- English

- 中文版

Crypto Market Outlook: Is The Drawdown a Buying Opportunity or More Downside to Come?

Is the Latest Crypto Selloff Gone too Far?

After a significant crypto market pullback, traders are asking whether this correction now represents a more attractive entry point for medium- and longer-term positioning. With Bitcoin and altcoins facing heavy selling pressure, the key question is whether this drawdown has reached an attractive level to buy—or a sign of deeper downside risk.

Crypto markets have traded poorly since 7 October, a move intensified by the 10 October flash crash and then compounded by Jerome Powell’s testimony, where he made it clear that a December rate cut is “not a foregone conclusion”. From that moment, Bitcoin and altcoins have suffered broad, aggressive drawdowns—some altcoins are now down more than 70%.This does not necessarily create a floor—conversely, if price breaks below that level, an increased number of BTC ETF holders will be underwater. That increases the probability of further outflows and additional downside pressure in the BTC price.

Massive Liquidations and ETF Outflows Are Fueling Downside Momentum

Over the last seven days, we’ve seen:

- Nearly $10B of positioning closed in BTC futures

- Around $3B exiting the spot Bitcoin

- ~$1.6B in net outflows from Bitcoin spot ETFs in November

These ETFs were a major driver of the upside throughout 2024–2025. Now, sustained redemptions are acting as a headwind and contributing to weaker price action.

One important data point:

The average entry price for all outstanding Bitcoin spot ETFs is ~$89,600.

This does not necessarily create a floor—conversely, if price breaks below that level, an increased number of BTC ETF holders will be underwater. That increases the probability of further outflows and additional downside pressure in the BTC price.These stocks represent a leveraged play on Bitcoin/Ethereum and can act as early indicators for broader crypto sentiment. Right now, they are firmly in risk-off mode.

Key Crypto-Related Equities Are Signalling Stress

Crypto-linked equities are flashing warning signs:

- Strategy (MSTR) has fallen down 54%+ from recent highs – Interestingly, the MSTR price is now in line with its monthly net asset value (NAV)—potentially an early long-term buy signal

- BitMine Immersion down ~80%

- SharpLink -92% from its highs

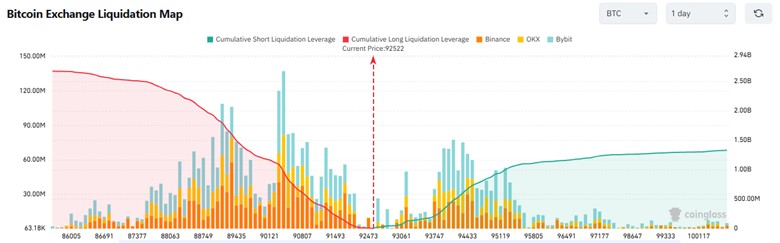

Leverage Positioning Suggests Asymmetric Downside Risk

Looking at the derivatives market:

- Between current levels and $90,000, there are ~$1.1B in leveraged long positions.

- If Bitcoin trades lower, those longs risk getting liquidated, potentially accelerating the decline in price

- On the upside, short interest is relatively light, meaning there is less fuel for a short squeeze rally.

The remains skewed toward downside risk.

A break below $91,800 is important.

Below that level:

- Traders who went long BTC on Tuesday from $89,153 (recent lows) would be facing a loss and may look to cut back.

- It would accelerate the move to $90k, big figure support.

Bitcoin also remains below the 5-day EMA, which has contained the rallies from 11 November and reinforcing the near-term bearish bias.

Macro Catalysts: Nvidia Earnings and US Payrolls Ahead

Traders should also keep an eye on macro catalysts:

- Nvidia earnings – Nvidia report Q326 earnings (after-market) in the session ahead – should Nvidia trade lower in response we could see higher beta risk assets (such as crypto) under pressure too.

- US Non-Farm Payrolls on Thursday – a weak payrolls report may increase the chance that the Fed cut rates in December, but it may also lower risk appetite in markets.

Both events could add pressure or spark a short-term reprieve.

Key Trading Levels to Watch

Bearish Levels

- $91,800 → Break here likely accelerates downside

- $90,000 → Large cluster of leveraged longs

- $89,600 → Average ETF holder entry price; sub-89k could trigger outflows from the BTC ETFs.

Bullish Trigger

- $96,000 → A clean break above this would be the first sign of a bullish reversal

Until Bitcoin regains $96,000, the bias remains bearish with risk skewed to the downside.

Bottom Line: More Downside Risk Before a Durable Bottom

While long-term investors may see emerging value, the short-term structure still favours further downside:

- Heavy ETF outflows

- Large clusters of vulnerable long leverage

- Crypto-linked equities under pressure

- Weak price action under the 5-day EMA

- A fragile macro backdrop

A break below $91,800 would likely accelerate selling toward deeper support levels.

Until Bitcoin can retake $96,000, the market remains in “sell rallies” territory.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.