- English

- 中文版

DAX / DOW JONES – Tagesausblick (Unfair Value): Di, 30.09.2025

Webinar: Donnerstag 19:00 bis 19:30 Uhr — mit Dennis Gürtler

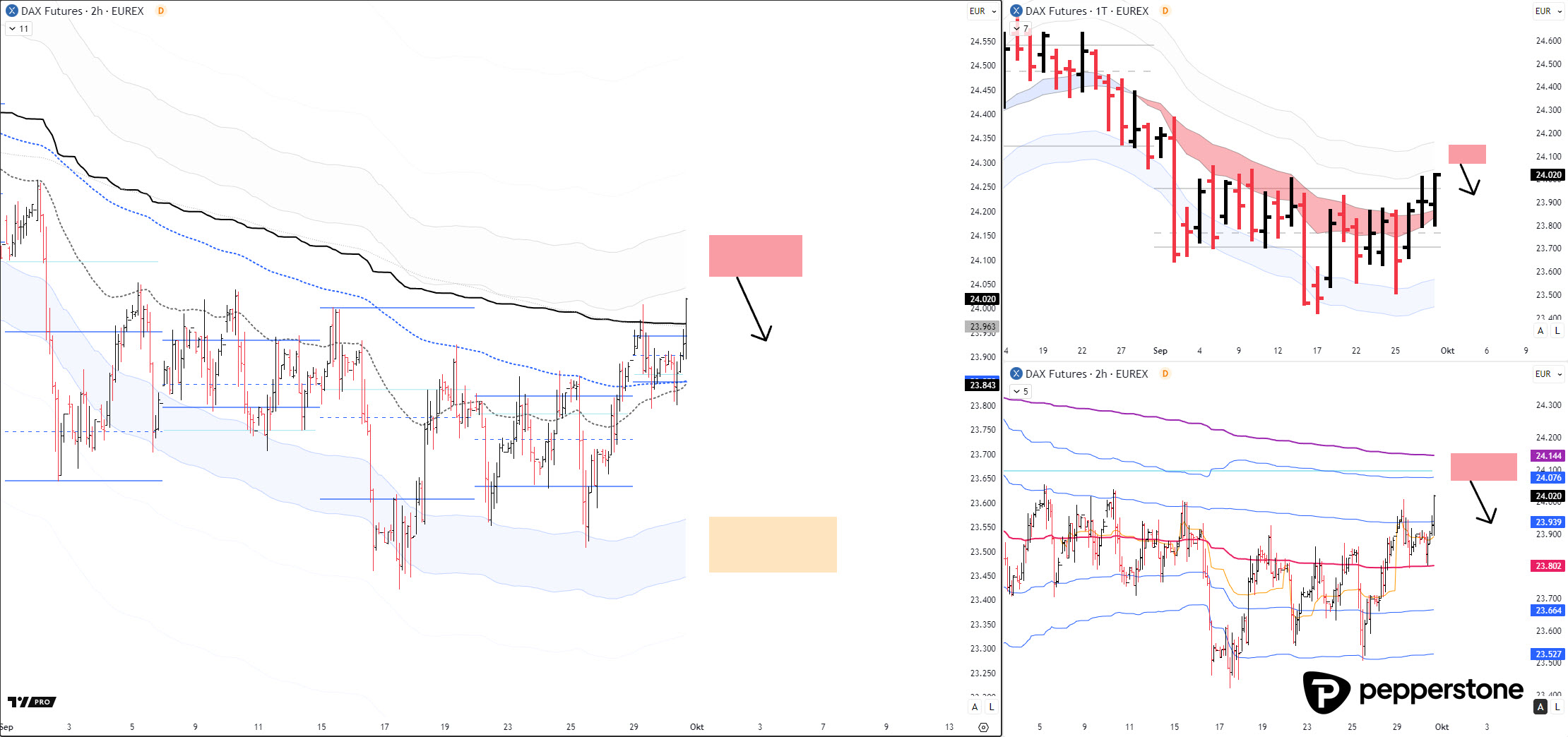

DAX PROGNOSE – INTRADAY DAY

DAX PROGNOSE: Der DAX hat nahezu alle Shortzonen abgearbeitet. Aktuell wartet noch eine letzte obere Shortzone, wie eingezeichnet bei 24.100 Punkten. Zeigt der Markt dort Schwäche, ergibt sich daraus eine weitere Position. Bis dahin bleibe ich an der Seitenlinie.

Handelszonen (LONG): keine

Handelszonen (SHORT): siehe eingezeichnete Marken

Orange Zone: Entgegen der Handelsausrichtung könnten an diesem Punkt Korrekturen eingeleitet werden, da dort der Index als überdehnt gilt.

