- English

- 中文版

An End To Fed QT Is Coming Sooner Rather Than Later

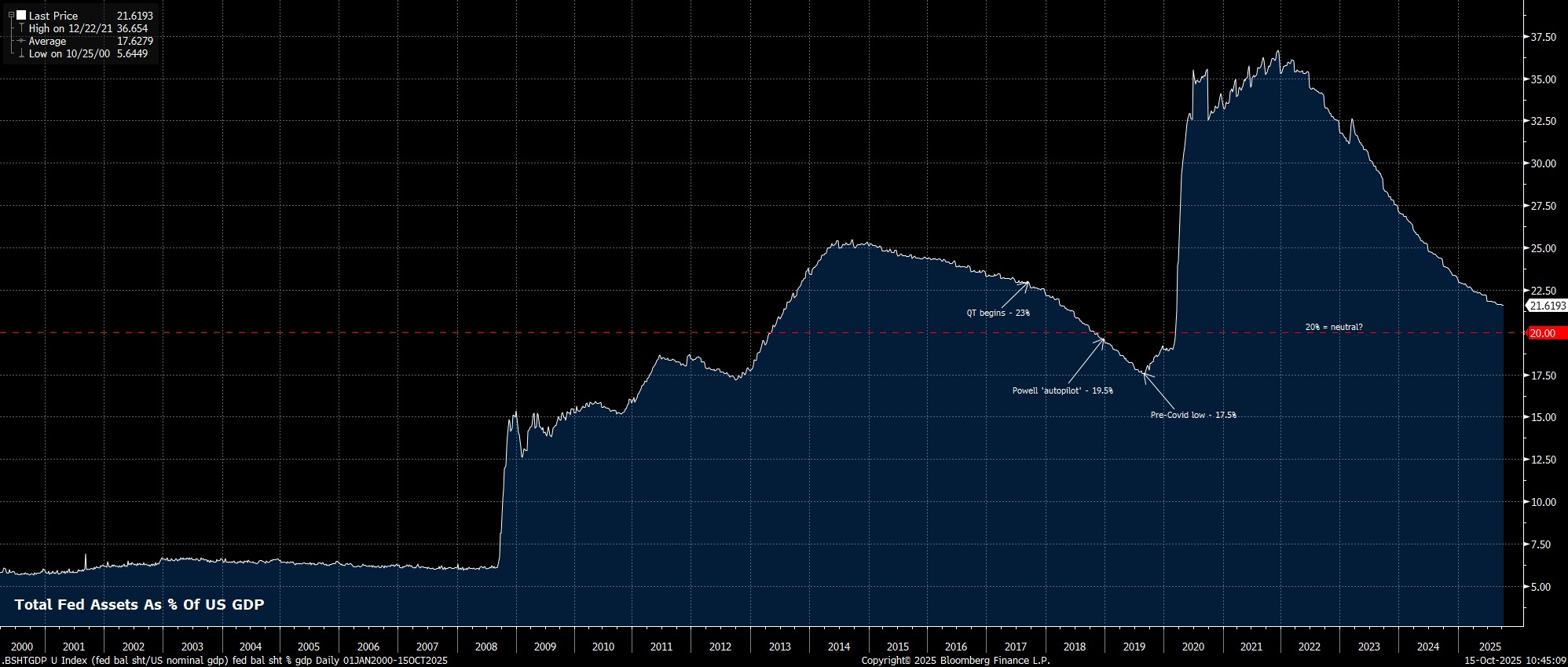

Powell’s decision to put the balance sheet in the spotlight once more makes a lot of sense as, while run-off has proceeded very smoothly indeed for the bulk of the cycle, there is now a risk that things start to become somewhat bumpier. Principally, this risk stems from the size of the balance sheet, not in nominal terms, but relative to the size of the US economy.

The Fed’s total asset holdings, which still comprise a mix of Treasuries and MBSs, are now approaching 20% of GDP, a level that can roughly be considered as a ‘neutral’ point for the balance sheet, based on the prior round of QT in the pre-covid period.

Of course, as the QT process continues, this has the effect of draining reserves from the financial system on a weekly basis.

Once again, this reserve drain has proceeded relatively smoothly thus far, barring some notable pressures around quarter-ends, though again are approaching notably tight levels, with both reserves/liabilities, at under 14%, and reserves/GDP, at under 10%, at their tightest levels since prior to the pandemic.

At the same time as money market conditions are “gradually tightening”, in Chair Powell’s words, the Fed’s room for error on this front is reducing rapidly.

