- English

- 中文版

Per FactSet, for the S&P 500 in aggregate, earnings growth is seen at 11.9% YoY in the three months to December, a fair margin above the 5-year average of 10.4% and, if delivered, would represent the fastest such rate since the fourth quarter of 2021. Meanwhile, on the revenue front, growth is seen at 4.8% YoY, a pace which would be below the 5.6% YoY growth delivered in Q3, and also below the 5-year average of 6.9%.

As has now been the case for some time, the index remains ‘over-valued’ per traditional metrics, with the forward 12-month P/E ratio currently at 21.7, above the 1-year average of 20.2, and the 5-year average of 19.7.

_spx_w_2025-01-08_10-08-46.jpg)

Throughout the final quarter of last year, consensus EPS expectations were revised lower, by 2.7%. This revision, though in keeping with the general trend of companies massaging expectations lower, before beating those lowered estimates, was somewhat smaller than the 5-year average of a 3.4% downward revision during the quarter.

At a sectoral level, eight of the S&P 500’s eleven sectors are expected to deliver positive annual revenue growth. This growth is likely to be led by the Technology sector, along with Utilities and Communication Services; in contrast, Energy, Industrials, and Materials are set to see negative YoY revenue growth. Meanwhile, eight of the eleven sectors are also set to see positive YoY EPS growth, with six of those eight likely to report a double-digit increase.

An extra, and important, consideration for Q4 24 earnings season is that the bulk of reports will coincide with the first fortnight or so of the President-elect Trump’s second term in the White House.

Inauguration Day on 20th January is likely to herald a sharp increase in policy uncertainty, and subsequently in cross-asset volatility, as participants attempt to gauge, and price in, the impact of Trump’s plans. Chiefly, focus will fall on the area of trade, particularly with the threat of universal tariffs on US imports looming large, as well as country-specific disputes with China, Mexico, Canada, Denmark, and others. The broader fiscal stance will also be eyed, in terms of both potential tax cuts, and Government spending plans, particularly as concern persists over the elevated degree of borrowing – reflected by the continued sell-off at the long-end of the Treasury curve.

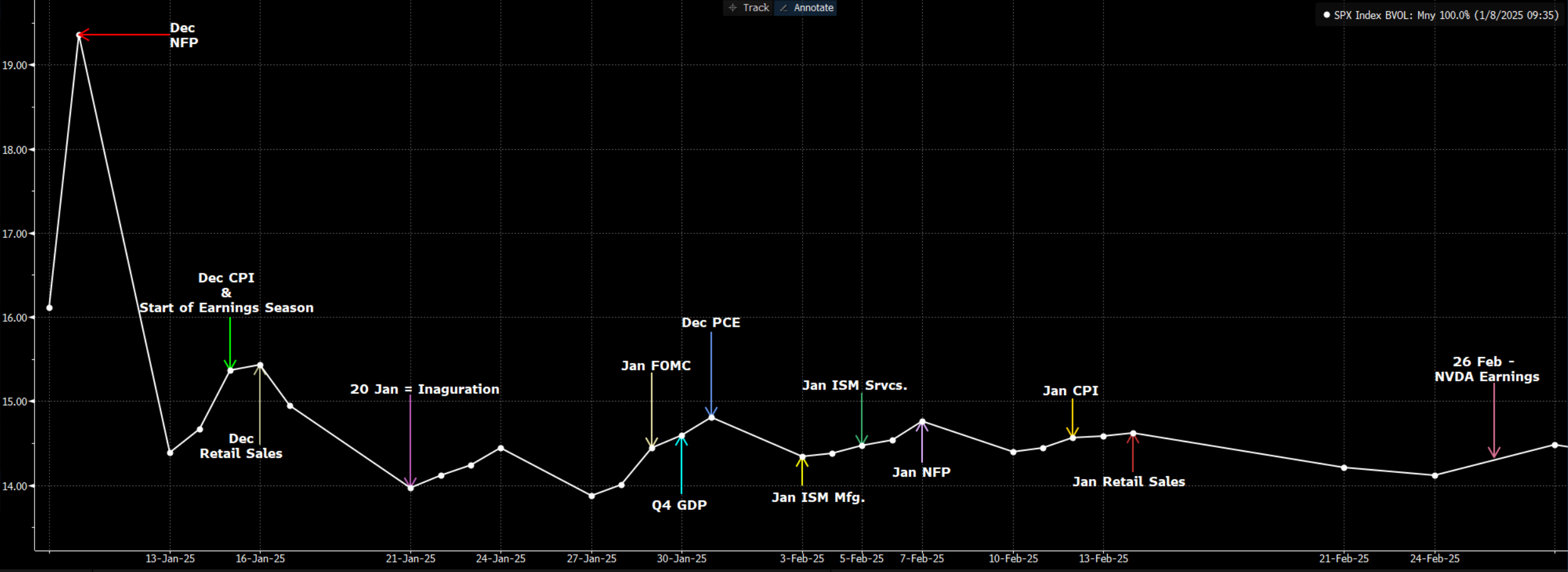

A look at the S&P’s implied vol curve shows the plethora of event risk on the horizon, but also points to markets seemingly not yet pricing an adequate pick-up in vol around inauguration day. One would expect a ‘kink’ to develop in the curve in due course, where vol on, and immediately after, Trump’s first day in office becomes elevated.

Finally, for more information on Pepperstone’s equity offering, including stocks which can be traded in pre- and post-market sessions, as well as overnight during the trading week, please visit the following page.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.