- English

- 中文版

Australia Q3 CPI Playbook: Will Softer-Than-Expected CPI Trigger an RBA Interest Rate Cut?

Summary

• Interest rate swaps currently imply an RBA rate cut in November is more likely than not.

• The Q3 CPI result could significantly alter market pricing and expectations.

• Traders will be watching how the AUD and ASX200 react to the inflation data.

A Make-or-Break Inflation Print

At its September meeting, the RBA kept the cash rate at 3.6%, describing policy as “still a little restrictive,” while reaffirming its focus on delivering price stability and full employment. Since then, the RBA has assessed the September employment data, which revealed a 20bp rise in unemployment to 4.5%, the highest since November 2021 — along with a loss of 40,900 full-time jobs. Although the increase partly reflected a rise in participation and labour supply, the RBA would still see 4.5% as close to full employment.

On balance, the jobs data could support one more 25bp rate cut to bring the cash rate to a neutral setting. However, with the economy showing signs of a soft landing and GDP growing around potential, the final decision will hinge on inflation.

Given the slightly hawkish tone in the RBA’s minutes, the bias seems tilted towards a mindset of “show us why we should cut” rather than “show us why we should hold.”

Q3 CPI Scenarios: How It Could Shape Market Pricing

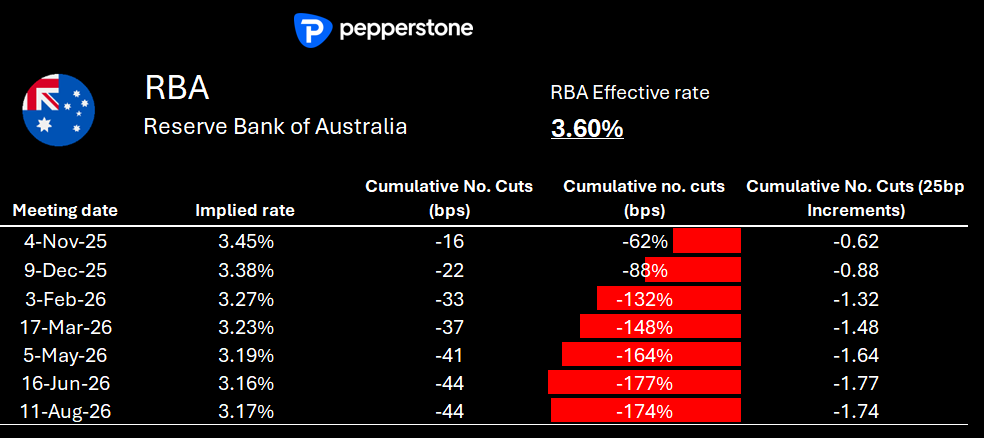

Current setup in AUD rates:

• Aussie interest rate swaps price in 16bp of cuts for the 4 November meeting (≈62% chance of easing).

• If the RBA holds in November, markets imply an 86% probability of a December cut.

• By mid-2026, swaps price roughly 50bp of total cuts, with a projected terminal rate around 3.15%.

The Q3 CPI print could meaningfully alter this pricing — and with it, the direction of the AUD and ASX200.

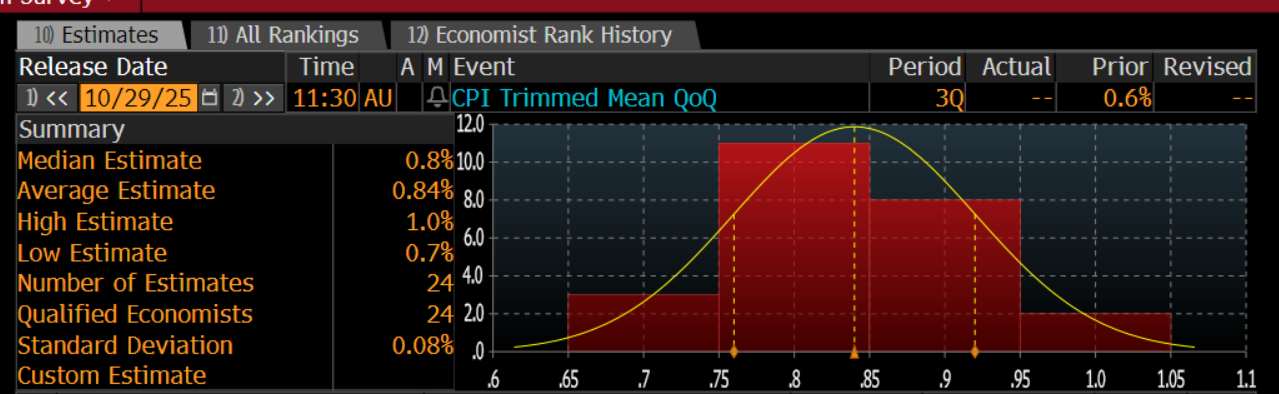

Economists’ Consensus Forecasts

• Headline CPI: +1.1% q/q, +3.0% y/y

• Trimmed Mean CPI: +0.8% q/q, +2.7% y/y

• Range for Trimmed Mean CPI: +0.7% to +1.0%

Scenario Playbook

Market Implication Expected Reaction - Using Trimmed Mean CPI (q/q) to Guide:

- ≤ 0.7% - Swaps imply a 75–85% probability of a November rate cut. AUD trades lower, ASX200 rallies

- 0.8% - The outcome that should largely be priced in; muted market reaction Lineball for November cut — volatility in AUD possible

- 0.9% The implied odds of a cut fall to 45–55%. AUD strengthens, ASX200 modestly weaker

- ≥ 1.0% Inflation would be above the RBA's target band; Swaps imply a <20% probability of a 25bp cut - AUD rallies 60–70 pips, ASX200 down ~0.6%+

Markets to Watch

• FX: The AUDNZD is typically the most sensitive to shifts in Aussie rate expectations, though volatility could extend across other AUD crosses. The AUDUSD will also be in focus, though moves may be shorter-lived given its broader sensitivity to global risk sentiment.

• Equities: Within the ASX200, rate-sensitive sectors such as insurers, banks, REITs, and consumer stocks will likely draw trader attention.

Bottom Line

The RBA has made it clear that it places significant weight on the quarterly CPI print. With markets pricing a mild skew toward a November rate cut, the Q3 CPI data could decisively guide expectations for whether the RBA cuts or holds — and in doing so, set the tone for AUD, rates, and equity market performance into year-end.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.