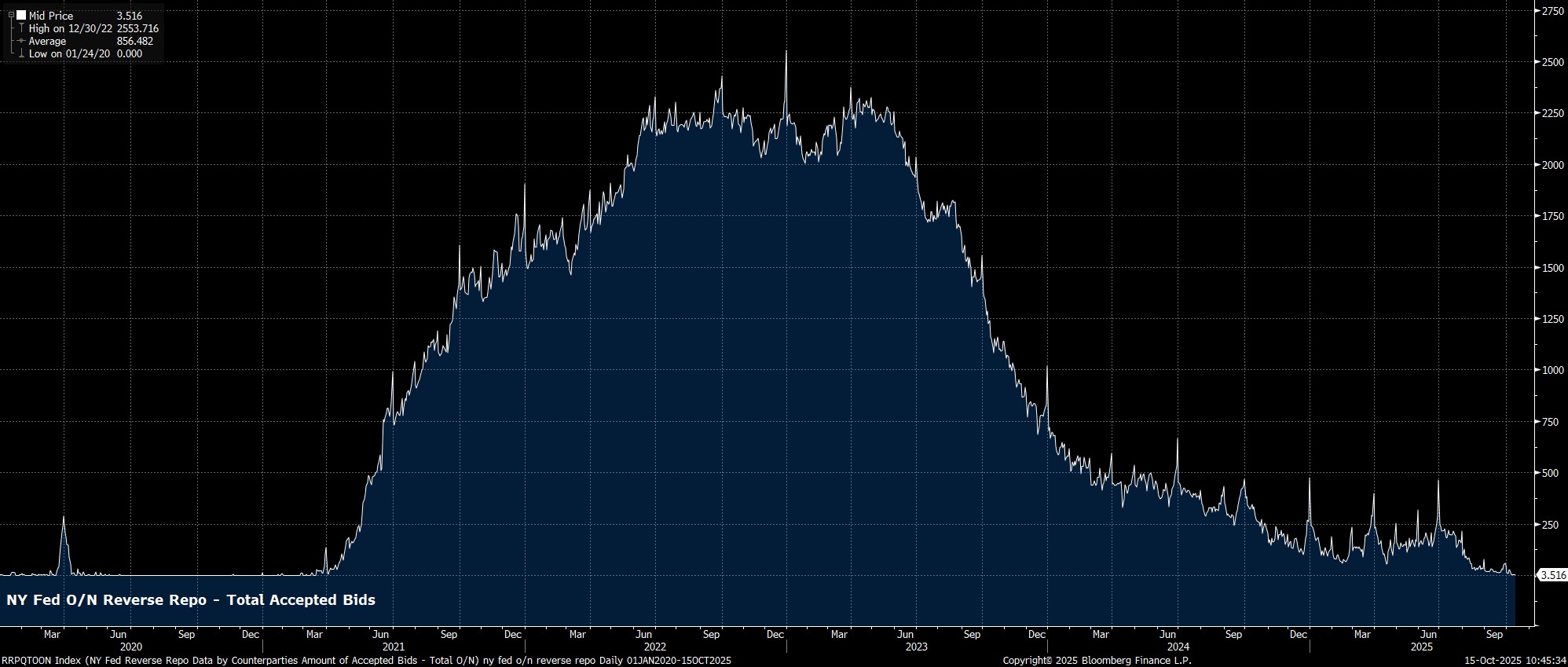

As noted, the ongoing QT process removes reserves from the system with every passing week, though this is occurring at the same time as the NY Fed’s reverse repo facility, usage of which had been well over $2tln at a peak, is now nearly empty, meaning that the final stage of the runoff process will proceed with even less of a margin of error than had previously been in place.

Taking all this into account, the part that Powell didn’t say on Tuesday, but which appears relatively obvious, is the FOMC acknowledging that they have probably pushed the quantitative tightening process as far as they can, or at least are very, very close to that point, without running the risk of a serious dislocation in funding markets. While the Fed would, rightly, never seek to admit to such a fact publicly, for risk of causing undue panic, this should very much be seen as Powell, and his colleagues, being rightly concerned that something could be close to breaking.

Naturally, this leads us to the implications of Chair Powell’s recent remarks.

The first, rather obvious, of these is that balance sheet run-off will likely come to an end sooner rather than later. For now, the base case is that the quantitative tightening process will wrap up at the end of the year, with an announcement to that end coming at the December FOMC, though risks skew towards that decision coming in shorter order, if funding pressures were to persist.

Secondly, this confirms that the FOMC’s overall policy stance is now moving back towards a much more neutral structure. Despite having delivered 125bp of cuts to the fed funds rate since last autumn, the balance sheet run-off process has been tightening conditions at the same time, thus lessening the impact that those rate cuts have had on the economy at large. Now, the Fed are moving to a structure where the two principal policy levers will be working in tandem, not in opposite directions.

Lastly, and perhaps most importantly, this is another reflection of the Fed yet again having market participants’ backs, being aware of stresses as they emerge, and using the full policy arsenal to tackle those issues as necessary. This, then, is further evidence of the overall ‘Fed put’ structure, with that being a structure that’s only likely to become even more powerful upon the almost certain appointment of a more dovish Chair next May, with that approach continuing to tilt risks to the US economy, equities, and the dollar firmly to the upside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.