- English

- 中文版

Euro, the sick man of Europe

If one looks at the recent rhetoric by the Fed and then compares that with the ECB, one looks dovish and the other hawkish. The Fed are actively talking up tapering QE while the ECB’s Lagarde stated yesterday that “we must avoid the mistake of removing support too early”. These comments were echoed by Schnabel who warned against tightening rates too soon.

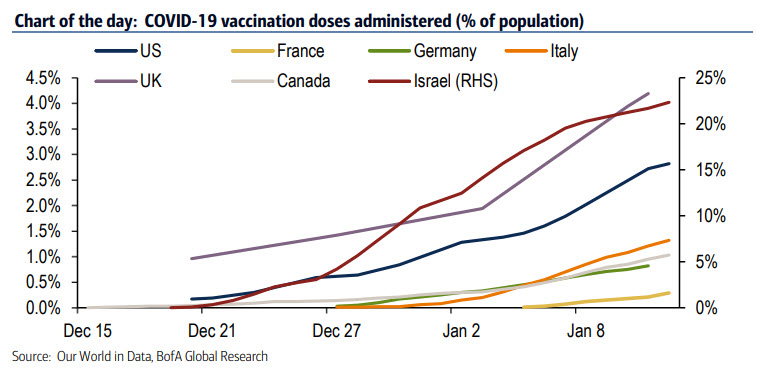

On the virus front tightening restrictions are becoming a common trend across Europe. Germany’s could last till April. Most banks are now forecasting a double-dip recession for the EU with 2021 GDP forecasts also being slashed lower. The vaccine rollout on a relative basis is lagging severely as the below chart from BofA indicates. Early Thursday morning we will get Germany's 2020 GDP print, consensus is expecting -5.1%.

Italian political issues have flared up again with the resignation of 3 ministers from the ruling coalition, putting PM Conte’s reign in doubt. Former PM Renzi orchestrated this maneuver and added to the euro’s woes. Continuing with the political theme we have German CDU elections over the weekend with Smarkets showing a lead for Mr Merz who is more sceptical about closer integration within the EU. If he wins this could have important consequences for Europe, given Germany’s dominance.

Positioning data indicates that euro longs are still substantial and could be prone to a large liquidation should a sell-off occur. The one factor that could work in the euro’s favour is equity flows into the Euro Stoxx to try capture the heavy cyclical component within the index as the reflation trade takes hold. From a seasonal perspective, January typically is the worst period for EURUSD so this weakness is not too surprising on that basis.

Societe Generale is recommending a 1.23 strike call option with a knock-in of 1.21. All this means is that for the option to become activated the EURUSD needs to fall to 1.21 and then they’re looking for a rebound and price to be trading above the strike price of 1.23 within a 3-month time period. This is the same really as buying the dip on a sell-off to 1.21/1.20.

The Technicals offer a mixed picture. The Stochastic looks to be turning upwards from oversold levels. There is good support to back that up - lower Bollinger Band, 38.2% Fibonacci level and the 50-day SMA. However, the pale pink line (21-day EMA) has been breached, since November this has provided dynamic support to the EURUSD. Could the 21-day EMA now act as dynamic resistance from here?

Related articles

Ready to trade?

Opening a Pepperstone account is simple. Apply in minutes. Start your Pepperstone journey today.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.