- English

- 中文版

Bitcoin Dips Below $90,000: Not a Trend Reversal, Liquidity and Holdings Are Key

.jpg)

On October 6, 2025, Bitcoin briefly surged to a record high above $126,000, sparking excitement among traders worldwide. However, over the following six weeks, prices steadily retraced. On Tuesday, Bitcoin’s intraday low fell below $90,000, marking the lowest level since late April. From its all-time high, the maximum drawdown is approaching 30%, indicating that Bitcoin has entered a technical bear market.

After briefly touching the lower boundary of the downtrend channel that began in early October, Bitcoin rebounded to around $93,000 this morning. If bullish momentum continues, support levels from late April at $93,500 and the June low near $98,200 could act as key hurdles before challenging the $100,000 mark.

Conversely, if the pullback intensifies, the local high from March at $88,600 may provide short-term support, while the annual low of $74,500 represents a potential key bottom.

With bulls facing heavy losses and leveraged positions forced to liquidate, traders are asking: what triggered this large-scale sell-off? Is this a short-term correction or the start of a longer-term trend reversal?

Macro Storm: Economic Uncertainty and Slower Fed Rate Cuts

Bitcoin’s price is fundamentally driven by its scarcity and USD liquidity, and the recent decline is directly linked to tightening dollar liquidity.

Since Powell emphasized that a December rate cut is not guaranteed, several Fed officials have signaled a hawkish stance due to persistent inflation. Coupled with government shutdown disruptions that compromise the reliability and timeliness of economic data, markets remain “flying blind” in pricing Fed actions, increasing risk pricing challenges.

As a result, the market’s expectation for a December rate cut has dropped from over 90% a month ago to roughly 40%, and 2026 rate cuts could decline from three to just one. The slower expected pace of rate cuts has pushed up U.S. Treasury yields, putting pressure on Bitcoin and other risk assets.

