Analysis

June 2024 UK CPI - A Headache On Threadneedle Street

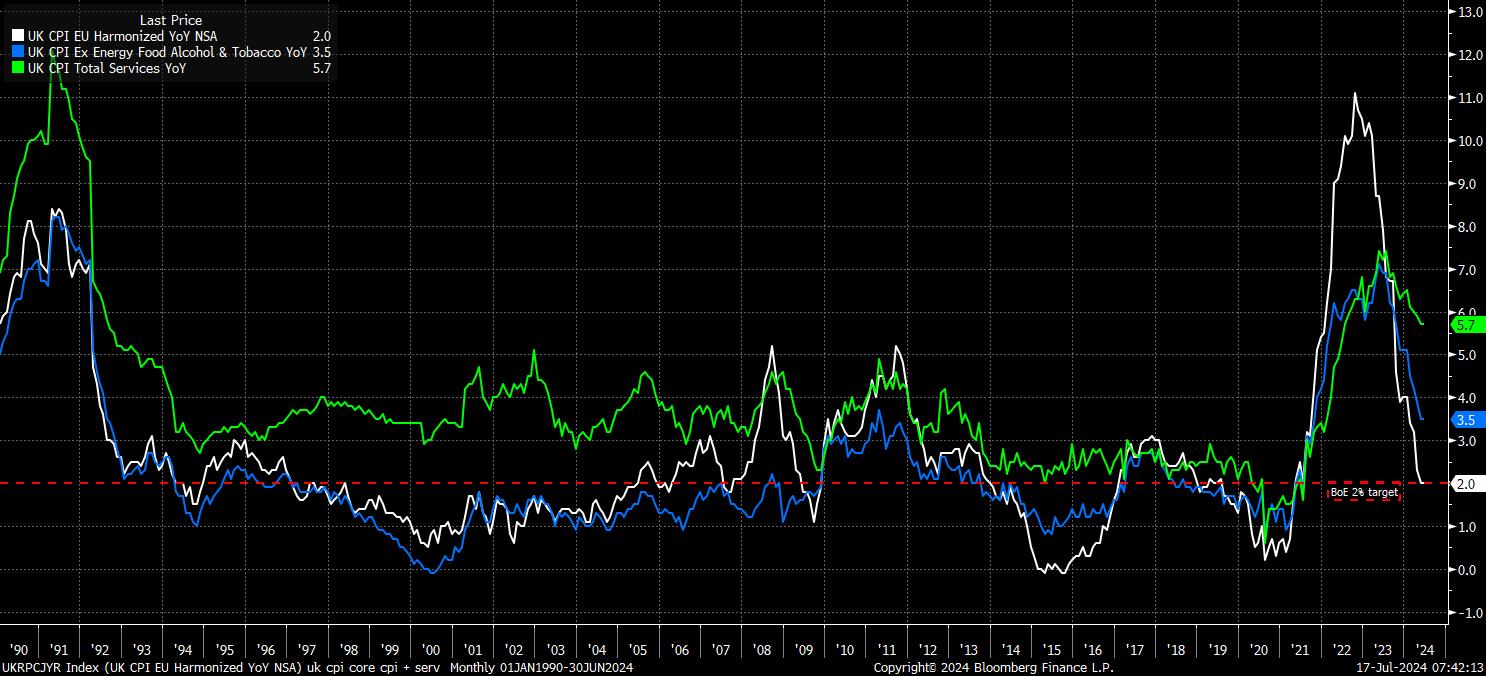

This morning's UK inflation figures were not exactly what you can call good news for the BoE's MPC. Although headline CPI remained at 2.0% YoY for the second straight month, in line with both the Bank's forecast, and inflation target, digging into the data paints a somewhat gloomier picture.

Core CPI held steady at 3.5% YoY, while the all-important services CPI gauge remained at 5.7% YoY, the latter being a chunky 0.6pp above the Bank's own forecasts, and implying that price pressures remain relatively sticky within the UK economy. While a degree of this stickiness may be down to one-off factors, such as Taylor Swift's concert tour, intense earnings pressures, with regular pay having risen by 6% in the three months to May, ahead of the latest jobs data due tomorrow, also play a significant role.

For the MPC, it will likely now be tough for a majority of policymakers to endorse an August cut after today's data. For some time now, MPC members have stressed the need to see signs of inflation "persistence" abating before beginning to normalise policy. Today's figures make it relatively tough to justify that said evidence is yet being seen, likely pushing back the timing of the first 25bp cut to September, at the earliest. The August vote, however, is likely to be a split decision once more, given how "finely balanced" the 7-2 call to hold rates was back in June.

Consequently, were the first rate cut to be pushed back into the autumn, as is now my base case, sterling should remain underpinned, particularly with the GBP OIS curve continuing to discount around 10bp of easing for the August MPC, and with the market viewing a September Fed cut as all-but-certain.

_2024-07-17_07-46-02.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.