- English

- 中文版

Extreme Volatility, Tariff Chaos: What Traders Need to Know This Week

Reports that on Friday hedge funds sold the highest level of global equity since 2010 won’t necessarily surprise given the incredible volumes traded across futures, options, ETFs and cash equity – where volumes were either near the highest on record or since March 2020. The extreme volatility and the sheer pace of price movement impact liquidity conditions and make the pricing of risk far more complicated and as a result, dislocations are becoming increasingly more apparent. We see this front and centre in interest rate/swaps pricing, with the collective expecting aggressive and almost immediate central bank support, while recent central bank speeches (including that of Jay Powell on Friday) are currently some ways away from sharing that vision.

Expectations for RBA policy easing are perhaps the most divergent, with AU swaps pricing almost five 25bp cuts this year, when recent RBA communication has us questioning if rate cuts are even on the table for 2025… but things have changed a lot in a short space of time and financial markets make dynamic assumptions of the future, while central banks typically react to facts - but when certain market players start talking about inter-meeting rate cuts, you know things are truly breaking down.

RBA Gov Bullock's speech on Thursday (at 8pm AEST) will get great attention and ironically a hawkish stance could feasibly accelerate the selling in the AUD.

Eyeing an Ugly Open for Asia

Asia will face the music on the Monday open, where our calls suggest we see Asia equity cash indices open 4%+ lower, with HK/China playing catch up after closing on Friday. A tough open for many, and markets also look to discount news that China has countered the US tariffs by an equal measure. What was truly ugly in US trade will spill over into Asia with blanket selling of equity to be seen early in the piece - margin calls and deleveraging playing will play a big role as to the extent of the moves, and what goes down – notably in Japan – could be pronounced.

Flow desks, liquidity providers and market makers have had the weekend to prepare for what could play out in Asia, and many will have the JPY-funded carry trade unwind/VIX spike (on 5 August 2024) fresh in their minds – but should we see volatility become unhinged, this time around we may not see the rapid snapback in risk that played out in the days and weeks post 5 August.

Emotions run hot with the extreme volatility and the incredible daily high-low trading ranges testing even the most disciplined traders to adhere to their strategy and process. This trading environment isn’t for everyone, and when S&P500 futures trade a (record) 361-point high low range, and AUDUSD 345-pips (7x the average seen in March) it’s in this backdrop that many consider staying out until things settle. For those who remain on the front line, the sizing of positions relative to the volatility and recent range is more important than ever.

The volatility markets are screaming that the risk to markets remains incredibly high and could feasibly become even more pronounced. However, the vol sellers are to make a play, where a sharp reduction in implied vol would send equities, equity indices, the AUD and crude higher, the market needs to hear what it wants to hear and headlines that offer some belief that the 25% weighted tariff rate on US imports could be either paused or set to moderate. Headlines of a planned call between Trump and Xi could even be enough to promote a punchy intraday rally in risk, such is life with the VIX at 45%, and S&P500 ATM 1-week implied vol at 50%.

Markets to Test Trump's Resolve

Whether any intraday rallies can be sustained is another factor, as both President Trump and Treasury Secretary Bessent seem unnerved by the reaction in markets, and the markets will look to test their resolve this week, while the Fed are yet to take a step towards market pricing. A dangerous game, especially when equity and corporate credit reflect increasing recession and default risk – relief to one’s debt serviceability matters little if you’ve lost your job.

Clearly, the longer the current tariff rates remain in place the greater the impact on inflation, and deterioration in business confidence and subsequently the higher the probability that Trump’s tariff policy will be seen as responsible for causing a US and possibly global recession - hence, the need for Trump et al to accelerate the timeline on tax cuts and other fiscal support levers.

While we’ve seen a number of EM nations making moves to have their tariff rate taken down, the market is far more sensitive to news and moves that involve China, Europe, the UK and Japan. Here we see the gulf in relations between Xi and Trump becomes increasingly fractured and we even consider whether Trump re-counters China’s counter. EU leaders meet today, where one look for their collective response and whether EU leaders look to engage with Trump and attempt to have its 20% tariff rate taken down or go the way of China and match the 20% tariff increase on US imports.