Liquidity Outflows: Leveraged Liquidations and Long-Term Holder Sales

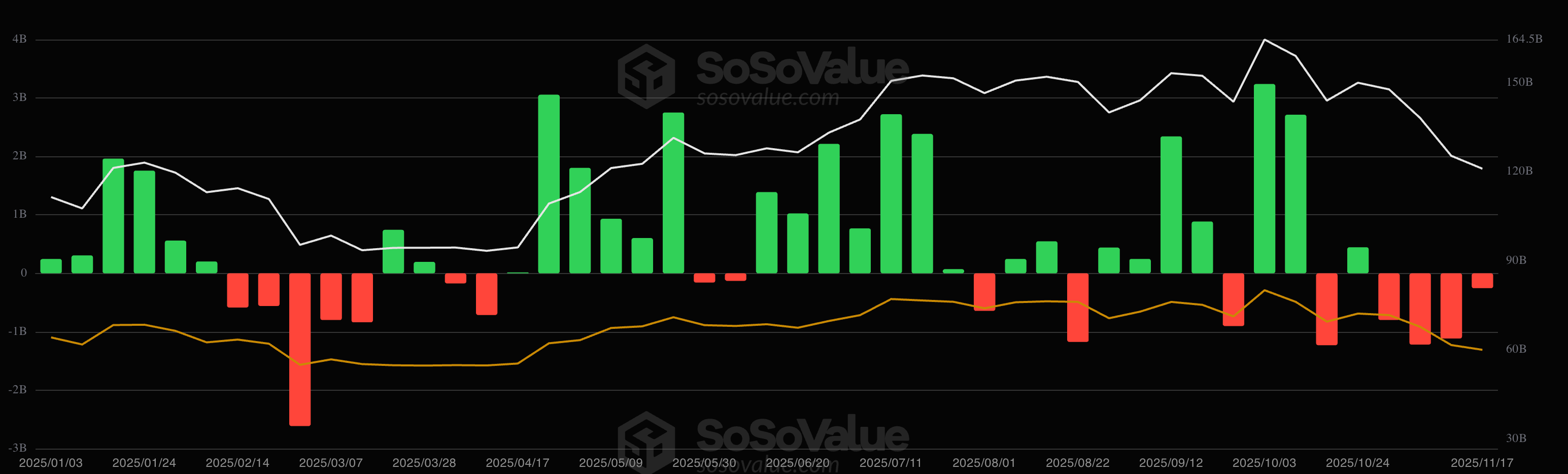

Spot Bitcoin ETFs have historically been a key support for the market, but large outflows have weakened that support. Long-term holders taking profits at highs, coupled with a lack of new capital inflows, has increased structural pressure on the market.

SoSoValue data shows that as of November 17, spot Bitcoin ETFs recorded net outflows of nearly $3.4 billion for the month, with the largest single-day outflow on November 13 at roughly $870 million. Institutional funds that once drove Bitcoin to all-time highs, such as BlackRock’s IBIT and Fidelity’s FBTC, are leading withdrawals. This marks the fourth consecutive week of net outflows. If the trend continues or accelerates, the pullback may be prolonged.

