- English

- 中文版

A Traders' Playbook: Fed Ends QT, USD Rallies, and Traders Eye US Labour Markets and BoE Risk

Headlines around a US–China agreement was also a clear theme, and one that has further lowered the negative political risk premium in the USD, with the DXY now eyeing the 100 level and breaking out to its best levels since August. This has refocused market attention on relative growth, inflation dynamics, and China’s efforts to boost domestic demand.

Meanwhile, the US funding markets are drawing closer scrutiny as the Fed prepares to end its QT program on 1 December. Traders express some disappointment that the Fed could have done more to help the private sector absorb the increased supply of US T-bill issuance from the Treasury Department. The surge in short-term issuance has led to a cleanout in RRP balances (held on the Fed's balance sheet) to fund the supply of short-term govt debt, which in turn has boosted the Fed’s TGA account towards $1 trillion and widened repo rates relative to what the Fed pays in interest banks to park excess reserves with them (IORB).

The Fed’s Standing Repo Facility has become a growing source of overnight cash for the banking system, but as reduced liquidity remains a focus, debate around a return of QE has kicked up - and notably following Dallas Fed President Logan’s remarks last week on asset purchases and a return to an increasing balance sheet. The market therefore expects the Fed’s balance sheet to rise again in 2026, with the Fed supporting liquidity and the repo market through the purchases of short-term US Treasuries in the secondary market. Crucially, any such purchases would not follow a fixed schedule or a prescribed monthly target and would not technically be seen as 'QE' in the classic technical sense. Still, the conversation has now begun.

As we roll into the new week, US clocks have shifted for Daylight Savings, impacting traders outside the US who operate during the first and final hours of the futures or cash sessions.

OPEC+ has announced a further 137k bpd output hike for December, though this was widely expected. Importantly, the group signalled that output increases will pause between January and March. The US government shutdown continues, and it appears likely that we won’t have another nonfarm payrolls report to react to. As a result, traders will turn their attention to alternative labour market data to gauge risk.

Amid a raft of central bank meetings, the Bank of England meeting holds the greatest potential for a surprise relative to market pricing. After last week’s deluge of US earnings, the pace slows — with Palantir and AMD the key trader favourites due to hit the street with numbers this week. In Australia, ASX200 bank earnings take centre stage, drawing attention from traders focused on Aussie equities and the AUS200 index. Key

Events for Traders to Navigate

US Political Developments

US Government Shutdown:

The shutdown could soon feasibly become the longest on record, though markets remain largely unperturbed. Public frustration is expected to build this week as SNAP benefits for lower-income families are paused, and disruptions increase for domestic travel. New enrolments for Americans seeking access to Affordable Care Act plans may also become increasingly problematic.

SCOTUS IEEPA Tariff Hearing:

On Wednesday, the US Supreme Court will hear oral arguments on whether former President Trump overstepped his authority with the IEEPA tariffs. While the timing of the final ruling remains unclear, the market implications could be significant. This is a complex issue with multiple potential outcomes, and with little visibility on the timing of any decision, traders may prefer to leave this event well alone for now.

Focus on the US Labour Market

With Friday’s scheduled US Nonfarm Payrolls report unlikely to be released, traders will likely turn to other labour market data, including:

