- English

- 中文版

A Traders’ Weekly Playbook: Equity Strong, Gold ATHs & JPY volatility

The exception being the blanket sell-off seen in the JPY, but the “Buy Everything” rally is clearly well subscribed, and positioning remains incredibly rich, but most had suggested this was the case throughout last week, and yet the markets that are on the move found new capital ever present to further fuel the trade.

Bitcoin hit a new ATH of 125,801 (our price) in weekend trade, although the negative aspect of what has been a solid rally since 28 September is that price failed to hold and close above the former ATH of 124,560. I would look for consolidation in the price action after this modest pullback from 125k, and for new capital to re-enter on the long side as liquidity in markets increases.. Buy the rip after this modest dip....

FX traders are reacting to Sanae Takaichi's LDP election win, where we see a blanket gap lower in the JPY in interbank FX trade, and we look set for new ATHs to make headlines for the Nikkei 225. The reopening of JGB futures and cash trading may further impact sentiment toward the JPY and could feasibly cap rallies in the Japanese equity if long-end JGB yields do spike higher, with the bond market potentially set to test the new PM’s fiscal agenda — and just how close Takaichi could be to Abenomics. Unlike in late 2024, Takaichi has refrained from talking up Abenomics in this LDP leadership campaign, but most know her underlying stance and her appreciation of Shinzo Abe's Three Arrows philosophy. Traders may therefore move to obtain clarity on that position, as well as exactly how influential she may be in shaping the BoJ’s policy thinking, given the October BoJ meeting is seen as a “live” affair and a 25bp hike seen as a real possibility...

The reopening of crude futures will also draw focus from traders after OPEC+ increased output by 137k barrels — and outcome which falls on the lower end of expectations — which could see a market that had priced in a higher run-rate now move to cover shorts.

The US government shutdown will continue to hang like a grey cloud over markets. While the shutdown has so far been more a story for the headline writers than an emphatic market driver, the underlying disagreement between Democrats and Republicans that centres on the expiring Affordable Care Act (ACA) has the potential to derail the risk rally and lift volatility later this year. The expiring healthcare subsidies remain a key sticking point in the fiscal math, and it may prove a tall order to make the deficit projections add up under Trump’s “One Big Beautiful Bill Act.”

Markets are also eyeing the Supreme Court ruling on the legality of IEEPA trade tariffs, expected later this year. If the Court were to deem them illegal, it could combine with proposed healthcare spending cuts to raise the deficit — a scenario that may prove a meaningful catalyst for US bond markets and would be a scenario that would be hard to price, in turn, that lack of visibility to price risk could well be a major source of future cross asset volatility.

That’s for another day, and we consider that selling volatility has been a huge trade in Q3, but it could prove to be a major catalyst for markets, nonetheless. Until then, we look to see whether gold and silver can continue pushing higher, with silver eyeing a major test of the 1980 and 2012 highs in the $48–$50 range.

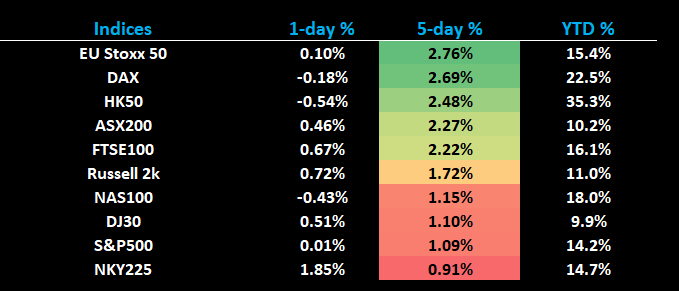

In equity land, European indices outperformed last week and may do so again this week, although one could argue that the Nikkei 225 will start the week on the front foot. The ASX200 looks set to reopen above 9000 and could well revisit the ATH of 9054 early in the week. The NASDAQ 100 will be in focus too, with the SEMICON West Conference underway in Phoenix, where many of the world’s leading AI and semiconductor innovators will offer insights into the future of the biggest theme in markets. We also gear up for the US Q3 earnings season, which really kicks into gear next week...

Elsewhere, several of the CAD crosses have come up on the radar, notably AUDCAD, which looks set for a possible bullish breakout. The NZD crosses are also of interest as we head into the RBNZ meeting, where markets imply a 30% chance of a 50bp cut — a somewhat tall order for a bank that has signalled a preference for more conventional-sized moves.

Good luck to all.

