- English

- 中文版

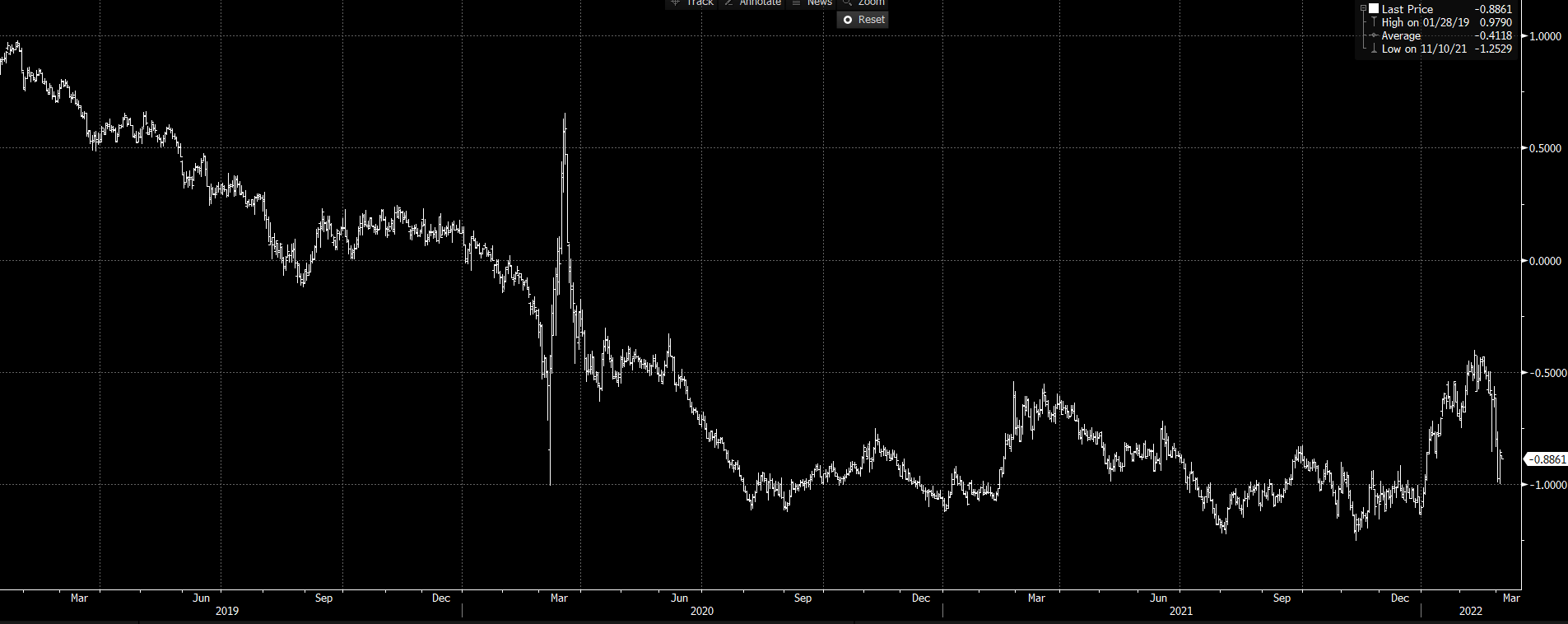

Gold’s price action leading up to the invasion of Ukraine has left many including myself perplexed. US 10-year real yields as seen in the below graphic have risen circa 50bps YTD, yet gold appreciated by 3.7%. The reason why this is confounding is due to the strong causal relationship between the two variables. Running a regression on these two variables yields an R-squared north of 85% (R-squared tells us the amount of the variation in gold’s price explained by US 10-year real yields). Given this highly predictive relationship which has held through many different economic cycles, why then did price diverge from real yields and lead to gold trading at a substantial premium to its fair value based on real yields. Although this premium has narrowed recently as the surge in energy prices drives inflation expectations higher and depresses real yields, there is still a sizable premium. This analysis will try to provide reasons for this oddity and hopefully provide a framework to better analyse gold going forward.

(Source: Bloomberg - chart of US 10-year real yields)

Policy Mistake Hedge:

Staying on the theme of yields, many began to see gold as a potential hedge for overzealous central banks. The rationale behind the thesis is that in order to stamp out inflation, the Fed will need to hike aggressively, but end up having to reverse these series of hikes as the economy buckles under the pressure of the rapid normalization. Evidence of this being the case can be seen in the 2s10s curve, which has flattened dramatically as well as the Eurodollar curve inverting as shown by the below chart with the spread between the 2024 and 2023 contract negative. That inversion is saying rate markets expect the Fed to cut rates down the line.

