- English

- 中文版

Navigating a High-Stakes Week in Global Markets: Key Risks and Opportunities

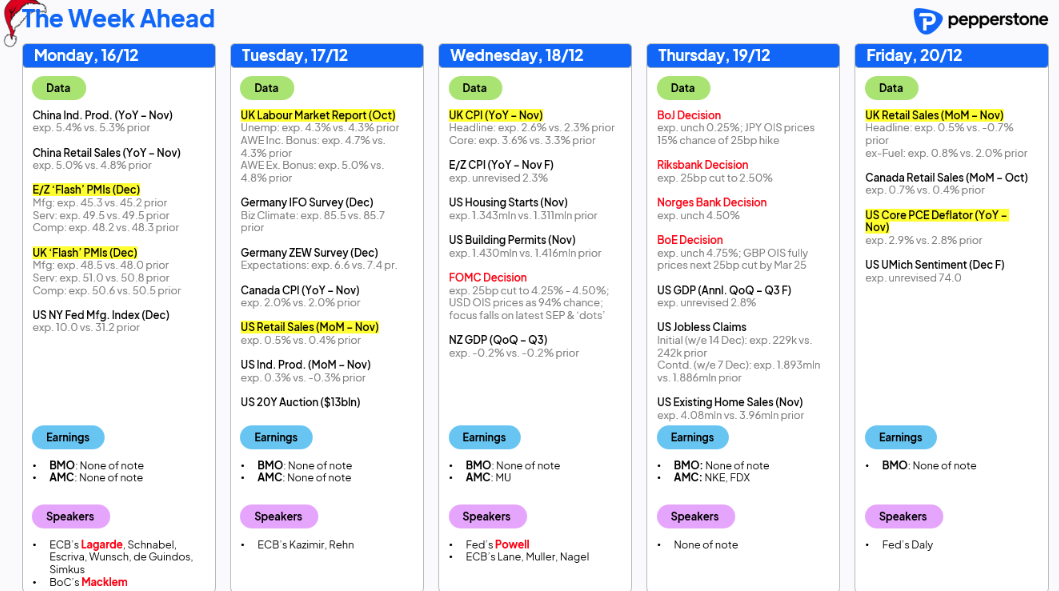

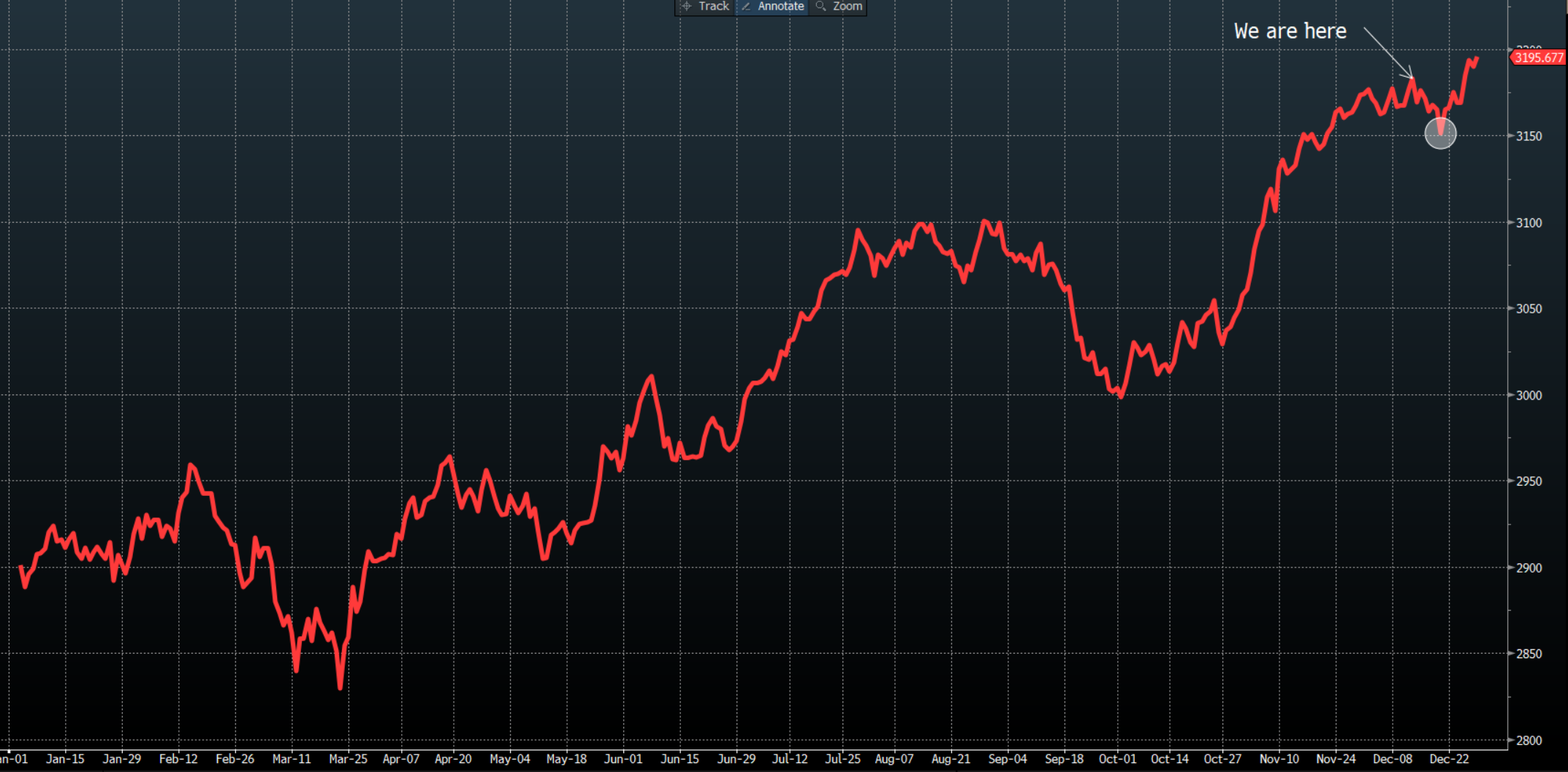

The known tier 1 landmines come in on the heavy side this week, and the uncertainty this brings may initially result in further position squaring and limit buying activity in risk. Coincidentally, it’s worth noting that over the past 10 years, the S&P500 has fallen 1% (on average) this week - That is, before historically kicking higher from next week and into year-end.

10-years of blended S&P500 returns

Will history rhyme this year?

With the typical year-end liquidity drain starting to kick in, and amid such rich positioning in S&P500 and NAS100 futures, and DM equities having already had such a year, throw in some big event risk and things a little funky for traders this week.

Traders need to consider which – if any – of these event(s) offer the possibility to really catch positioning offside and promote increased volatility.

The Risk from the FOMC Meeting

Wednesday’s FOMC meeting is clearly the marquee event of the week, although the prospect of market players being overly surprised by what they hear seems low.

To quantify this call, I’ll note that S&P500 at-the-money options (expiring on FOMC day) are priced with a 9.2% implied volatility vs 7.9% the day before – a premium, but nothing too striking, which suggests dealers are not seeing a marked probability of outsized moves in the S&P500 over the Fed meeting.

