- English

- 中文版

Beyond Meat: The New Meme Stock — A Trader Case Study in the Importance of Flows

Summary

• Crash and Burn: Reviewing the incredible two-way moves in Beyond Meat’s (BYND) share price

• Respect the Volatility: Essential intel when trading in such a high-volatility market

• Selecting a Meme Stock Candidate: The mechanics required to drive such explosive moves

Beyond Meat: What Drove Such Incredible Moves?

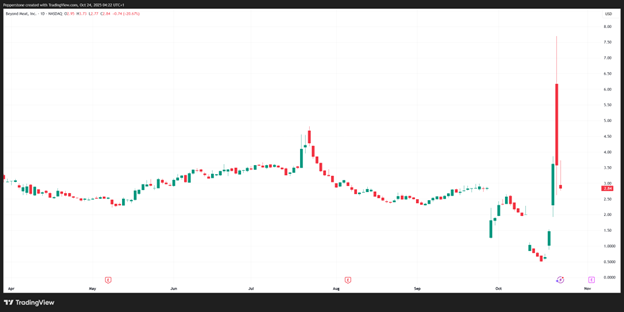

For traders with a tolerance for ultra-high risk, any stock that rallies 1,400% in four days will hardly go unnoticed. Beyond Meat (BYND) had been savaged since hitting $221 in January 2021, with shares last week (17 Oct) falling to an all-time low of $0.50 (market cap of $34 million).

Things started to turn more positive from 20 October, when BYND announced a distribution deal with Walmart — news that was quickly followed by Roundhill adding BYND to its ‘Meme Stock ETF’. The anticipated passive flows provided further modest tailwinds for the share price.

Both pieces of news helped support the price, but they were clearly not the catalyst for the ensuing 1,400% rally.

BYND, the New GameStop

This is where we turn to the GameStop playbook from 2021 and the influence that “Roaring Kitty” had in driving GME’s share price up 1,000% in a five day period. While Keith Gill was not involved in the BYND move, the process and structure that led to the spectacular gains in both GME and BYND were remarkably similar.

In the BYND run, it was a trader named Dimitri Semenikhim who announced in a Reddit thread that he had taken a substantial position in the stock (amounting to around 4% of the outstanding shares) and laid out a reasonably compelling investment case for his purchase.

Short Positioning Taken Down Aggressively

From there, the WallStreetBets crowd turned its full attention to BYND, seeing a structural setup that offered near-perfect conditions — where, if the masses acted in unison, there was a high probability the stock could experience a massive short-covering rally and options gamma squeeze.

And that’s exactly what unfolded.

Retail traders (and high-frequency players) piled into long positions from $1 to $2. From that point, the heavy short positions were forced to part cover, buying back the stock.

The Influence of Options Buying

We also saw record demand for short-dated BYND call options. While implied volatility in BYND options was already high — making these calls expensive to buy — the new wave of demand sent implied vol across strikes and expiries to extreme levels.

For example, the implied volatility in BYND $4 calls expiring on 24 October reached 826% on 22 October.

The market makers who sold these call options were only interested in collecting the rich premiums paid by buyers. However, they stood to lose heavily if the underlying shares continued to rally. To hedge that risk, they dynamically bought BYND shares in accordance with their net exposure — bringing their delta back toward zero.

Subsequently, with shorts covering and dealers hedging their delta exposure, any potential sellers saw exactly what was happening and stepped aside. The offer side of the order book thinned out markedly, further exacerbating the upside move. By Wednesday (22 October), the share price had run red-hot to $7.69.

Of course, any market that can rally at such a pace can just as easily fall at a similar pace — and that’s exactly what we observed, with the share price subsequently cratering 63% to $2.84.

It’s hard to pinpoint the exact cause of the 63% sell-off back to $2.84. Despite the stock showing no connection to fundamentals, it could easily have rallied another 30–50% before rolling over. That said, when implied volatility in the short-dated options approaches 1,000%, it then becomes quite attractive for high-risk options traders to sell calls and capture those elevated premiums.

While many traders who were short below $5 would have been in a world of hurt in the position, if they managed to close their positions for a manageable loss, it’s likely they were soon calling around the broker community looking to reborrow shares to short again.

And voila — here we are.

Implied volatility in short-dated calls remains very high, making call options expensive to buy and therefore limiting the prospect of another spike higher. Yet short interest is presumably highly elevated once more. One could feasibly see a period of consolidation in the near term given this dynamic, but BYND remains a stock for the brave — and for those with a very high tolerance for risk.

Summary

Many traders will now be scanning the U.S. equity universe for stocks with:

• High short interest ratios

• Constraints on additional shorting

• A liquid options market

• Market capitalisation below $400 million

This is the precise setup required for another meme-style rally.

As we’ve seen from GME, AMC, and now BYND, when a company is identified as a “squeeze” candidate, the combination of shorts covering, dealers hedging their options exposure, and sellers stepping aside can generate truly incredible moves.

Beyond Meat has been a genuine case study in how these flows can all come together to pull a market some distance away from fundamental reality.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.