(Source: Bloomberg - spread between 2024 and 2023 Eurodollar contract)

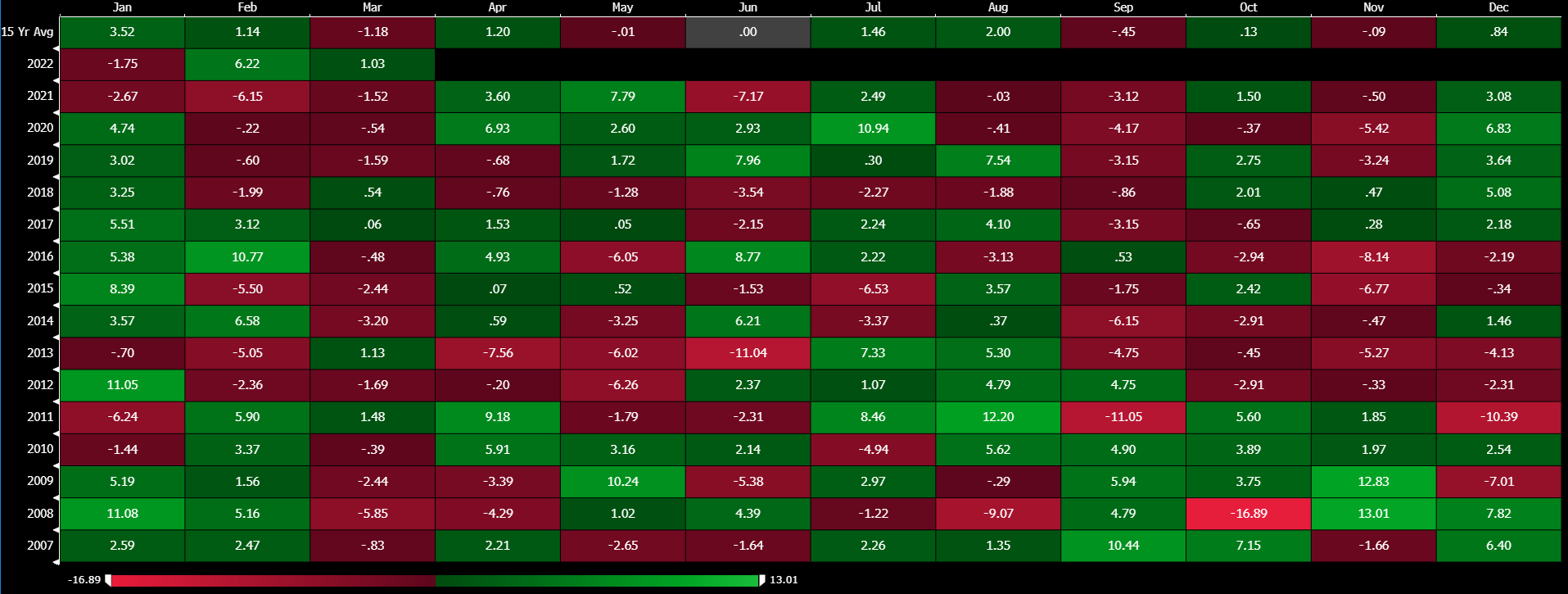

Seasonality:

January and February are traditionally solid months for the yellow metal as the below chart indicates. As we move into March, gold tends to experience weakness. We will have to see if this is the case this year given the incredibly unique circumstances we found ourselves in. Seasonality is not something to be relied on solely, but rather as another tool within the analytical toolbox.

Weakness in Cryptocurrency CFDs:

Given the narrative of Bitcoin being a form of “digital gold” and a substitute for physical gold by some, there was likely a rotation out of Bitcoin towards gold when Bitcoin was rapidly depreciating. Millennials are becoming a more important demographic within the investment universe and they certainly have a proclivity for Bitcoin over gold. I expect this to be a slow drip as opposed to a gushing tap in terms of future demand destruction for gold. The problem for Bitcoin’s legitimacy within the institutional space is its volatility. Bitcoin currently boasts realized volatilities around 3-4 times higher than that of gold. From a portfolio management perspective this is a problem, in order for Bitcoin to be a real competitor for gold we’d have to see that vol from Bitcoin drop substantially. Gold has a relatively low realised volatility - so if you want a portfolio diversifier from both a correlation and volatility perspective, gold is the place to be. With a hawkish Fed, bonds have not been a good place to hide while equity markets sell-off.