We can also look at G10 FX 1-week (options) implied volatility and see vols in the USD pairs and gold sitting in the 40-50th percentile of the 12-month high-low range. Like S&P500 options, options market makers/dealers see some signs of increased movement in the USD, but nothing that should overly concern traders running USD positions over the FOMC meeting.

The market sees a 25bp cut from the Fed as a done deal and expects Jay Powell to stress that the Fed remains open to further easing, with the pace and magnitude of future cuts conditional on the incoming data flow. Policy optionality as we head into an uncertain Q125 seems assured. A new set of quarterly economic projections and ‘Dots’ will also be widely dissected and should offer some steer to current market pricing. We can expect tweaks to the Fed’s 2025 and 2026 forecasts for unemployment, GDP and inflation, although these changes shouldn’t be overly market-moving.

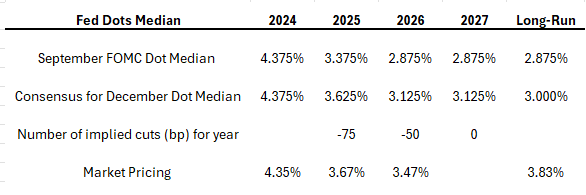

The ‘dots’ (each voting member's estimate on where the Fed funds rate could be in the years ahead) could impact markets. As we see in the table, the consensus view from economists is that the median dot for 2025 is likely to be raised to 3.625% (from 3.375%), and to 3.125% (from 2.875%) in 2026, highlighting a central tendency for three 25bp cuts next year and two 25 bp cuts in 2026. The long-run neutral rate is expected to be taken up to 3%.

