- English

- 中文版

August 2025 UK Jobs Report: Slack Persists But Earnings Stay Stubborn

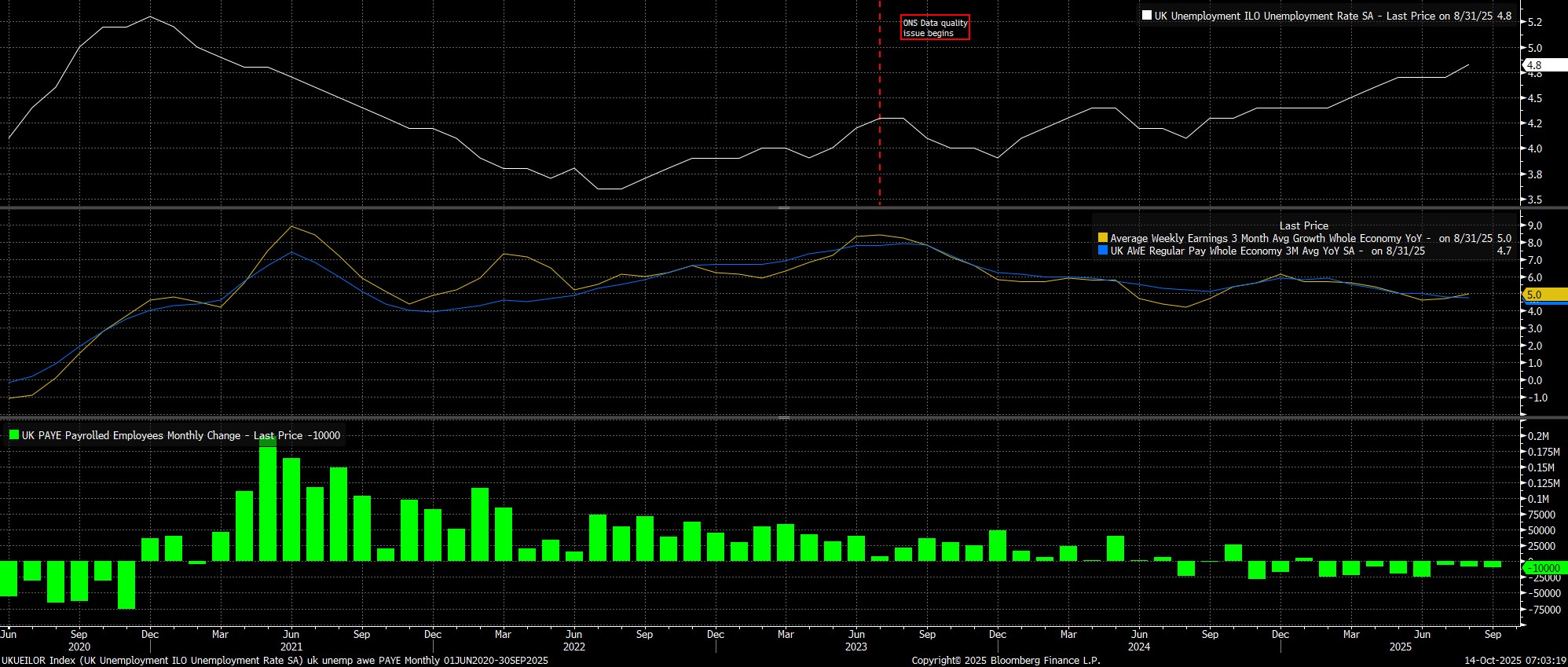

Headline unemployment, in the three months to August, ticked higher to 4.8%, the highest level since mid-2021, implying that a notable margin of slack persists, even if the data must continue to be taken with a pinch of salt

This slack, however, has yet to translate into markedly lower pay growth, with both overall pay (+5.0% YoY) and regular pay (+4.7% YoY) remaining at rates which are quite clearly incompatible with a sustainable return to the Bank of England's 2% inflation aim. While earnings, in August, are likely to have been boosted somewhat by the annual NHS staff pay award, the stubborn nature of earnings pressures is unlikely to provide much cause for comfort for the MPC.

Meanwhile, the more timely PAYE metric of payrolled employees pointed to a decline of 10k in September, the 8th monthly decline in a row, indicating that while the pace of job shedding has slowed markedly from earlier in the year, hiring has yet to materially pick-up.

On the whole, risks to the labour market remain tilted firmly to the downside in the near-term. While the initial adjustment to last year's hike in employer National Insurance contributions appears now to have finally worked its way through the system, uncertainty ahead of this year's Budget is now clearly acting as a notable drag on economic activity.

In any case, there are limited implications from this morning's data for the Bank of England's Monetary Policy Committee, with the reaction function not only hinging largely, if not entirely, on incoming inflation data, but also as quality and accuracy concerns continue to plague the employment statistics.

That said, my base case in terms of the BoE outlook has now shifted, and I no longer expect a 25bp cut in November, given not only the lack of overt hints towards such an outcome in recent remarks from MPC members, but also fading confidence in headline CPI peaking at 4% in September. The aforementioned pre-Budget uncertainty, chiefly where tax rises are going to stem from, and whether they may flare up another bout of price pressures, are another reason for the 'Old Lady' to stand pat for now, even if some of the MPC's more dovish members continue to dissent in favour of further rate reductions.

My expectations is that the BoE will now hold Bank Rate steady until next February, delivering a 25bp cut at that meeting, and then quarterly thereafter, before a terminal rate at around 3.25% is reached in late-2026. Risks to this view, however, tilt in a dovish direction, were price pressures to fade more rapidly than expected.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.