- English

- 中文版

Bitcoin Breaks $95,000: Short Squeeze Drives Move, Trend Remains Uncertain

.jpg)

Bitcoin recently broke through the $94,900–$95,000 key resistance zone, ending a consolidation phase that had lasted since mid-November. Following the breakout, the price quickly moved higher, stabilizing above the 100-day moving average and briefly approaching the $98,000 region, marking a two-month high.

From a technical perspective, this is clearly an important breakout. However, the immediate driver of this rally was not fresh spot buying but a concentrated short squeeze. While improvements in macro conditions and institutional capital inflows provided the necessary backdrop, the sustainability of the upward trend still requires validation.

Short Squeeze Fuels the Breakout

Derivative market data indicate that this breakout exhibits a typical structural rally pattern.

Within just 12 hours of surpassing $95,000, the market experienced large-scale forced short liquidations, totaling roughly $250 million, while long liquidations remained relatively limited. This demonstrates that once the key resistance was breached, selling liquidity rapidly evaporated and was passively converted into buying pressure, driving the price higher.

When stop-loss orders and margin calls are triggered simultaneously, short positions are forced to cover at market prices, creating a feedback loop of “price rise → short covering → further price push.” This mechanism represents the most immediate and core driving force behind the breakout.

From a trading perspective, the price’s ability to swiftly surpass the previous high-volume zone was not due to a sudden consensus on bullish sentiment but rather the concentrated removal of bearish pressure, creating a clear opportunity for buyers to step in.

Fundamentals Support Price Action

While the short squeeze provided the immediate impetus, such rallies are rarely sustainable without a relatively supportive macro and capital environment. The current price action shows that Bitcoin is consolidating in an orderly manner above $95,000, repeatedly confirming support levels, indicating that underlying fundamentals continue to provide structural support.

First, the moderate easing of U.S. inflation and employment data has reinforced expectations of a potential mid-2026 rate cut. Even if the Federal Reserve likely remains on hold in January, the anticipation of continued liquidity supports non-yielding, high-beta assets such as Bitcoin.

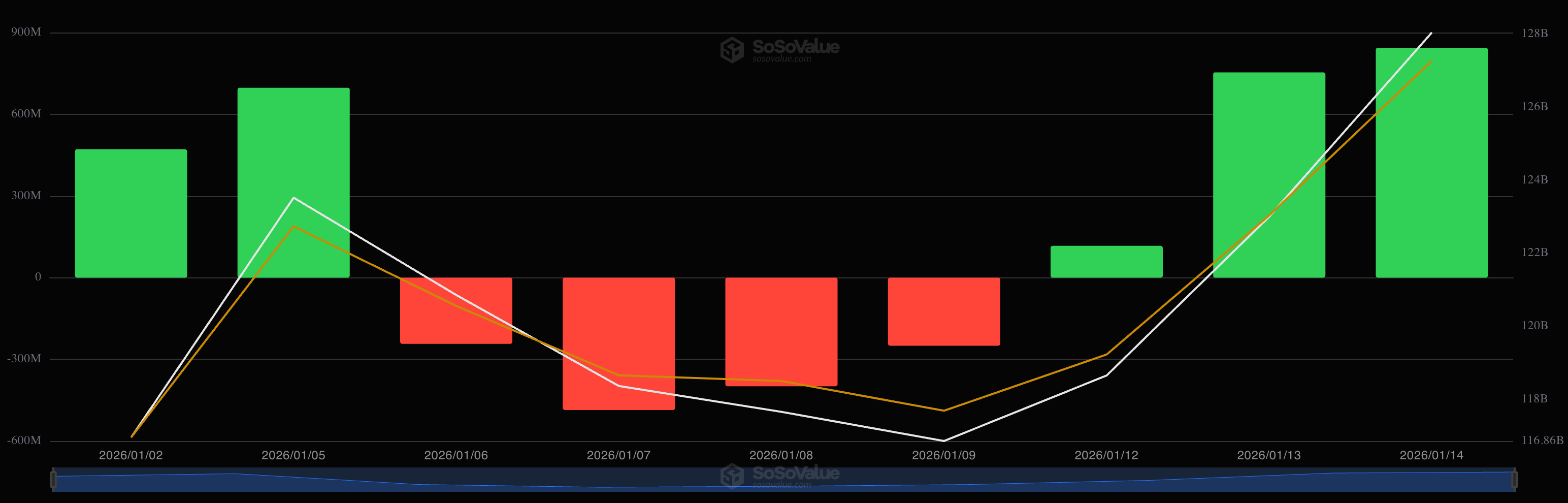

Second, U.S. spot Bitcoin ETFs have seen significant capital inflows recently. According to SoSoValue data, on January 14 alone, these ETFs recorded net inflows exceeding $840 million—the largest single-day inflow since October last year. This indicates that institutions, after completing year-end portfolio adjustments, are redeploying capital into crypto assets, which in turn reduces selling pressure in the spot market.

Additionally, the expiration of certain derivative contracts has cleared previously restrictive hedging structures. Glassnode on-chain data show that by the end of 2025, over 45% of outstanding option contracts were settled, freeing the price from “hedge-related constraints” and paving the way for upward movement post-breakout.

Although these fundamental factors did not directly drive the price higher, they provide crucial support for Bitcoin to hold above breakout levels and increase the probability of trend continuation, allowing the market to remain relatively stable after the release of short-side risk.

Upside Set, But Trend Still Needs Confirmation

Overall, Bitcoin has successfully emerged from its previous high-range consolidation, opening the path for further upside. The short-side pressure has been largely cleared, but whether buyers are willing to step in at higher levels remains to be seen. Without sustained inflows, prices could consolidate near current highs rather than continue in a clear one-sided rally.

The market should closely monitor three key validation signals:

- Whether Bitcoin can establish a new high-volume area above $94,500–$95,000 to reinforce support;

- Whether ETF inflows are sustainable rather than a temporary surge around the breakout;

- Whether the delayed CLARITY Act progresses substantively, providing clearer regulatory guidance.

If these conditions are not gradually met, the current move may be more of a structural recovery than a continuation of a trend. Should bullish momentum persist, the $98,000–$100,000 range, representing prior high-volume levels and key psychological resistance, is likely to see increased volatility in the short term.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.