Analysis

ASX200 1H25 Earnings: Market Trends, Key Stocks & Volatility Insights

Adding to the cross currents, these earnings arrive as the RBA is expected to cut the cash rate for the first time since 2020. The central bank's guidance could significantly influence market sentiment and equity prices. Meanwhile, inflation moderates towards target levels, national house prices edge lower, household spending reaccelerates, and credit demand remains robust.

While domestic economic conditions are stable, they do not necessarily indicate rampant earnings growth in 2025. Job creation has been concentrated in the public sector, driven by government spending, making the upcoming federal election a key event for Australian equities. Internationally, uncertainty looms over Trump’s potential trade policies, and concerns grow about the pace of US economic expansion under a Scott Bessent/Doge efficiency drive. Additionally, the market is assessing the impact of China's stimulus rollout on global demand.

The upcoming earnings reports and corporate outlooks will be crucial in gauging economic health and could drive volatility at both the stock and index levels.

Key Considerations for ASX200 Earnings

JBH, CSL, and CBA Set the Pace

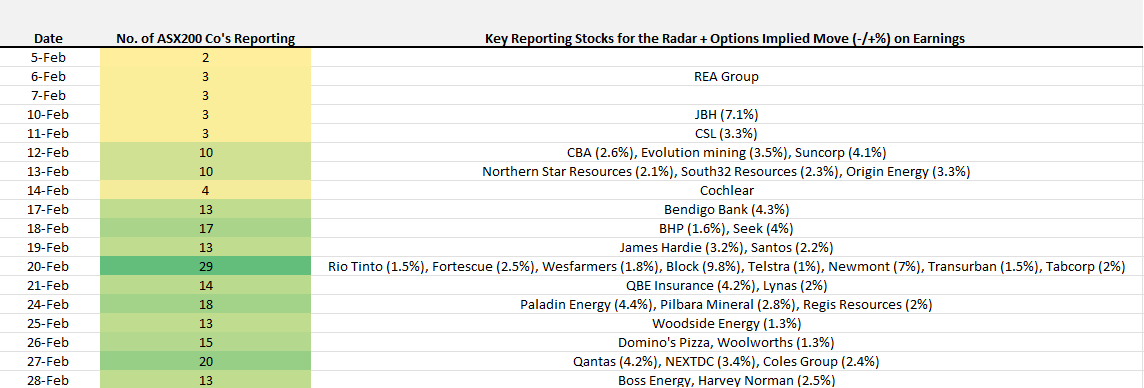

The earnings season kicks off with key names such as JB Hi-Fi (JBH), CSL, and Commonwealth Bank of Australia (CBA), attracting strong trader interest. However, the real action occurs between 17-28 February, when approximately 80% of ASX200 companies report.

Strong Focus on CBA and ASX Banks

- CBA (Reporting 12 Feb): With its share price at all-time highs, the expectations bar is set high. To maintain momentum, CBA must comfortably exceed consensus forecasts and provide a bullish outlook.

- Expected Volatility: Options pricing suggests a -/+2.6% move on earnings day, aligning with an average 2.4% absolute move over the past eight earnings reports.

- Key Metrics: Investors will scrutinize margins, credit growth, and potential increases in non-performing loans, with asset quality acting as a catalyst for market moves.

- Sector Impact: While WBC, NAB, ANZ, and MQG provide lower-impact quarterly trading updates in February, their full 1H25 results won’t arrive until May. CBA’s earnings trends may set the tone for the sector.

ASX200 Retailers Surge Into Earnings

- Consumer Discretionary Sector: The best-performing ASX200 sector heading into earnings, buoyed by July tax cuts, rising incomes, and anticipated RBA rate cuts.

- JB Hi-Fi: A favorite among CFD traders, with options pricing indicating a -/+7.1% move on reporting day. Historically, JBH has closed higher in 10 of the past 12 earnings reports.

- Key Focus: Household spending trends, competitive pressures, and the impact of discounting on profit margins.

Is It Time to Buy ASX200 Mining Stocks?

- Materials Sector Outlook: Traders remain focused on diversified and pure-play miners. China’s improving growth supports sentiment, but Trump’s trade policies create uncertainty around future commodity demand.

- Key Stocks: BHP, RIO, and FMG dominate trader attention. BHP consolidates near 12-month lows, requiring strong guidance to reignite investor interest.

- Gold Miners: High volatility expected amid gold’s surge to all-time highs. Regis Resources (reporting 24 Feb) is up 27% YTD, setting a high bar, while Newmont (reporting 20 Feb) faces an implied -/+7% earnings move.

Assessing the Impact of a Falling AUD

- Offshore Revenue Exposure: Companies with significant foreign earnings could be impacted by AUD movements.

- CSL: A core trader focus, as it trades at 12-month lows and could struggle with currency-related headwinds.

- Qantas: Near all-time highs, needing strong earnings to justify its valuation. Long-term investors will watch for guidance pushing the stock toward the $10 mark.

High-Volatility Stocks to Watch

For traders favoring high-volatility names, ZIP, Star, Magellan, Credit Corp, and Orora exhibit the highest 10-day volatility leading into earnings (as per above)

In summary, the upcoming ASX200 1H25 earnings season presents a compelling mix of macroeconomic forces, corporate performance, and potential market volatility. As traders position themselves, I would expect significant movement in single stocks and across the index.

For more information on trading Australian equity CFDs chat to the team at Pepperstone or visit the, visit our website

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.