Technical Factors:

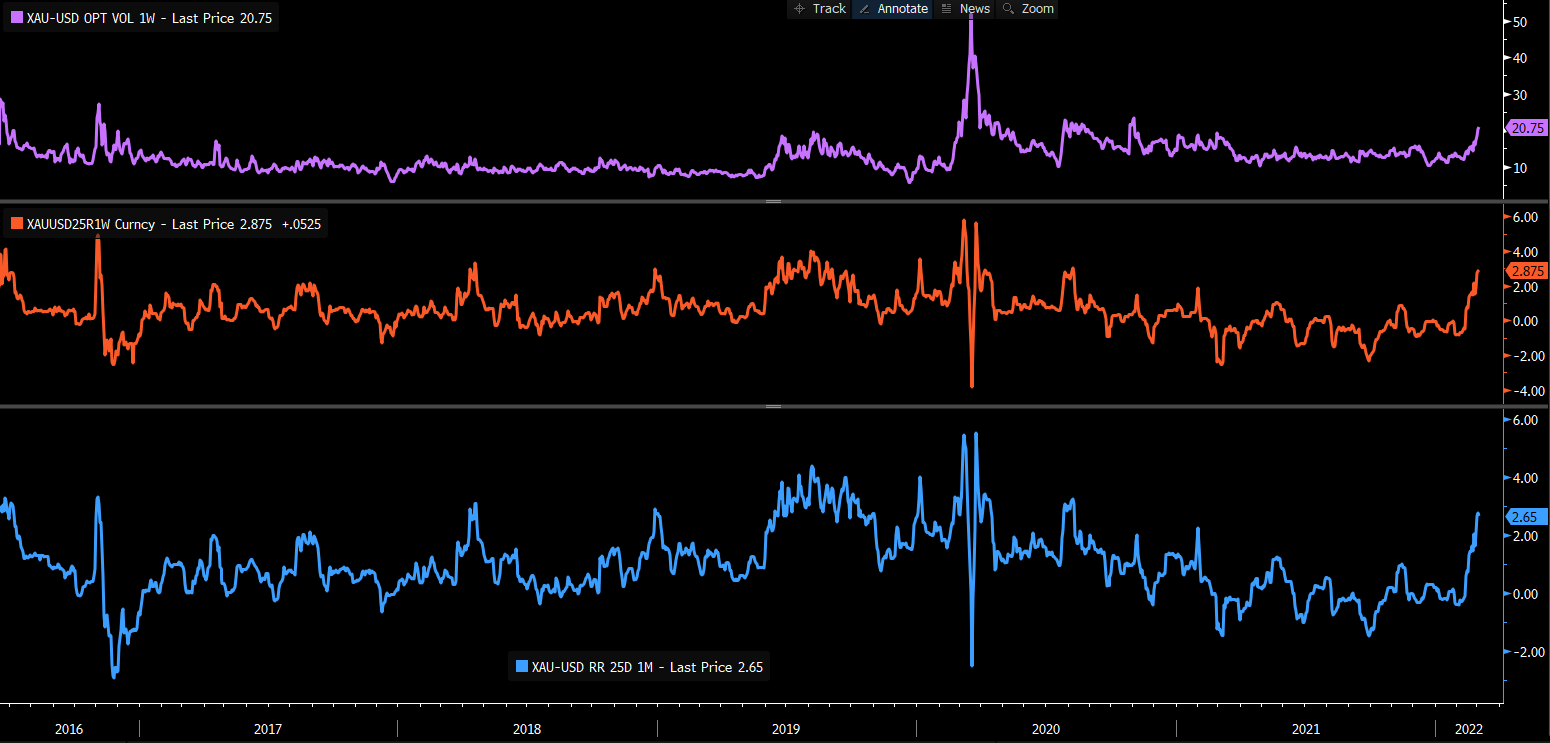

There is definitely some shorts that would have been squeezed as price broke key resistance levels and momentum & trend following funds chased price higher. Sentiment with the options market - significant vol skew towards the upside i.e. call implied volatility is higher than that of put implied volatility, meaning much more demand for exposure to upside price moves.

(Source: Bloomberg - 25D 1-week and 1-month Risk Reversals for gold)

Ukraine Russia Conflict:

Lastly, the main driver of gold’s price currently. Clearly gold’s price is discounting a hefty geopolitical risk premium, however, some may point to this as a downside risk to price if there is a more optimistic resolution to the current situation. If the situation deteriorates further then $2000 at a minimum becomes the next likely price target which comes into play. The conflict could actually have a negative effect on gold’s price. With Russia unable to utilize their foreign margin FX reserves they may need to liquidate large chunks of their gold holdings and this could cause some weakness in the yellow metal.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)