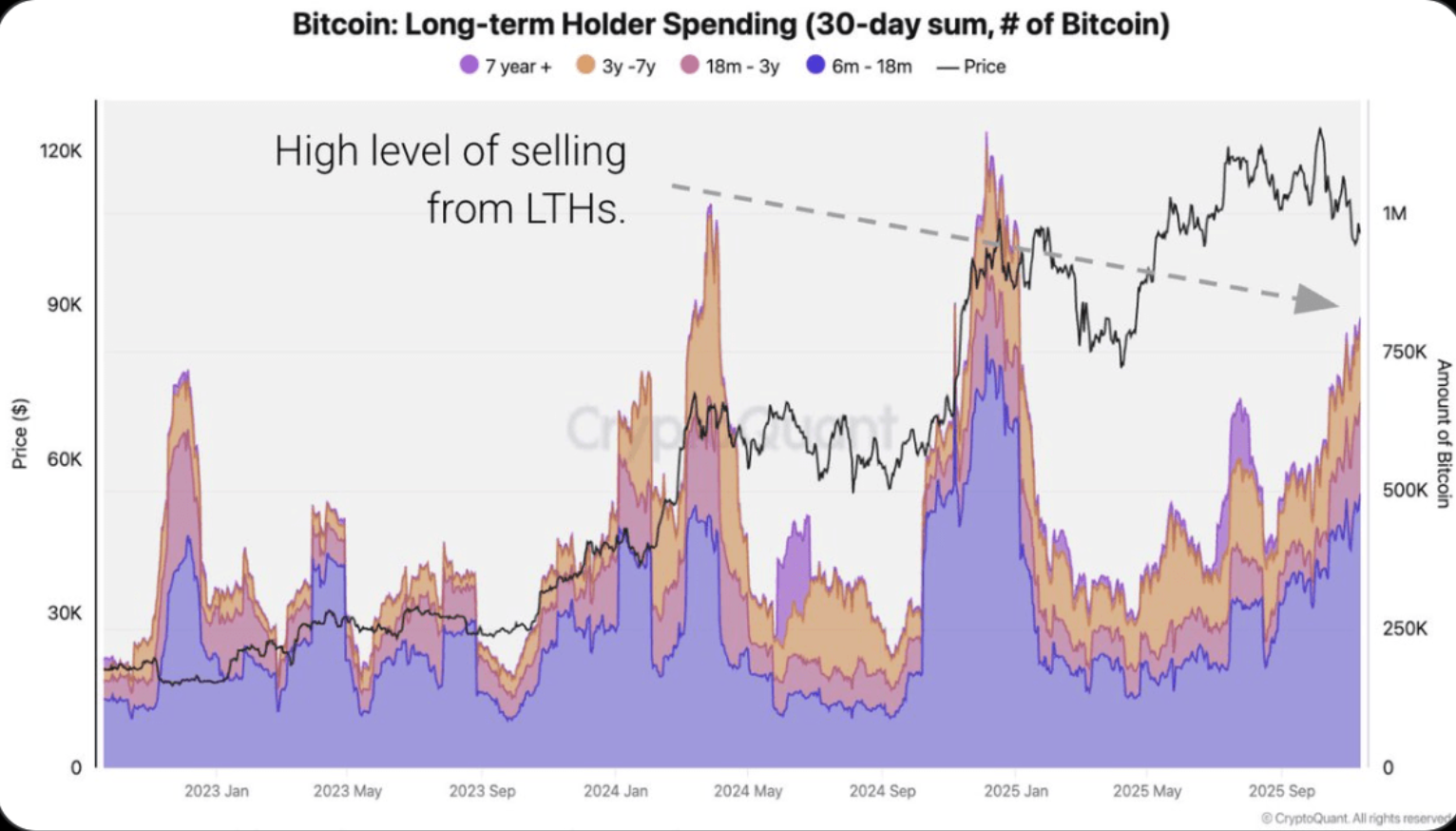

Meanwhile, long-term holders are actively adjusting positions. CryptoQuant data shows that investors holding Bitcoin for over 155 days sold approximately 815,000 BTC in the past 30 days, the highest volume since January 2024.

ETF outflows combined with long-term holder sales have tightened market liquidity, pushing short-term Bitcoin prices lower and highlighting weakening market confidence.

Growing Cryptocurrency Trust Crisis

Beyond macro factors, trust issues within the crypto market itself are intensifying downward pressure.

In October 2025, the U.S. Department of Justice seized 127,000 BTC from a Cambodian cyber fraud group, valued at around $15 billion, setting a new global record for crypto asset confiscation. This event shattered the perception of absolute security in crypto, as private keys once considered inviolable were compromised by law enforcement.

Questions over security have further shaken investor confidence, directly hitting the value foundation of crypto assets and presenting unprecedented challenges to market trust.

Long-Term Bullish Narrative Remains: Liquidity and Institutional Holdings Are Key

Overall, this Bitcoin pullback is not due to a single factor. It is the result of combined forces: Fed policy uncertainty, tightening liquidity, crypto security challenges, and trader sentiment. The market is now reassessing fundamentals and liquidity conditions, limiting Bitcoin’s near-term upside.

That said, I view this retracement more as a short-term correction rather than the start of a 60%-70% crash. Historically, Bitcoin bull markets have been driven by the “dual engines” of supply contraction from halvings and global liquidity expansion. With the most recent halving concluded, liquidity becomes the critical factor.

After the recent crash, futures markets have completed a “leverage reset,” creating healthier positions that allow Bitcoin to rebuild upward momentum. With the U.S. government resuming operations, approximately $1 trillion in TGA account liquidity will gradually flow into markets, potentially boosting Bitcoin bulls.

Moreover, despite the slower pace, the Fed remains on a rate-cut path and will end balance sheet reductions starting December 1. The global economy is still in a loose cycle, and with clearer regulatory frameworks and expanding institutional holdings in Bitcoin ETFs, these factors provide strong long-term support.

In the short term, traders face a critical decision: is the bull cycle over, or will liquidity gradually returning to the market fuel healthier gains? Two points deserve attention: institutional holdings and the Fed’s rate trajectory.

Recently, Bitcoin advocate MSTR sent a clear signal—on Monday, they purchased 8,178 BTC at an average price of $102,000, spending approximately $835 million, providing “buy the dip” support. If more institutions follow suit during the pullback and net holdings rebuild, it could be a key driver for upward movement.

Additionally, if upcoming labor data supports a December Fed rate cut, ample USD liquidity could flow into risk assets, favoring Bitcoin. Conversely, a cautious Fed stance could redirect funds back to Treasuries and cash, pressuring Bitcoin in the short term.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.