- English

- 中文版

Traders’ Week Ahead Playbook - Nonfarm Payrolls, US CPI, Central Banks & the Year-End Liquidity Test

The depth of liquidity in order books will be key for the trading environment this week, with the volume to fill orders at the top of book as well as the resting limit orders set to have a strong influence on volatility, daily high-low ranges, and the cost to trade through bid-offer spreads. One suspects liquidity conditions will thin out this week from what is typical, but remain sufficient for size to be worked without excessively moving prices, but will then really drop next week.

The technical set-ups and the price action will matter greatly this week. A further sell-off (higher yields) in 10- and 30-year developed market government bonds may catalyse broader selling in risk assets, particularly if 10-year JGB yields break above 2% and US 10-year yields push through 4.25%. Should the MAG7, Broadcom, NAS100, Russell 2000 or S&P 500, and silver follow through on Friday’s selling, many traders may feel compelled to cut back hard on extended long positioning, lock in gains, and seek first-mover advantage before others unwind portfolio winners.

Alternatively, if the selling seen on Friday in the 2025 winners such as silver, quantum computing, AI leaders, and AI power generators proves short-lived, and buyers step up to reverse prices higher, active participants may feel obliged to run positions hot and chase these themes into year-end.

Last week’s FOMC meeting was about as market friendly as bulls could have hoped for. That said, Chair Powell did signal that the Fed’s base case is for the fed funds rate to be held for an extended period and made it clear that policy settings are at or close to neutral (the policy setting considered to be neither stimulatory nor restrictive), so the bar to ease further in the near-term is now fairly high.

