- English

- 中文版

WHERE WE STAND – Well, here we go again then. Back to the grindstone, buckled up and ready for the rollercoaster ride that 2025 is likely to bring.

I’m loath to read too much into the price action that has panned out during the two-week festive break. As with any period where volumes are so light, and conditions so thin, market moves tend to produce an incredible volume of noise, but precious little when it comes to signal.

The year properly gets underway now, though I do wonder whether we see the seemingly typical dramatic shift in sentiment in a fortnight’s time. Participants, traditionally, reassess their initial positioning around the time of Martin Luther King Jr. Day (20th January), which this year coincides with the inauguration of President-elect Trump. That would, then, seem a natural juncture for some de-risking, and lightening up of positions, in preparation for the early days, and actions, of Trump’s second term in office.

I can only hope my 2025 outlook has a longer sell-by date than 2025’s early market moves might have! In one word, my thoughts on the year ahead remain as follows, let’s see how these calls age:

- US: Exceptionalism

- UK: Stagflation

- Eurozone: Stagnation

- China: Disappointment

- Japan: Normalisation

As for the here and now, we start the new trading week, and new trading year, with stocks having enjoyed a strong Friday rally, where both the S&P 500 and Nasdaq 100 erased all of the declines seen a day prior. A choppy start, then, albeit in what were still thin trading conditions, with S&P volumes around 20% below the 20-day average.

I’d wager, though, that these choppy trading conditions are likely to set the tone for what we can expect as the year progresses. While the path of least resistance for equities should continue to lead to the upside, that path is likely to be somewhat bumpier than seen last year, for two reasons.

Firstly, the comfort blanket of the ‘Fed put’ has been removed, after Chair Powell’s December presser built in a greater degree of optionality around the policy outlook, amid increased upside inflation risks, with a ‘skip’ later this month the base case. Secondly, greater policy uncertainty presents itself, particularly on the fiscal front, and with ‘government by tweet’ (or Truth Social) set to make a return from the end of this month. Buying vol seems reasonable.

The tail end of last week also saw Treasuries selling-off across the curve, though again trade here has been extremely choppy over the festive period. That said, 10s at 4.60% and 30s at 4.80% both feel like moves which have gone too far, too fast, and appear to present solid buying opportunities, even if we are to expect a more expansionary fiscal stance from President-elect Trump’s Administration.

It was interesting, though, that last Friday saw some modest USD weakness, as the DXY retreated back under the 109 figure, losing ground against all G10 peers. Again, I’m reluctant to read too much into this move, and remain bullish on the buck over the medium-term.

That said, the greenback has also rallied a long way, in a short space of time, with the DXY now trading more than 4% above both the 100- and 200-day moving averages, the greatest such gulf, in both cases, since the tail end of 2022. Hence, there is potential for a short-term pullback in the buck, perhaps by virtue of some profit taking, ahead of this Friday’s all-important US labour market report.

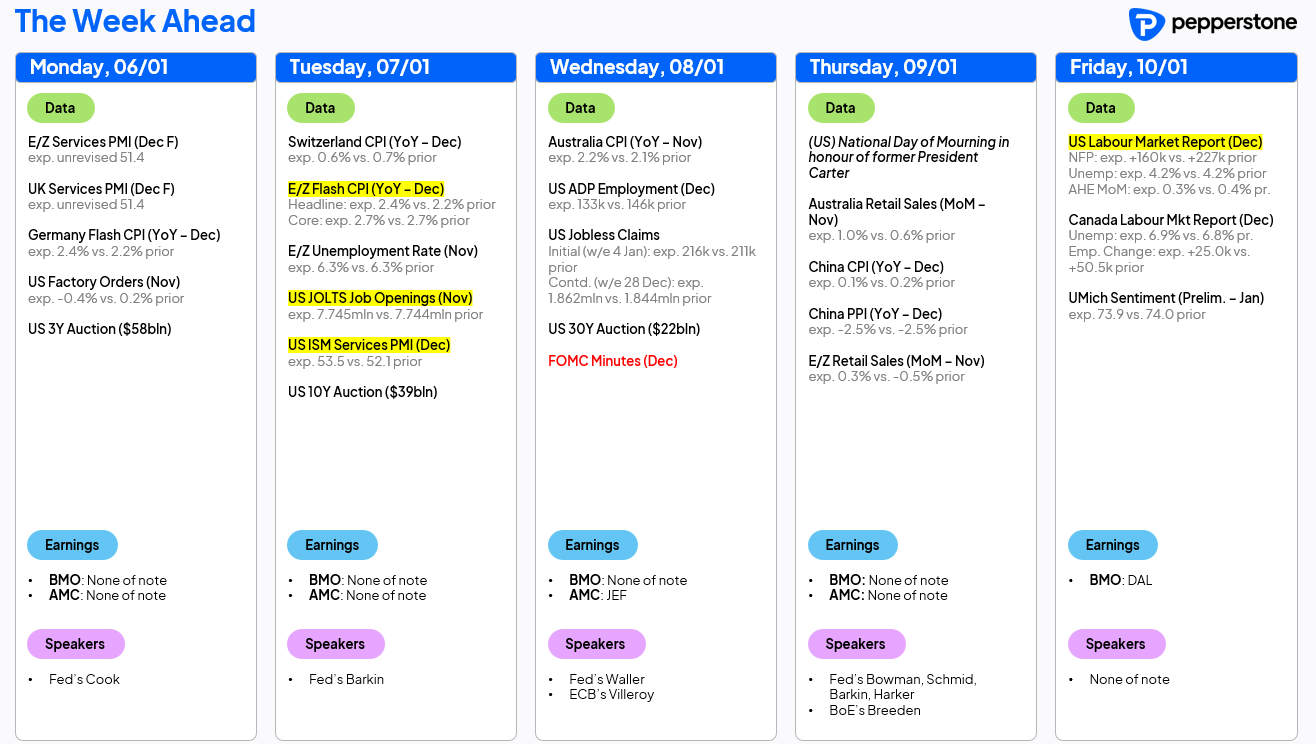

LOOK AHEAD – A busy enough data docket awaits as we start the first proper trading week of 2025, albeit one where most market participants will already have half an eye on Friday’s US labour market report.

Before that, though, a plethora of services PMI prints await today, though with the figures being ‘final’ readings, market-moving potential is low. German inflation figures, though, have considerably more potential to move the needle, acting as a useful leading indicator for the eurozone-wide figure due tomorrow.

Treasury supply is also due later on, with a 3-year note auction scheduled, with the prior auction having tailed by a modest 0.1bp, compared to the 6-auction average of a 0.2bp stop-through.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.