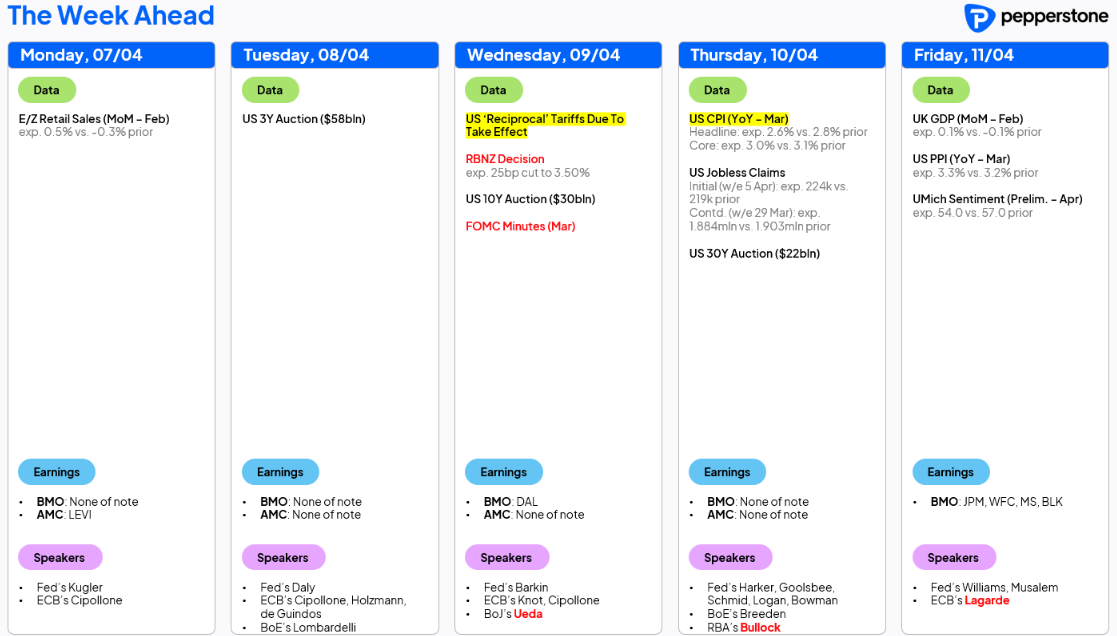

Event Risks for the Week Ahead

While we’ve not heard anything through the weekend to further shake markets, headlines on the tariff talks will start to trickle in once again, and with volatility at such extremes really any headline, economic data point or Fed speaker could move the dial.

US core CPI (due Thursday) will be closely monitored and will have to moderate by a fair measure from the February print of 3.1% to cause any real relief to risk, as a hotter print – given it reflects price pressures prior to ‘Liberation Day’ which are only going to increase – will unlikely be taken kindly. What’s more important for markets and our quest to price economics and recession risk is the incoming April economic data series that captures the fallout from new tariff rates on US imports. This puts Friday's University of Michigan sentiment and inflation expectations survey as a potentially high impact risk, even if the data will likely be skewed by respondents’ political biases.

Further ahead, the April NY Empire manufacturing report (due on 15 April) will get more attention than would typically be the case, with April preliminary PMIs in the US, Europe & the UK (all due 23 April) and China (30 April) expected to greatly influence market sentiment and central bank thinking.

US Q125 Earnings in Focus

US Q125 earnings also start to play a key role, with JP Morgan, Morgan Stanley and Wells Fargo kicking earnings into gear on Friday. We can almost assume the reported earnings, revenues, and margins for the reported quarter will be almost irrelevant, as its the guidance, outlooks and commentary about how companies are managing the tariff impact that will be far more important. Perhaps it's too early to offer investors anything too explicit as the situation remains fluid, but US corporations are the first derivatives of the tariff shock and as many try to price recession risk and company earnings and revenue estimates, what companies say or don't say matters to markets.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.