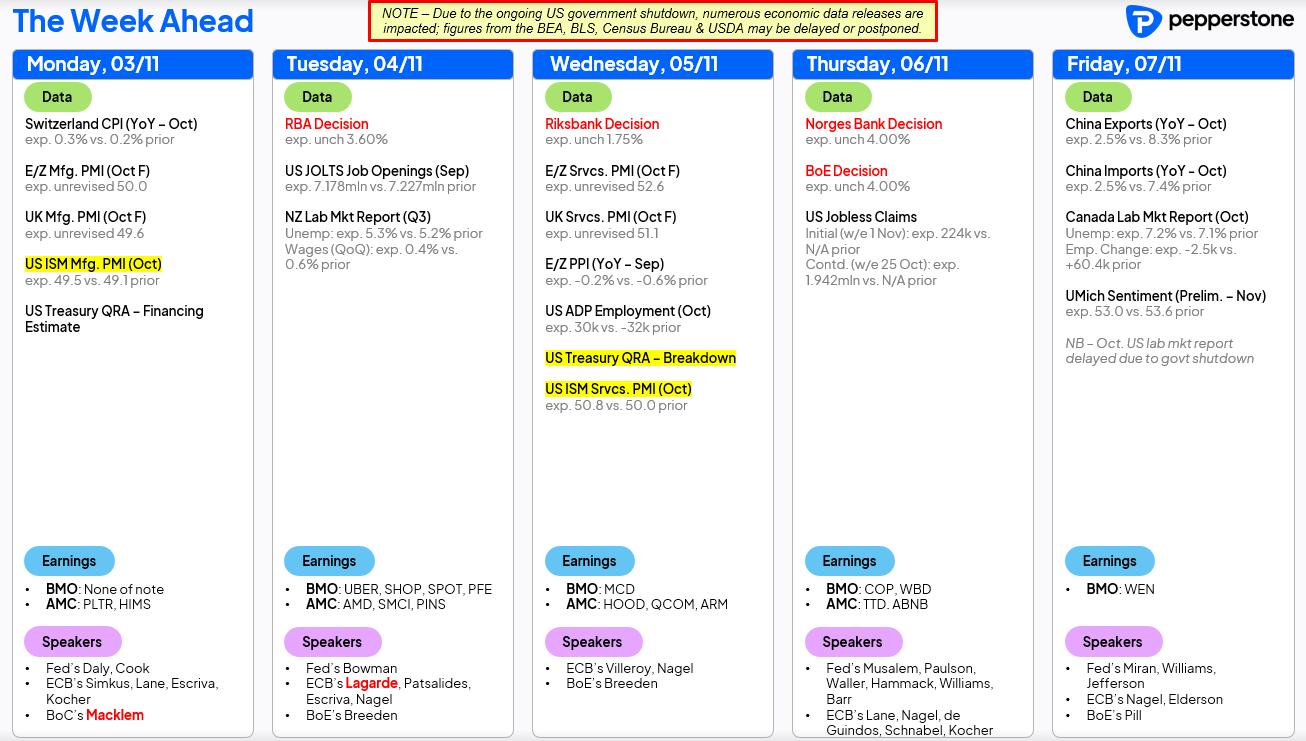

- ISM Manufacturing & Services PMIs (Monday and Wednesday): The market will focus on prices paid and new orders components, but there will be heightened attention on employment, particularly in the services sector, to gauge whether managers are still hiring.

- JOLTS Report (Tuesday): Offers fresh insight into job openings, the layoff rate, and the quits rate.

- ADP Payrolls (Wednesday): After a surprise loss of 32k jobs in September, consensus expects a rebound of +30k in October. While ADP has a poor record in predicting NFP, the direction of change can still serve as a useful guide.

- Fed Speakers: Fifteen scheduled Federal Reserve speeches will also shape expectations.

Central Bank Meetings

- RBA (Tuesday): After the upside surprise in Q3 CPI, a 25bp rate cut is firmly off the table. Governor Michele Bullock is expected to reiterate confidence that inflation will return to target over time, but the tone is likely to turn more hawkish. Inflation forecasts will probably be revised higher for Dec 2025 (currently 3%) and June 2026 (3.1%) — the key question is, by how much?

- BoE (Thursday): A pivotal meeting for GBP traders. UK interest rate swaps imply a 29% chance of a cut, with 7 out of 42 economists forecasting one. Many expect the Bank to wait until after the 26 November budget to act, possibly cutting in December instead. The decision may hinge on whether the Labour government’s budget is viewed as sufficiently tight. There’s a downside risk for GBP, particularly if 2-year gilts close below 3.73%.

- Banxico (Thursday): The Bank of Mexico is widely expected to cut the overnight rate by 25bp to 7.25%. The market will focus on forward guidance, with swaps currently pricing an additional 36bp of easing over the next 12 months.

- Riksbank (Wednesday): Expected to be a non-event, with the Swedish central bank almost certain to hold rates at 1.75%.

- Norges Bank (Thursday): Another likely low-impact event, with markets pricing just a 2% probability of a cut.

Global (ex-US) Economic Data

- China Trade Data (Friday): October’s trade surplus is expected to expand to $97bn, though both export and import growth are forecast to slow. From a tactical standpoint — particularly post-US–China agreement — I favour USDCNH higher, with 7.1500 in play this week.

- Canada Employment (Friday): Another weak CAD jobs report is anticipated. CAD swaps imply only a 12% chance of a December rate cut from the BoC. Having already cut rates from 5% to 2.25% since July 2023, the Bank may now pause. The jobs data could modestly alter that outlook.

- New Zealand Jobs (Wednesday): Expectations point to a rise in the unemployment rate to 7.2% and a net decline in employment. NZD rates imply a 92% probability of a 25bp cut at the 26 November RBNZ meeting.

Corporate Earnings

US Q3 Earnings:

After last week’s wave of mega-cap reports — which drove punchy single-stock volatility — around 11% of the S&P 500’s market cap is set to report this week. While we’ll see active moves at the single-stock level, the broader index impact should be contained. Key reports to watch: Palantir (the options implied move on earnings is ±9%), AMD (±6.2%), QUALCOMM (±6.2%), Pfizer (±3.5%), McDonald’s (±2.5%) & Robinhood (±7.7%)

ASX Bank Earnings:

The big Australian banks — plus Macquarie — step up to report FY results (ex-CBA). For AUS200 traders, the focus will be on earnings quality, asset performance, lending volumes, and forward guidance. Reports that APRA may tweak macroprudential controls (initially targeting risky lending) add another layer of interest, given strong investor demand for housing credit.

- Westpac: Today

- NAB: Thursday

- Macquarie: Friday

- ANZ: 10 November

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.