- English

- 中文版

Capturing Earnings Volatility With Pepperstone’s US 24-Hour Share CFDs

For context, during the Q324 reporting period (seen through October and November 2024), the average S&P500 company saw its share price move -/+5.3% on the day of reporting.

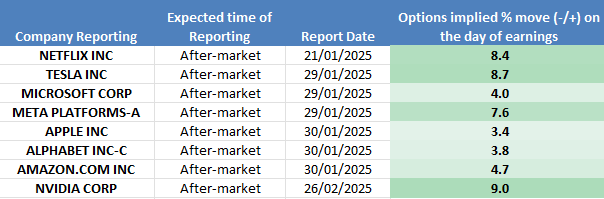

For the upcoming reporting quarter (Q424), options pricing implies S&P500 companies will move on average just under -/+5% on the day. For the well-traded trader favourites, we list the options implied move on the day:

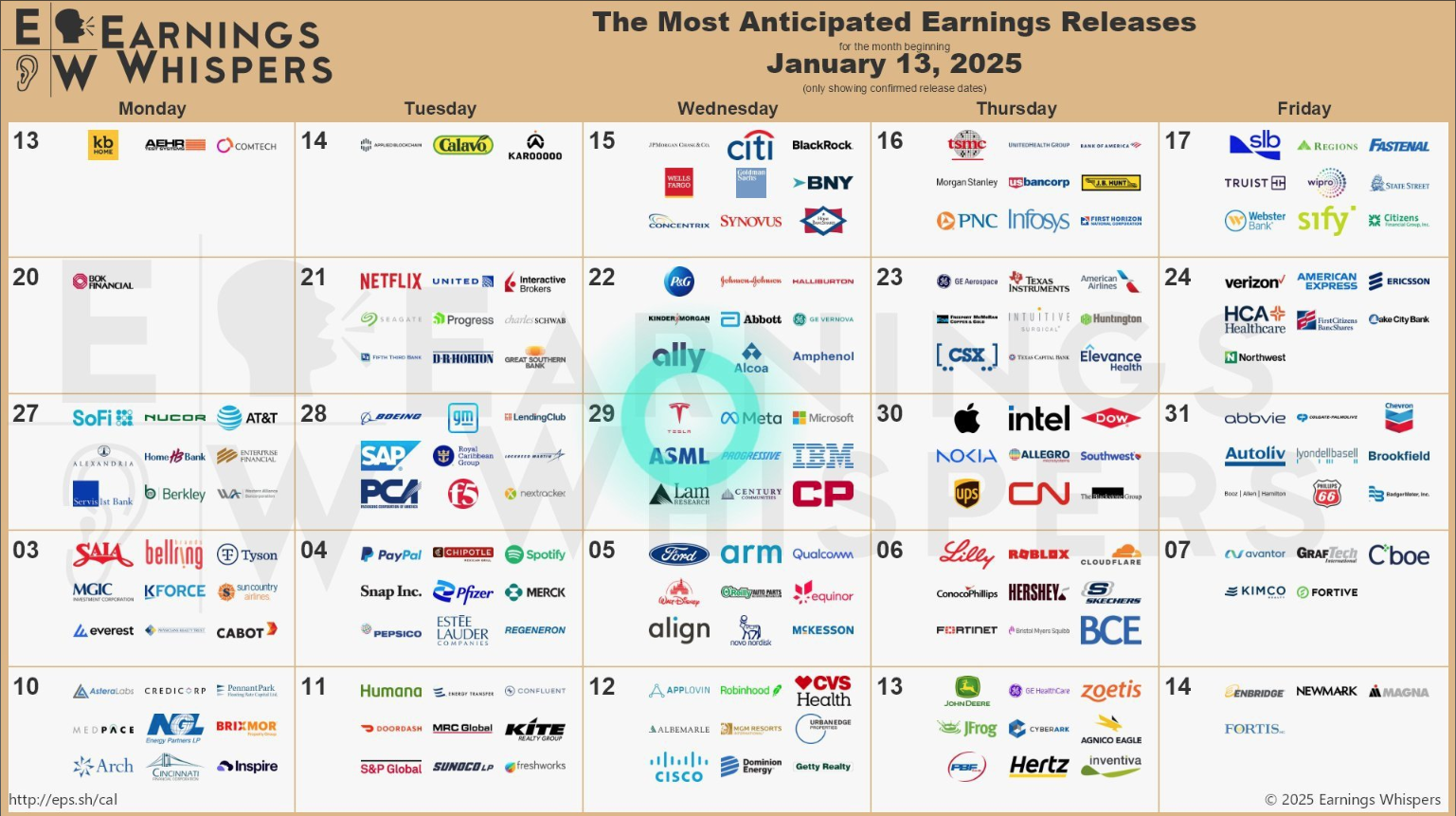

Reporting Dates (Source: Earnings Whispers)