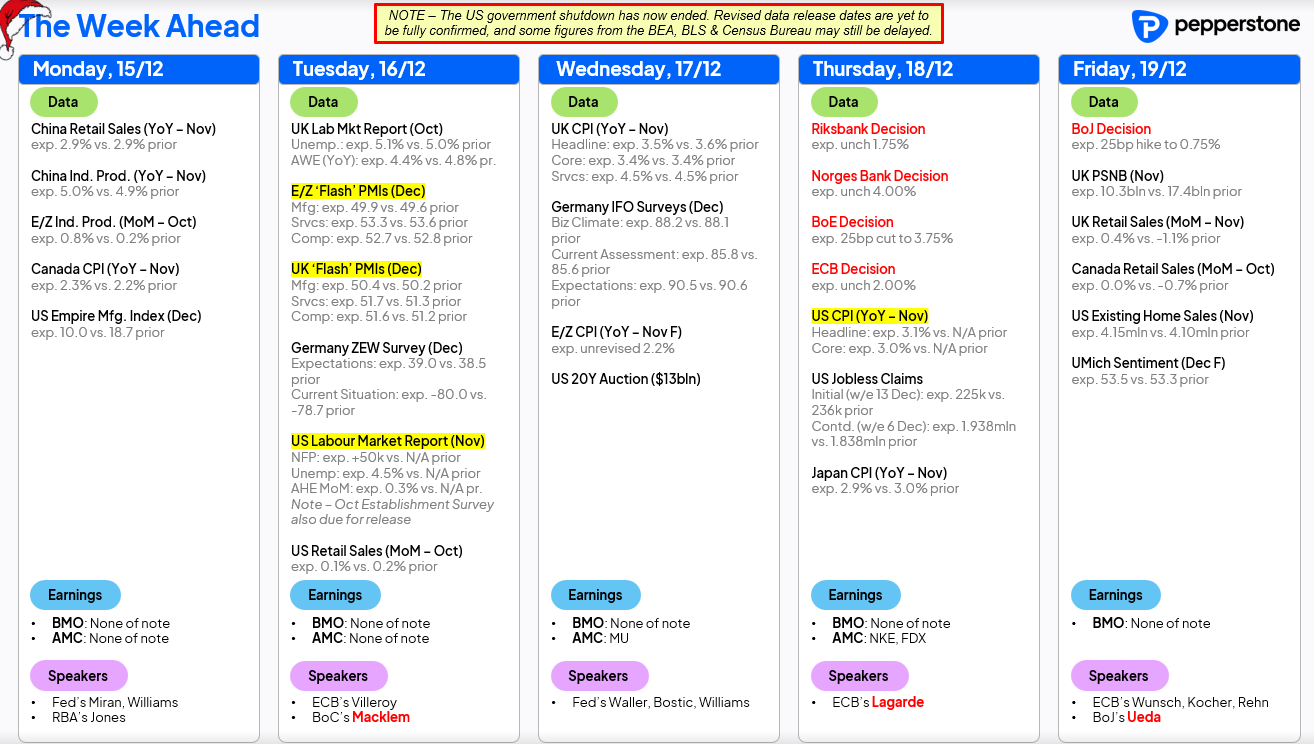

US NFP and CPI the marquee risks of the week

With both November US nonfarm payrolls and CPI released this week, both sides of the Fed’s mandate are in play. These releases could drive pre-positioning flows ahead of the tier 1 data, trigger volatility on the outcomes, but also help set the tone for risk markets heading into 2026.

Equity bulls would like to see US nonfarm payrolls print between 50k and 70k, with the unemployment rate at either 4.4% or 4.5%. This would represent a 'Goldilocks' outcome, where labour market concerns ease modestly while keeping Fed rate cuts on the table. Conversely, should payrolls show net job losses, which is possible, and the unemployment rates rises to 4.6%, labour market concerns could dominate market sentiment, even if interest rate markets price a higher probability of a Fed cut in January or March - with the likely response being a broad equity de-risking, a weaker USD, and rotation into cash, bonds, and safe-haven assets.

A November core CPI print at 2.9% y/y, or below, would offer further tailwinds to risk markets and validate Chair Powell’s relative lack of concern on the inflation outlook. Depending on the payrolls outcome, a core CPI print above 3.2% y/y would likely prompt traders to reduce risk exposure or remain engaged through the holiday period via low-volatility defensive assets.

Central bank meetings

While US NFP and CPI are the marquee risks this week, traders also navigate five G10 central bank meetings. Consensus expectations point to policy changes from the Bank of Japan, via a hike, and the Bank of England, via a cut, while the remaining meetings are expected to be low-impact and largely priced. Of these, the BoJ meeting carries the greatest potential to influence broader market volatility. A 25bp hike from the BoJ is almost fully discounted in swaps, but focus will remain on guidance around the pace of hikes in 2026 and any updates to the Bank’s estimated terminal policy rate.

The event risks for the week ahead

This is a big week that could provide tailwinds for a year-end rally or, conversely, be the catalyst for many to close shop and head for the Hamptons.

What's on the radar for the week ahead:

- US nonfarm payrolls (Tuesday) - economists expect payrolls to come in at 50k jobs, with estimates ranging from 127k to -20k. The unemployment rate is forecast at 4.5% from 4.4%, with average hourly earnings at 3.6% from 3.8%.

- US CPI (Thursday) - consensus sees headline CPI at 3.1% and core CPI at 3.0%, with estimates ranging from 3.2% to 2.9%.

- BoJ meeting (Friday) - a 25bp hike is expected and priced in JPY swaps at a 91% probability, with the next hike priced for September 2026 and a terminal rate implied at 1.50%.

- UK data and BoE meeting - in the UK we see October employment and wage data, November headline CPI eyed at 3.5%, and the BoE meeting on Thursday. A 25bp cut from the BoE is priced into UK swaps at 91%, with another 25BP cut expected in April.

- ECB, Riksbank, and Norges Bank meetings - all are expected to leave rates unchanged and should be low-impact events.

- China November activity data (Monday) - home prices, retail sales, and industrial production.

- Australia - December consumer confidence, November private credit, and the Mid-Year Economic and Fiscal Outlook.

- New Zealand Q3 GDP (Thursday) - expected at +0.8% q/q and 1.3% y/y. Markets price the next RBNZ move as a 25bp hike in July 2026.

- Canada CPI (Monday) - headline CPI expected at 2.3% from 2.2%, supporting the pricing of a mild tightening bias for 2026 priced into CAD swaps.

- US retail sales - this is the October data that was delayed due to the shutdown and therefore potentially stale, but still relevant. Markets expect headline sales at +0.1%, with the control group at +0.4%.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.