting markets to sharply revise previously over-optimistic expectations—the probability of a rate cut fell from 96% to below 70%.

The US dollar surged in response, directly impacting risk assets including Bitcoin, while short-term capital sought safety and speculative buying contracted significantly.

Meanwhile, the US bond market continued to “absorb liquidity,” further constraining global cash flow. With delays in government operations, the Treasury General Account (TGA) was depleted, tightening market liquidity even further. Although the Fed attempted to alleviate the pressure by injecting liquidity through the banking system, Treasury auction volumes far exceeded expectations.

This week, bids for 3- and 6-month Treasuries totaled $163 billion, with approximately $65 billion in corporate debt also scheduled for issuance. The massive funding demand in the bond market forced capital out of risk assets, intensifying selling pressure on Bitcoin.

Internal confidence within the crypto market is also under strain. In just 48 hours, Balancer and Stream Finance both suffered security breaches, resulting in over $200 million in funds lost. These incidents have further undermined trust in DeFi platforms.

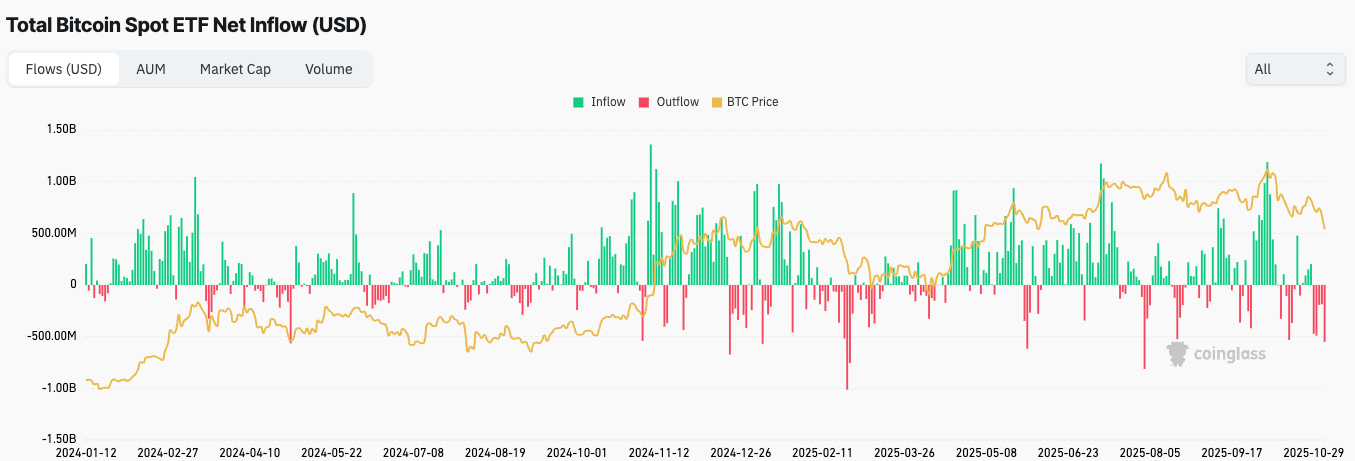

Caught between macro headwinds and internal market pressures, the primary driver behind Bitcoin’s recent gains—institutional capital—has begun to retreat. According to CoinShares data, Bitcoin spot ETFs have seen net outflows of approximately $1.88 billion since October 29, with significant contributions from iShares Bitcoin Trust (IBIT) and Grayscale GBTC, reflecting a notable cooling of institutional bullish sentiment.

Nevertheless, it is worth noting that cumulative inflows for the year remain positive, indicating that the long-term rationale for institutional allocation has not been fully undermined. Despite pronounced short-term volatility, Bitcoin’s price retains structural resilience.

The $100K Battle: Where Is Bitcoin’s Short-Term Bottom?

From a technical perspective, $100,000 remains a key support level for Bitcoin. After the intense volatility seen in October, both market liquidity and investor confidence require time to recover. Currently, Bitcoin sentiment indicators have entered “extreme fear” territory, suggesting that short-term volatility may remain elevated.

If the $100,000 support level fails to hold, Bitcoin could face more severe selling pressure, potentially dipping toward $98,000 as buyers seek entry at lower levels. Conversely, if a technical rebound occurs, attention should focus on the local lows around $107,250 and $109,350, repeatedly tested since July and near the 20-day moving average. These levels will be critical in determining whether bulls can regain control.

Historically, November tends to be an active month for Bitcoin. Over the past decade, it has delivered positive returns eight times, with an average gain of roughly 19%, and in some years exceeding 40%. While past performance is not a guarantee of future results, this seasonal pattern may provide useful guidance as market sentiment recovers.

Monitoring On-Chain Signals to Navigate Market Swings

Overall, with a slowdown in Fed rate cut expectations, market security incidents, and large-scale institutional outflows, Bitcoin faces significant short-term pressure. In this context, traders and investors should focus on several key points.

First, maintaining rational decision-making and robust risk management is critical. Historical experience shows that crypto markets are highly cyclical. Staying disciplined during periods of panic and exercising caution during overheating are essential for long-term, sustainable returns. Ignoring risk control and chasing momentum can magnify losses.

Second, place greater emphasis on on-chain metrics rather than short-term market noise. Core indicators, such as the fear index, funding rates, and the Stablecoin Supply Ratio (SSR), provide more objective insights into market sentiment.

According to CryptoQuant, SSR has fallen to around 13, a level historically associated with potential liquidity inflection points. A declining SSR indicates an increase in stablecoin balances and accumulation of latent buying power, suggesting that capital may be quietly entering the market.

For long-term investors, even amid sharp short-term swings, some remain committed to buying the dip. From a macro perspective, the Fed has signaled a potential policy pivot, and markets expect liquidity conditions to ease—an encouraging factor for crypto and other risk assets in the medium to long term.

Additionally, market structure is gradually stabilizing. The introduction of spot Bitcoin and Ethereum ETFs lowers barriers to entry and diversifies price reactions. Improved regulatory frameworks have also increased institutional participation, enhancing market resilience to short-term fluctuation.

Finally, volatility is a market constant. Every deep correction may create the foundation for the next growth phase. Being aware of market cycles and maintaining a disciplined approach can help traders navigate periods of uncertainty more effectively than focusing only on immediate market swings.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.