Trading 24-hour US share CFDs – React to earnings, news and moves 24/5

With nearly all the marquee US companies reporting in the pre-or post-market session, traders can react dynamically to company earnings announcements and the likely increased movement in the share price through Pepperstone’s 24-hour share CFDs.

Pepperstone’s 24-hour share CFDs offer continuous pricing 24 hours a day, 5 days a week and facilitates two-way trading (long and short) for all sessions.

For those actively trading US equity CFDs, it is worth noting that while the NAS100 cash gained 25% in 2024, all the gains can be explained by the overnight futures move, which saw the NAS100 cash index gap up on the open. Cumulative moves through the cash intraday session offered no contribution to the gains seen through the year.

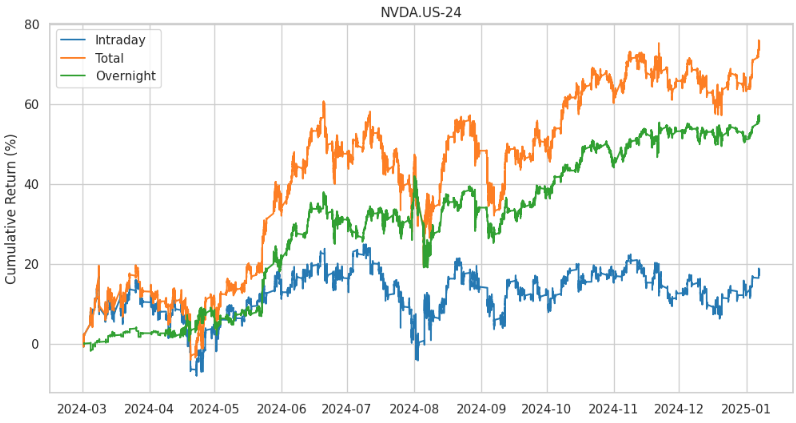

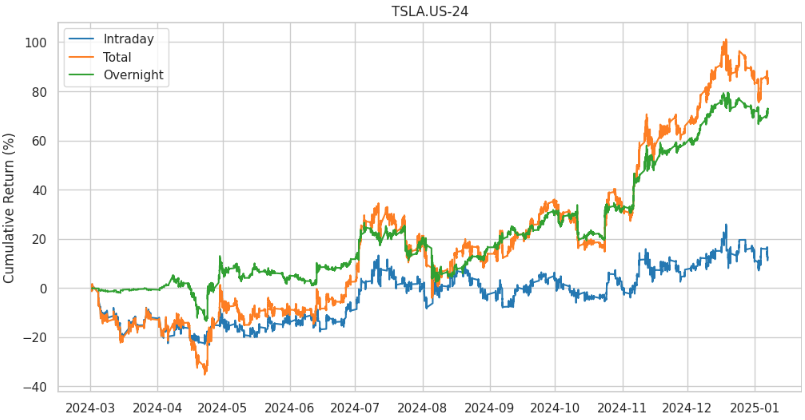

Drilling down into individual equity names, we can also observe that the large percentage of the returns in the MAG7 stocks took place outside of NYSE cash exchange hours – i.e. in the pre-, post- or overnight sessions.

Nvidia – Running the numbers on Pepperstone’s 24-hour CFDs (since March), we can see that 76% of the total gain in share price can through that period be attributed to the cumulative moves that took place out of exchange hours.

Total Gain (from March to January) – 74.27%

Cumulative % gain in overnight hours - (this includes the pre-, post- and overnight sessions) – 56.43%

Cumulative % gain in cash exchange hours – 17.84%

Tesla – Looking at the data for Tesla's 24-hour share CFDs, we see that 85% of the total gain can be explained by the cumulative gain recorded in out-of-exchange hours.