Unterstützungen & Widerstände richtig handeln: Hier aufrufen

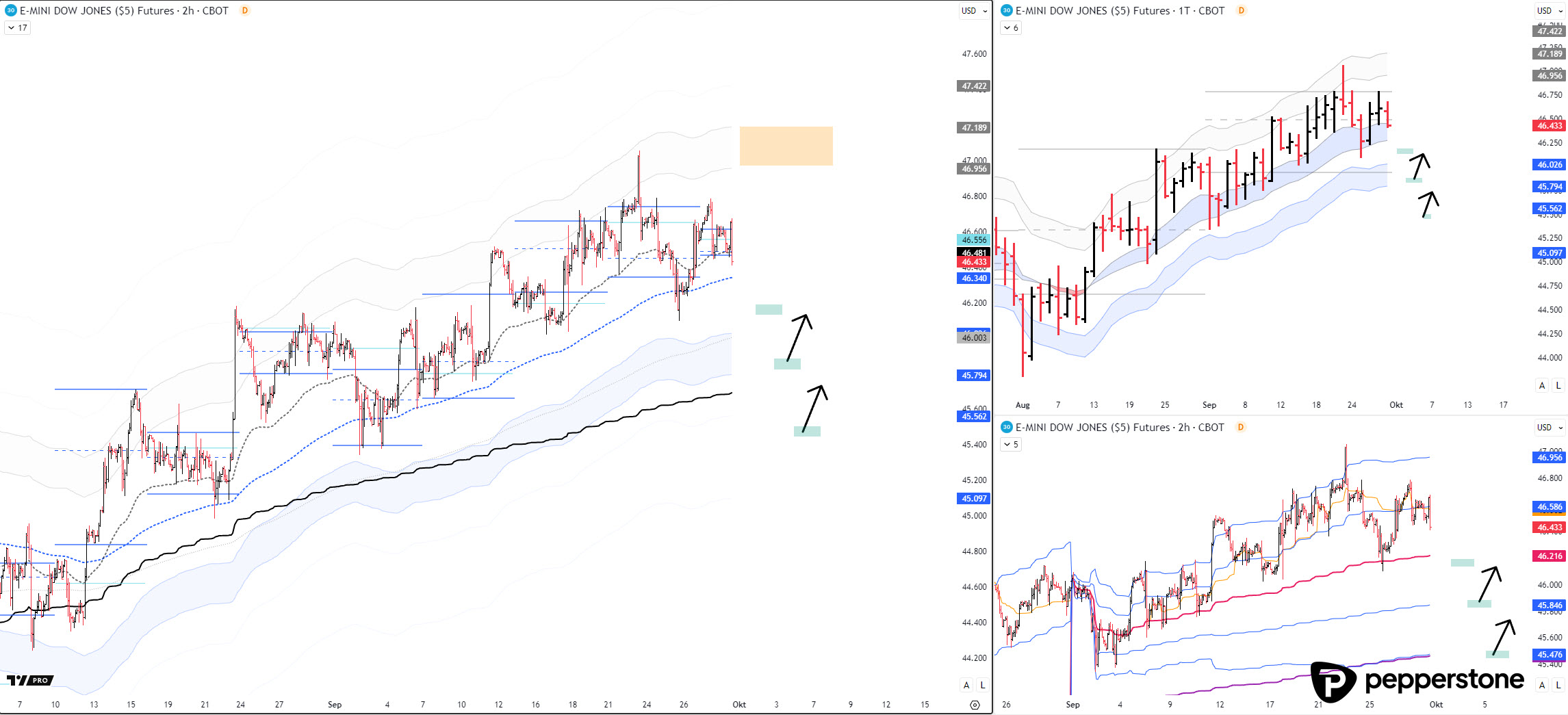

DOW JONES PROGNOSE – INTRADAY DAY

DOW JONES PROGNOSE: Die Handelsausrichtung im DOW JONES bleibt weiterhin aufwärtsgerichtet, allerdings fehlt es hier an tieferen Korrekturen für weitere Einstiege in Richtung des steigenden Trends. Entsprechende Handelsorte habe ich farblich hervorgehoben.

Handelszonen (LONG): siehe eingezeichnete Marken

Handelszonen (SHORT): keine

Orange Zone: Entgegen der Handelsausrichtung könnten an diesem Punkt Korrekturen eingeleitet werden, da dort der Index als überdehnt gilt.

Unterstützungen & Widerstände richtig handeln: Hier aufrufen

Viel Erfolg,

Ihr Dennis Gürtler.

WANN WERDEN UNTERSTÜTZUNGEN / WIDERSTÄNDE GEHANDELT?

Einer der wichtigsten Fähigkeiten erfolgreicher Händler ist die Kompetenz mit, Unterstützungen und Widerständen richtig umzugehen. In diesem Beitrag gehe ich darauf ein wie Anfänger, Fortgeschrittene aber auch erfahrene Händler Unterstützungen sowie Widerstände effizient nutzen können. HIER LESEN

TRADEMANAGEMENT

Entscheidend ist, den Stop-Loss wie immer sofort auf das Einstiegsniveau nachzuziehen, um das Risiko zu begrenzen. Wie weit dann der potenzielle Trade läuft, entscheidet wie immer der Markt. Gewinnmitnahmen bei +0.5R, +1R und +2R sind in der Regel sinnvoll. Mit „R“ sind Risikoeinheiten gemeint.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.