One could therefore argue that the bear case for the USD / the equity positive outcome would be if the Fed left the 2025 dot unchanged, signaling a median view of 100bp of cuts for 2025 - although this would be a surprise, especially if the collective within the Fed’s ranks upgrade its growth and U/E forecasts. The hawkish risk is seen if the median dot for 2025 was raised to 3.875%, in turn, signaling two 25bp cuts in 2025.

Other central bank meetings in play

Central bank meetings from the BoJ (hold), BoE (hold), Norges Bank (hold), Riksbank (25bp cut) and Banxico (25bp cut) are also due out through the week. Again, while these are big events for traders to navigate, the prospect of hearing anything too leftfield that surprises the market seems low.

The BoJ meeting (Thursday – Asian afternoon) and Gov Ueda’s presser do carry some risk of increased vol for the JPY, and the BoJ have been known to surprise the market before. The market is now largely in the camp that hikes come in 2025, with Japan swaps now pricing a low 14% chance of a 25bp hike this week.

The conditions for a hike are largely in place given the positive outcome in the recent wage negotiations, and the strength in Friday’s Tankan survey. However, the BoJ appears to be in no rush, with press reports suggesting they hold out until January or even March 2025 before cranking up the policy rate. USDJPY tracks the US 10-year Treasury most closely, but should we see a ‘hawkish hold’ from the BoJ, i.e. rates are left unchanged, but Ueda offers a strong preference to hike in January, then we could see better buyers of the JPY this week.

US data to have on the radar this week

On the data side, US PMI's (today) could offer some small degree of vol risk for US equity and the USD, but we'd likely need to see an outlier print. US retail sales (Tuesday) shouldn’t impact market sentiment to any great degree given it pre-dates the FOMC meeting and won’t affect their near-term thinking.

US core PCE (Friday) is expected to come in at 0.2% m/m / 2.9% y/y, but, unless we see a significant deviation from the consensus estimates, the inflation data is also likely to be a low-impact event.

The US Treasury market is the central guide for risk this week

All eyes fall on the reaction in the US Treasury market. With the US 10-year real rate back above 2%, and the 10-year (nominal) Treasury rising a punchy 24bp last week and fast approaching 4.50%, it feels as though the US bond market will play an increased role in shaping the volatility in equity, FX and gold this week. Higher yields and a steeper yield curve, especially if not backed by a solid improvement in the US data flow, will likely become more of a headwind for equity risk.

A big week of UK event risk

The BoE meeting should be a non-event for GBPUSD and GBP cross rates, but with UK PMIs, employment and wages, CPI, and retail sales all due out through the week, there is plenty of event risk for those holding GBP exposures to manage. GBPUSD has broken the rising uptrend (drawn from the 22 Nov lows) last week with traders happy to fade the recent GBP strength and square up GBP risk into this week’s data deluge. The data will dictate the fate of the GBP this week, but it feels as though the risk (for the GBP) is skewed lower.

We also get PMIs in Europe, with both services and manufacturing prints likely to remain weak and that could be a vol event for EUR traders. A weaker-than-feared set of EU PMIs could see EURUSD break 1.0450 – a level that has been well supported of late.

Yet another failed rally in China's equity indices

In China, the focus today falls on the data dump in the early Asia afternoon, with new/used home prices, industrial production, retail sales, and property investment all due between 12:30 - 13:00 AEDT. China may be seen by some as ‘uninvestible’ in its current form, but it is certainly tradeable, and as we saw late last week there is no follow-through in the rallies and traders are quick to fade strength on disappointment. We’ll see if the buyer's step in and support, but the risk is weaker data this week takes us back towards the November lows in the HK50, CN50 and H-shares.

So, there is plenty of risk to navigate this week, and while the options market suggests a low probability that the event risk proves to light up the markets with volatility if we do move past the week without any major hiccups, then it could offer the green light to run risk hot into year-end.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.