- English

- 中文版

Gold Outlook: Rate-Cut Expectations Hit, Eyes on Nonfarm Payrolls

.jpg)

Over the past week, gold prices followed a classic rally-then-retreat pattern. Bulls and bears were both active: on one hand, rising uncertainty over the U.S. economic outlook and doubts about the Fed’s independence supported safe-haven demand; on the other hand, with the government reopening, some profit-taking by bulls, and continued hawkish signals from Fed officials along with lowered market expectations for easing, bullish momentum was restrained.

This week, market attention is focused on the September nonfarm payrolls report, scheduled for early Friday (AEDT). While the data may be somewhat lagged due to the government shutdown, it could still act as a key catalyst for short-term volatility.

Technical Observation: High Volatility, Searching for Direction

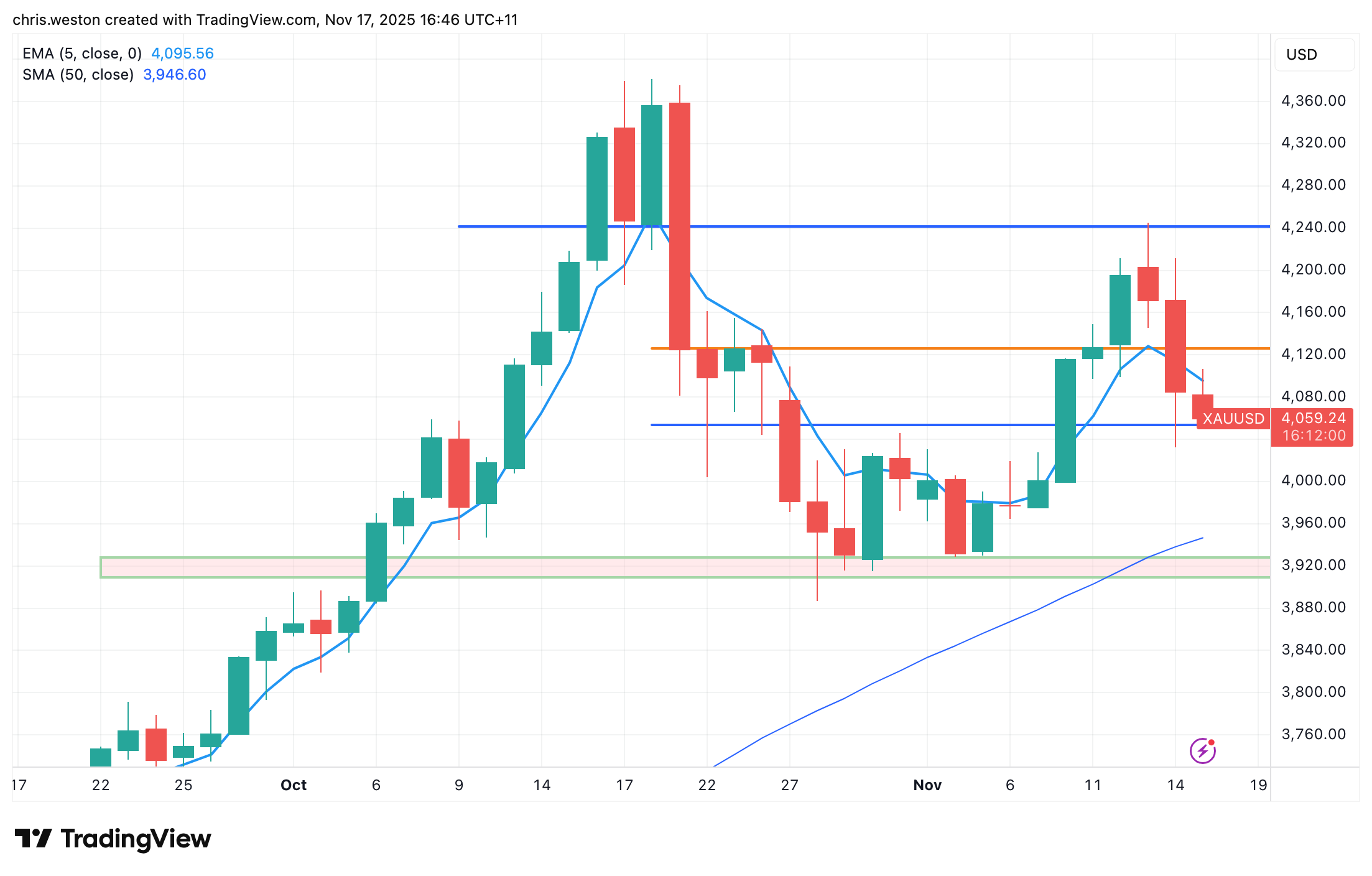

Looking at the XAUUSD daily chart, gold experienced a sharp rally followed by a rapid pullback. Early last week, the price held above $4,000 and broke through $4,100 and $4,200, peaking intraday at $4,245. However, sentiment shifted abruptly on Thursday, sending gold back below $4,100, with a weekly close at $4,085.

This morning, gold is trading around $4,080. On the downside, $4,050 and $4,000 could provide support; on the upside, a move back above $4,100 would put last week’s high of $4,245 in focus as a key resistance for challenging historical highs.

Notably, gold’s correlation with the USD, Treasury yields, and equities is currently low, meaning prices are largely driven by flows rather than traditional macro factors, which amplifies volatility. Recent fundamental developments are worth monitoring as they could guide future price direction.

December Rate-Cut Odds Drop, Selling Pressure Intensifies

Last week’s pivotal move in gold stemmed from a sharp decline in market expectations for a Fed rate cut in December. Several Fed officials, including Schmied and Logan, highlighted persistent inflation pressures and issued hawkish signals, directly curbing expectations for further easing this year.

A month ago, the market was nearly certain of a December cut, with odds around 90%; today, that probability has fallen below 50%. The Treasury yield curve has steepened on the downside, indicating traders are repricing both inflation risk and the pace of Fed easing. As a non-yielding asset, gold naturally faces pressure.

Risk-off sentiment, which pushed equities sharply lower, also intensified selling pressure on gold due to margin call pressures.

