- English

- 中文版

BHP Surges to Record High as 1H26 Earnings Beat Drives Copper-Led Re-Rating

Summary

• BHP shares surged 7.7% to record highs after delivering a strong 1H26 earnings beat.

• Copper division outperformed expectations, with upgraded production guidance and earlier cash flow expected from Vicuna.

• Robust free cash flow and a 60% payout ratio for its dividend, reinforce BHP as a preferred ASX copper exposure.

Market Reaction: Earnings Beat Sparks 7.7% Rally

Shares in BHP Group surged to fresh all-time highs of $54.20 following the release of its 1H26 results, delivering a 7.7% earnings-day move. Options markets had priced an implied move of ±4.5% for earnings day, meaning the days rally represented a clear upside surprise. The magnitude of the move places BHP alongside the ASX mega-cap banks in terms of outsized earnings-day performance. The takeaway is simple: the market was positively shocked, both by the earnings result and the forward guidance.

What Did the Market Like?

1. Copper Earnings Beat Consensus

BHP’s copper division delivered earnings well above consensus expectations in 1H26. At a time when copper remains one of the most structurally attractive commodities globally, driven by electrification, AI infrastructure, and energy transition demand, this matters.

Copper remains the commodity “du jour”, and BHP’s asset base positions it as a core institutional expression of that theme.

2. Clear Guidance on Vicuna Copper Project

BHP provided defined guidance on the Vicuna copper project, located on the Chile–Argentina border.

Key highlights:

• 3% compound annual production growth through 2030, accelerating into 2035

• Stage-one production expected in 2030, two years earlier than market expectations of 2032

• Capital-intensive project (~$18bn total capex previously flagged), but earlier cash flow improves NPV

Bringing forward production materially enhances valuation metrics. Earlier cash flow means stronger net present value (NPV), and that’s precisely the type of update that drives re-ratings in mining equities.

3. Escondida Production Guidance Upgraded

At Escondida, BHP is guiding to 1.0–1.1 million tonnes of copper production in 2027 - slightly above market expectations.

Importantly:

• Diversifies copper production across assets

• Unit costs are trending slightly below prior expectations

• Supports medium-term earnings resilience

This strengthens BHP’s position as a diversified copper major rather than a single-asset story.

Asset Monetisation and Silver Streaming Boost Balance Sheet

BHP also announced a $4.3 billion silver streaming agreement tied to future production at the Antamina Mine. Combined with other asset sales and monetisation initiatives, total asset realisations could approach $10 billion.

Implications:

• Strengthens forward EBITDA profile

• Improves balance sheet flexibility

• Supports capital returns This is strategic portfolio optimization - recycling capital into higher-growth copper opportunities.

Strong Free Cash Flow and Dividend Support

BHP maintained a 60% dividend payout ratio, a robust outcome for shareholders seeking income in the absence of major M&A. With strong free cash flow generation and asset monetisation underway:

• Dividend sustainability looks solid

• Capital discipline remains intact

• Shareholder returns remain a core focus

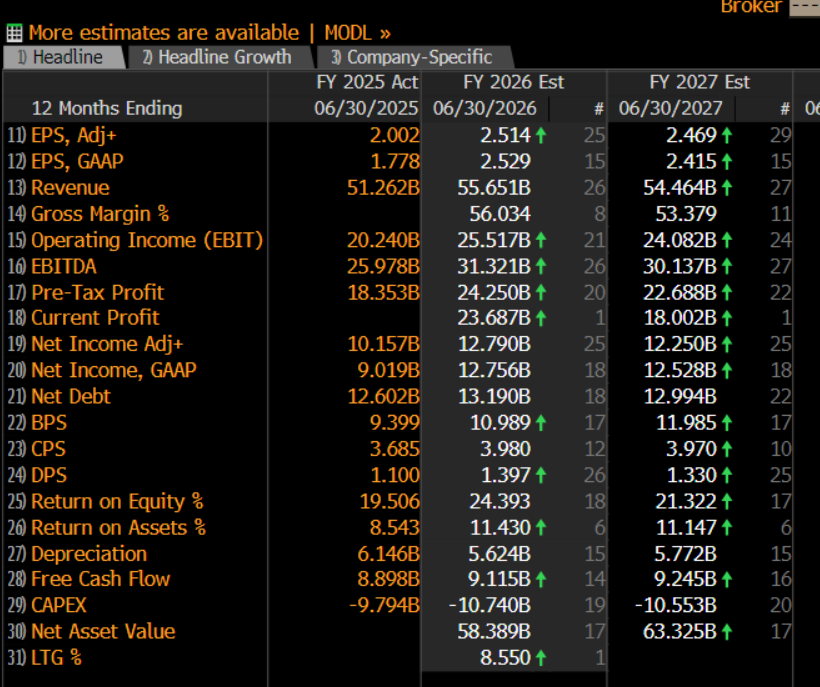

Consensus full-year EBITDA expectations currently sit around $31.3 billion, with FY27 at $30.2 billion. Given the earnings beat and upgraded copper trajectory, upward revisions appear likely.

Why BHP Is a Preferred Copper Expression

Structurally, BHP is in excellent condition:

• High-quality tier-one copper assets

• Visible multi-year production growth

• Improving cost profile

• Strong balance sheet

• Capital return discipline In a market that increasingly rewards exposure to structural copper deficits, BHP stands out as a scaled, liquid, institutionally preferred vehicle.

Outlook: Buy the Pullbacks?

The move to all-time highs signals a market re-rating in progress. With copper fundamentals supportive, earlier Vicuna cash flow, diversified production growth, and strong free cash generation, the bias remains constructive. Should the stock see tactical pullbacks, they are likely to be met with demand - particularly from investors seeking long-duration exposure to copper’s structural theme.

BHP has reasserted itself as a core ASX large-cap holding, and the market has taken notice.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.