- English

- 中文版

Australian Economy Heating Up: RBA Rate Hikes Implied for 2026, And What This Means for Trading the AUD

On Wednesday, RBA Governor Michele Bullock effectively opened the door to possible future hikes, emphasising that the central bank is fully alert to persistent inflation pressures and is prepared to respond. The easing bias that coloured earlier RBA rhetoric has now been removed. While the RBA still expects inflation to ease back toward target in 2H26, that outlook could change quickly if the Q4 CPI print (due 28 January) lands materially above 3.3%.

Aussie Growth Is Not Overheating - But It’s Running Hot Enough

It’s hard to argue the Australian economy is overheating, but it’s certainly bubbling along nicely, and inflation is now firmly outside of the RBA’s target band and rising. Expansive fiscal policy remains firmly in place, and it’s difficult to see the ALP scaling back spending to assist the RBA in cooling demand and inflation.

At the same time, rising house prices and strong demand for credit suggest policymakers are relying more on APRA to curb excesses. The recent move by the banking regulator to limit banks from lending more than 20% of new loans to borrowers with high debt-to-income ratios shows that macro-prudential tightening is now underway.

The labour market remains tight, with the unemployment rate back down to 4.3%. Household spending jumped 1.3% in October, more than double expectations, and signs point to another solid increase in November.

Q3 GDP grew 0.4% q/q and 2.1% y/y, slightly cooler than forecast and household consumption growth moderated, but remained resilient at 0.5% q/q. However, private demand and capex were notably strong and with Australia’s annual GDP growth above estimated “potential,” the risk of additional price pressures naturally increases. Layer in industrial metals strength, iron ore holding YTD highs, and precious metals rallying, and the macro backdrop skews inflationary.

Markets Reprice the RBA Path - Setting Up a Fascinating 2026

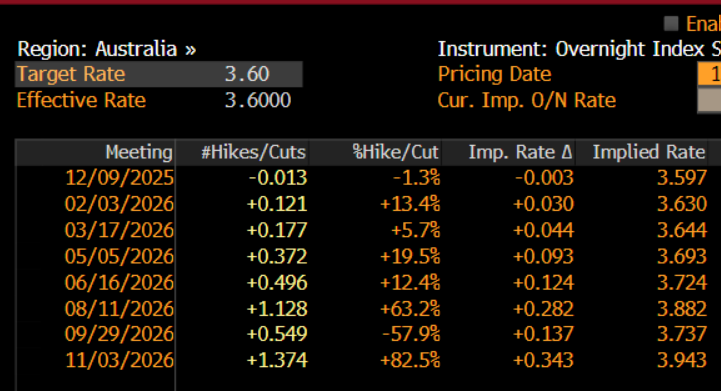

Interest rate markets have responded swiftly. As per the Bloomberg table, AUD interest rate swap pricing now shows:

• May 2026 RBA meeting: a live event with 9bp of implied rate hikes priced

• August 2026 RBA meeting: a 25bp hike is now fully priced

• November 2026 RBA meeting: Swap pricing implies a 37% probability of a second hike before the Melbourne Cup

The relative shift is even more striking when comparing the markets pricing for the RBA vs Fed future policy paths. The market’s implied 1-year forward spread has surged from –86bp to +86bp - an extraordinary swing and signalling diverging central-bank trajectories.

This relative repricing has already fed into AUD strength. When combined with:

• Broad USD weakness

• Low cross-asset volatility

• Strong S&P 500 performance • Firm commodity prices

• USDCNH at its lowest level since October 2024 The environment has become increasingly supportive of AUD appreciation. A stronger tape in Chinese equities would complete the picture to offer a near-perfect backdrop for further AUD upside.

AUD FX Pair Setups: Key Levels to Watch

• AUDUSD: Trading above 0.6600 on USD softness; a push toward 0.6690 range highs are on the radar.

• AUDCHF: Four straight days higher, breaking the 0.5300 range top and hitting the best levels since June. A strong daily close opens trend-following opportunity.

• AUDCAD: Testing YTD highs; range breakout suggests further momentum potential.

• AUDJPY: Momentum has cooled as BoJ hike expectations rise into the 19 Dec meeting but still holding the best levels since July 2024.

• EURAUD: Pressing toward the bottom of its multi-month 1.8100–1.7600 range. A breakdown would be a significant technical event.

ASX Sector Performance Reflects the Rates Story

Interest-rate-sensitive areas of the ASX200 continue to struggle:

• REITs, consumer discretionary, and financials have traded in the red since mid-November as flows rotate into resource names.

• CBA has pulled back to $150 and is consolidating tightly - a break below $150 could open a move toward the YTD low at $140.21.

• Retailers such as JB Hi-Fi show similarly constrained ranges, reflecting cautious sentiment.

Summary: Is the Market Right About Future Rate Hikes?

Whether the market’s pricing for RBA tightening proves to be on the money is debatable, but the data clearly justifies a mild tightening bias. We also need to be open-minded that forward rates pricing may even be too conservative, particularly for late 2026 and early 2027.

Next week’s RBA meeting should reinforce the message: the central bank is willing to respond if inflation risks flare up again. However, any firm guidance on a hiking cycle likely won’t emerge until well after the Q4 CPI print on 28 January.

That said, markets move well ahead of central banks - and the AUD could continue rallying long before the RBA provides explicit confirmation. Multiple AUD pairs are already threatening breakouts, and momentum could accelerate into early 2026.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.