Total Gain (from March to January) – 85.2%

Cumulative % gain in overnight hours - (this includes the pre-, post- and overnight sessions) – 72.6%

Cumulative % gain in cash exchange hours – 12.59%

To learn more about Pepperstone’s 24-hour share CFDs, click here

Trading US earnings through a challenging macro environment

While equity traders will be keen to position and react to US company earnings, making life more of a challenge is that the earnings period falls over Trump’s inauguration (on 20 January).

Trump comes in with the USD at the best levels since November 2022, with the Fed having already cut rates by 100bp under the Biden administration and is now expected to go on an extended pause until October – that will clearly not sit well with Trump.

We also see the US 10-year Treasury yield has risen to the highest levels since November 2023, with global bond markets now intensively competing for global investor capital. It also comes at a time when WTI crude has rallied 14% off its December low, FX and equity volatility are pushing higher, while the S&P500 has come off 4.2% from its recent highs, with poor market breadth and trading at sky-high valuations.

While Trump will be pleased to inherit a strong economy, these market dynamics suggest we could see increasingly lively market moves, both at a single stock and index level.

US Earnings Focus – Factors that could drive volatility in stocks and US indices

As we prepare for the earnings deluge, we consider some of the prominent talking points among traders, and the points of debate that could lead to equity volatility and tactical opportunities for traders.

• Will companies beat the high consensus earnings expectations? Those that miss and that have enjoyed a strong run higher in the share price will likely be treated poorly by the market.

• Planning for Trump 2.0 - How are US businesses preparing for tariff hikes, potential deregulation, tax cuts and Trump’s full fiscal agenda?

• Managing Margins - The market wants to learn how tariffs could impact margins, notably for the high import businesses, and to what extent these businesses will look to pass on any additional costs to the consumer.

• Goods prices set to rise? If the market hears evidence that goods inflation may be headed higher once again, then equity will be sold as inflation fears build.

• The true health of the US consumer – Retail, consumer stocks and banks offer a fresh perspective on trends in consumption, household spending, and the demand for credit.

• Will the Magnificent 7 (Mag7) stocks continue to dominate? The bar to exceed expectations from the Mag7 plays is high.

• Will investors see evidence that the companies who have made significant investments in AI are starting to monetize and show a return on the investments?

• With the sharp rise in US bond yields and mortgage rates, we look for commentary from the more interest rate-sensitive stocks – US regional banks and homebuilders for example – and how this dynamic is impacting their operating environment.

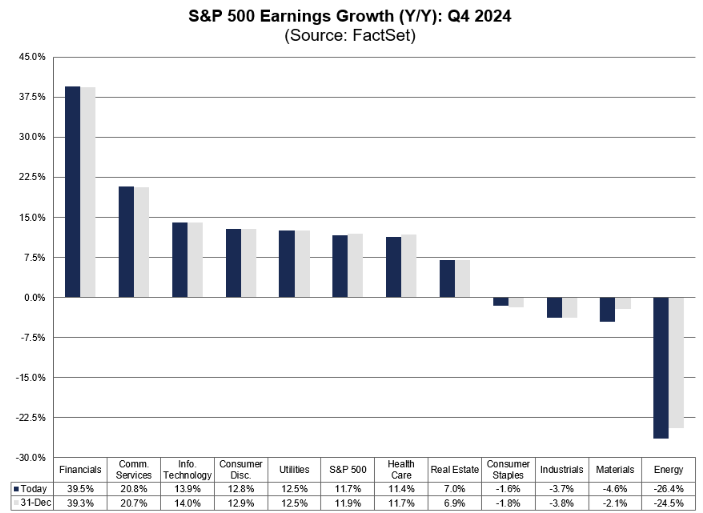

• US bank earnings to set the tone this week – the market expects strong EPS growth from financials, with the big US banks benefiting from a strong performance in investment banking, while net interest margins are expected to improve. Deposit growth, credit provisions and asset quality will be closely watched.

• Understanding plans, notably from the mega-cap companies', on capital expenditure (CAPEX) for 2025.

• With the USD gaining 8% since the end of September, expect the currency effect to feature more prominently in earnings statements.

So, with earnings set to increase the volatility seen within US equities, and at an index level too, and notably given the more challenging macro backdrop, it promises to be a lively few weeks in markets. Get set, prepare accordingly, and consider Pepperstone’s 24-hour share CFDs as a vehicle to trade US Q424 earnings.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.