Government Reopens, Fed Independence in Question: Supporting Safe-Haven Demand

The Fed’s hawkish shift is closely linked to the longest U.S. government shutdown in history, lasting 43 days. While the government reopening and the Treasury’s TGA account liquidity boost are supportive, the data gaps created during the shutdown leave policymakers and traders “flying blind.”

Key economic data collection was disrupted: October’s employment, inflation, and GDP initial estimates have clear gaps; November employment data is incomplete, and inflation statistics remain limited. This uncertainty reinforces gold’s appeal as a safe haven.

Additionally, Atlanta Fed President Bostic, a hawk, announced he will not seek reappointment. His position could be filled by a more dovish official, increasing concerns over Fed independence. Hassett publicly stated willingness to lead the Fed and pursue aggressive rate cuts, further heightening policy uncertainty and boosting gold’s safe-haven demand.

Eyes on Nonfarm Payrolls and FOMC Minutes

Overall, gold saw a rally-and-pullback pattern last week, with heightened volatility. The retreat in December rate-cut expectations was the main driver of lower prices, while short-term profit-taking and weak long-position liquidation added pressure. Still, safe-haven demand continues to support prices, and high U.S. debt levels along with ongoing central bank purchases limit medium- to long-term downside.

Short-term, gold is expected to trade in a $4,000–$4,250 range. Market focus will be on upcoming delayed data releases, which could affect rate-cut expectations.

Due to the shutdown, several delayed data points will be released this week:

- U.S. Census Bureau: August construction spending (Mon), factory orders (Tue), trade balance (Wed)

- Bureau of Economic Analysis: August international trade data (Wed)

- Bureau of Labor Statistics: September nonfarm payrolls (Fri)

Of these, the September nonfarm payrolls report is the most closely watched. Market expectations are for 50k new jobs, up from 22k previously, with unemployment steady at 4.3%. If the data shows a resilient labor market, it could exert modest pressure on gold. For the December 10 FOMC meeting, the November nonfarm report released on December 5 will be more relevant.

Additionally, the October FOMC minutes, due Wednesday, will be important. If the minutes show most officials remain concerned about inflation and oppose easing, gold may face headwinds; if concerns about economic slowdown are highlighted, it could provide limited support.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.