- English

- 中文版

AUD Broadly Strong: AUDUSD Breaks Above 0.68, Q4 CPI Key to Rate Outlook

.jpg)

Since late November 2025, the Australian dollar has been on a sustained upswing. Momentum accelerated further this week, with AUDUSD finding solid support around 0.666 before posting three consecutive daily gains. During today’s session, the pair pushed decisively above 0.68, marking its highest level since October 2024.

The strength is not confined to AUDUSD alone. Across the major crosses, AUD is also trading at multi-month highs, with AUDJPY, AUDCAD, and AUDNZD all drawing increased market attention.

This rally is not a short-lived speculative squeeze or a purely technical rebound. It reflects a genuine repricing driven by fundamentals and shifting expectations.

On one hand, rising RBA tightening expectations contrast with a number of developed-market central banks that remain on hold or closer to easing, improving Australia’s relative yield appeal. On the other hand, easing geopolitical tensions have allowed AUD to benefit from an additional layer of risk premium. In a market environment that favors high-yield, high-beta assets, the Australian dollar sits firmly at the front of the pack.

With both fundamentals and risk sentiment working in its favor, AUD’s near-term price action looks resilient. Even in the face of volatility or unexpected headlines, a sharp pullback appears unlikely for now.

Key Drivers: A Strong Labor Market and Improving Yield Differentials

The most immediate catalyst behind AUDUSD breaking to a 15-month high was Australia’s December employment report, which significantly exceeded expectations. Employment rose by 65,200, almost entirely driven by full-time positions, more than double the market consensus of 30,000.

The unemployment rate fell to 4.1%, participation increased, and total hours worked hit a record high—clear signs that labor demand remains robust and economic momentum intact.

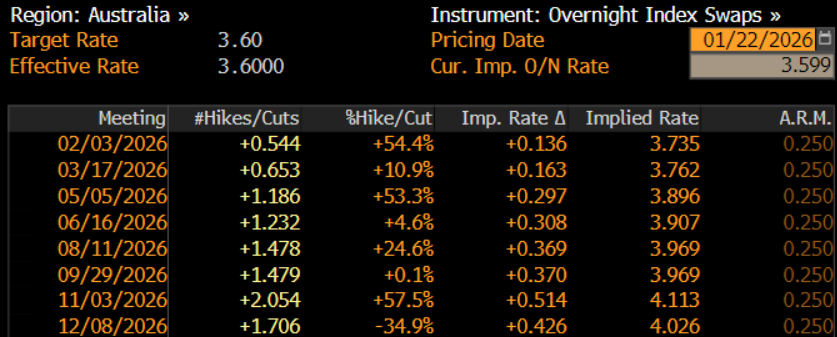

A resilient labor market gives the RBA greater room to tighten policy. Markets are now pricing in more than a 50% probability of a rate hike at the February meeting and have fully priced a 25bp hike by May. Against this backdrop, higher rates provide a natural tailwind for the Australian dollar.

Beyond the domestic story, monetary policy paths in Australia and the U.S. are diverging. Improving yield differentials remain a powerful driver of medium-term currency trends. They support not only short-term trading flows but also longer-horizon portfolio allocation into AUD.

Should the RBA clearly signal—or confirm—further tightening at upcoming meetings while the Fed stays on hold, Australia’s yield advantage is likely to become more pronounced, reinforcing demand for AUD.

Global risk sentiment has also played an important supporting role. Geopolitical tensions related to Greenland have eased for now, equity market inflows have picked up, and prices for Australia’s key export commodities—such as iron ore and gold—remain firm. Together, these factors allow the Australian dollar, as a classic commodity currency, to benefit from both fundamental support and improved risk appetite.

What Could Shape the Next Move in AUD?

Despite AUD’s strong performance, the outlook into the February 3 RBA meeting—and whether bullish momentum can be sustained—will hinge on several key data releases and risk events.

1. Australia’s Q4 CPI

The January 28 release of Australia’s fourth-quarter CPI will be critical in shaping expectations for a February rate hike.

If Q4 inflation stays above 3% or even reaccelerates, markets are likely to further price in a February hike, strengthening AUD bullish momentum.

Conversely, a clear downside surprise—such as inflation falling below 3%—could prompt the RBA to use the February meeting more as a communication checkpoint rather than a moment for aggressive action, potentially triggering short-term volatility in the AUD.

2. S. Labor Data and Policy Variables

The Fed’s policy path remains a key driver of the U.S. dollar and the AUDUSD yield spread, with labor market data central to the timing of any rate cuts. December’s nonfarm payrolls report pointed to structural softening in the U.S. labor market. Current consensus expects January job growth of 55,000 (vs. 50,000 previously), with the unemployment rate holding at 4.4%.

If payroll growth undershoots meaningfully—say in the 30,000–40,000 range—while unemployment remains elevated, the Fed may be forced to consider bringing forward rate cuts, a scenario that would be AUD-positive.

At the same time, lingering concerns over the Fed’s policy independence, shifts in its board structure, or renewed uncertainty around U.S. trade policy could undermine confidence in the dollar. In such an environment, capital may rotate out of USD and toward higher-yielding alternatives, indirectly benefiting the Australian dollar.

Trading the Trend, Staying Flexible

In summary, the Australian dollar’s current strength reflects a convergence of improving domestic fundamentals, a repricing of yield differentials, and a rebound in global risk appetite.

With policy expectations and price action aligned, the path of least resistance for AUD remains higher, and buy-on-dips strategies continue to find favor. A sustained daily close above 0.68 would open the door to a further move toward 0.69.

That said, traders should remain alert to potential volatility stemming from geopolitical developments, U.S. dollar rebounds, and shifts in commodity prices. Closely tracking changes in policy expectations and incoming economic data will be essential to navigating the trend with flexibility and discipline.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.