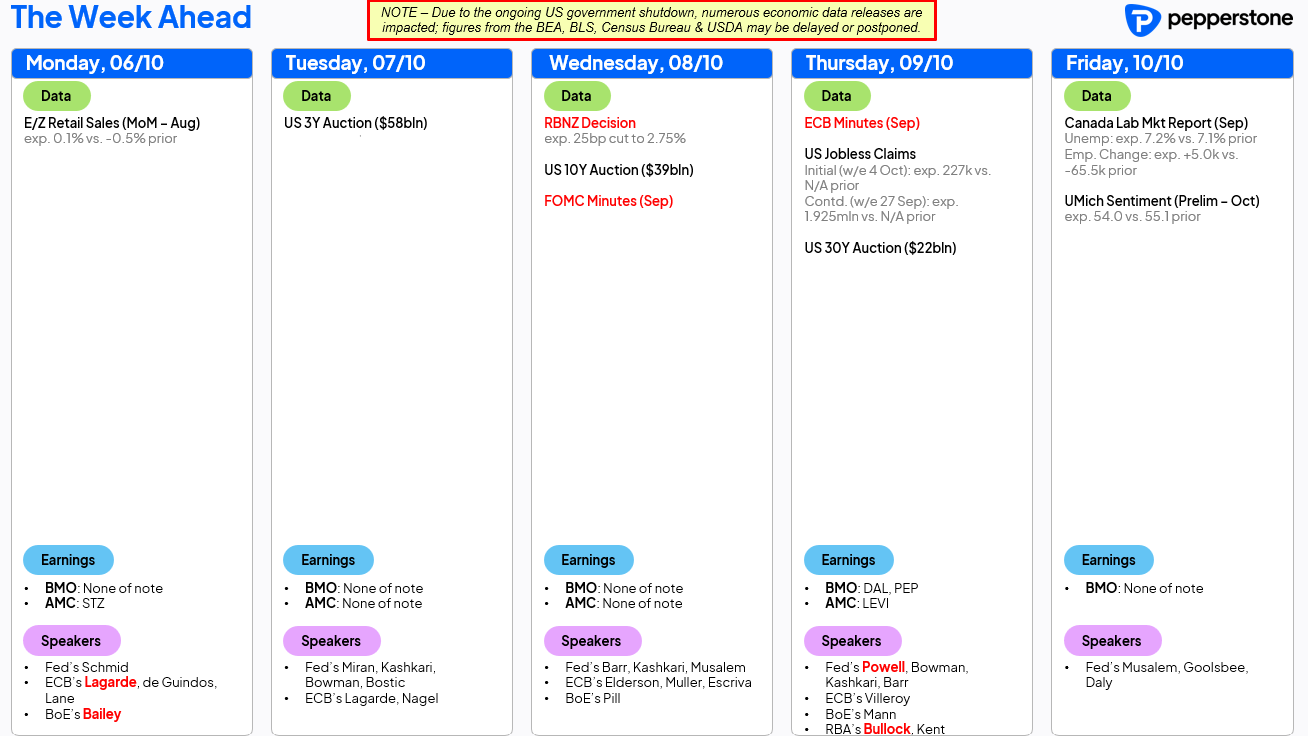

Key Event Risks for Traders to Navigate

• FOMC minutes (Wednesday): The September meeting minutes will be reviewed for clues on the appetite for a follow-up cut at the October FOMC meeting.

• Fed speakers: There are 21 Fed speeches this week. In the absence of any tier-one US economic data, guidance from these officials could have an outsized impact on markets. Remarks from Steven Miran and Jay Powell may attract closer attention.

• RBNZ meeting (Wednesday): The RBNZ is expected to cut rates — but by 25bp or 50bp? It’s a close call: 14 of 24 economists (surveyed by Bloomberg) expect a 25bp move, while swaps imply a 30% probability of a 50bp cut.

• Canada employment report (Friday): The market expects +5k jobs and a 7.2% unemployment rate (up from 7.1%). CAD interest rate swaps imply a 60% chance of a BoC rate cut at the 29 October meeting.

• China: Golden Week celebrations conclude Wednesday, with normal market activity resuming Thursday.

• Australia: RBA Governor Michele Bullock and Assistant Governor Christopher Kent (Financial Markets) are due to speak on Friday (9am AEDT). With the market having lowered the odds of a 25bp November rate cut to 41%, their comments could impact Aussie rates pricing and, by extension, the AUD.

• BoE speakers: On the week, we hear from Governor Bailey, Pill, and Mann. GBP swaps currently price the next 25bp BoE cut for March/April.

• ECB speakers: Ten ECB officials are scheduled to speak.

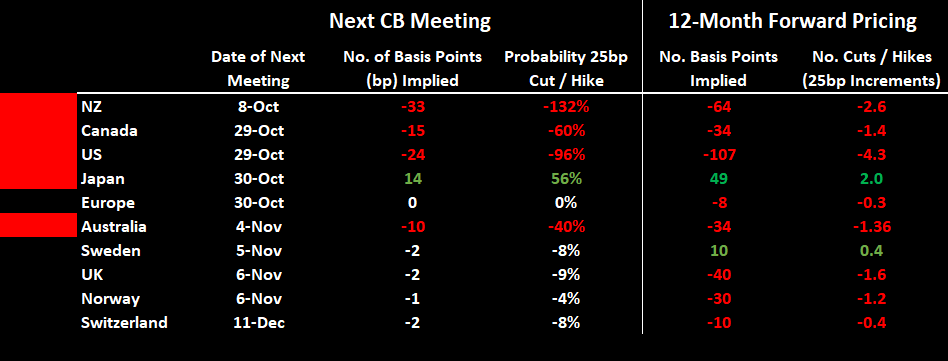

G10 Interest Rates Review

The table shows current pricing in the respective interest rate swaps, the market’s central expectations for policy changes at the next central bank meetings, and the pricing of rate cuts or hikes over the coming 12 months.

We see that the ECB, BoE, Norges Bank, Riksbank, and SNB are firmly expected to keep policy rates unchanged at their upcoming meetings. The market views a Fed rate cut on 29 October as a done deal. The RBNZ is expected to cut rates this week — the question is whether it will be 25bp or 50bp. The market currently assigns a 30% probability of a 50bp cut, which presents some initial upside risk for the NZD if the RBNZ ‘only’ cuts by 25bp.

The most interesting setup in rates pricing lies with the BoC, BoJ, and RBA, where traders see the probability of policy change as essentially a line-ball call. As such, we could see increased volatility in the CAD, JPY, and AUD leading into and over their respective meetings. Of course, as new economic data becomes available, this pricing will dynamically evolve, and these implied probabilities could shift accordingly.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.