How today’s OPEC+ meeting could rattle markets

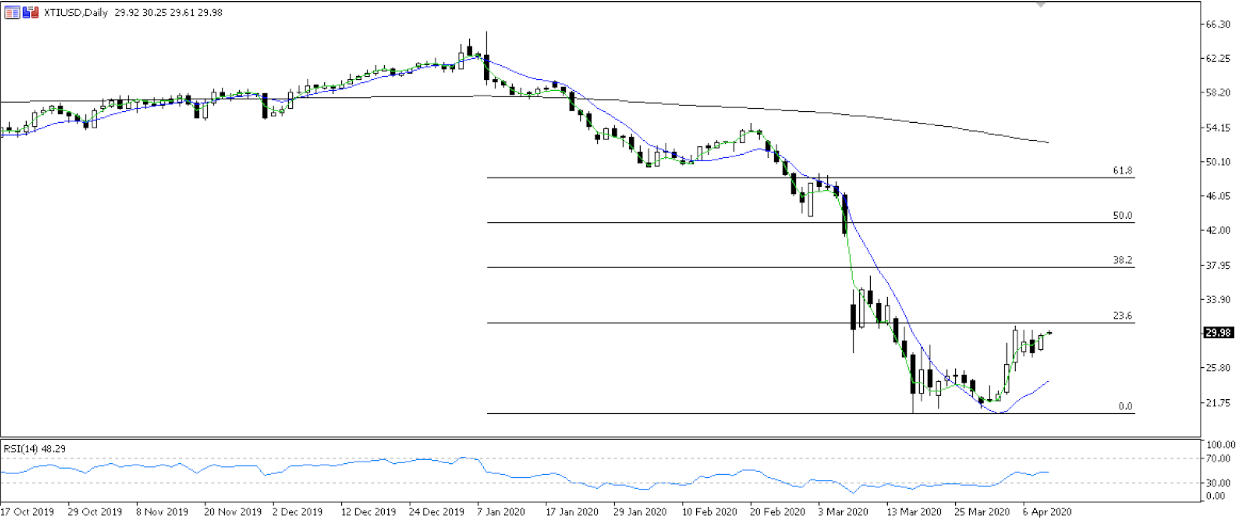

Daily chart: WTI crude has sold off from more than $60 a barrel in January to as low as $20 in March. Price action has found resistance below the 23.6% retracement of the sell-off as traders await tonight’s OPEC+ meeting. Chart source data: Metaquotes MT5

"Daily chart: WTI crude has sold off from more than $60 a barrel in January to as low as $20 in March. Price action has found resistance below the 23.6% retracement of the sell-off as traders await tonight\u2019s OPEC+ meeting. Chart source data: Metaquotes MT5"

WTI crude prices have rallied off the March lows of almost $20 per barrel as markets anticipate coordinated supply cuts. Traders have been hesitant to take this above $30 per barrel, close to the 23.6% Fib retracement of this year’s sell-off at 31.10, with too many uncertainties until an OPEC+ decision is confirmed. If the alliance can agree on coordinated supply cuts of 10-15 millions per day, I’d expect a break of that 23.6 retracement and a powerful move higher.

But an agreement on supply cuts isn’t so easy. There are many sticking points, including how to divide cuts among oil producing nations and whether or not the USA will commit to supply cuts substantial enough to stabilize price. President Trump has threatened tariffs on oil imports to prop up US energy producers, a measure which anger OPEC+ allies and prolong the price war.

Is a supply cut enough to stabilise prices?

The global oversupply is estimated at a massive 35 million barrels per day, far more than the anticipated 10 million barrel supply cut. OPEC and friends aren’t the only nations considering cuts, so are Brazil, Canada, and the USA.

If the OPEC+ meeting can deliver the anticipated supply cut of 10-15 million barrels, this can only partially relieve price. A much more substantial supply cut is needed to meaningfully correct an oil market facing a deep demand shock.

The major blow to the oil market this year has of course been from pandemic lockdowns and travel bans. Oil demand has plummeted as factories close, people travel less, and several global airlines grounded until further notice. Russia’s stunt of abandoning supply cuts was gas (literally) to an already roaring fire, its position being that cutting output only propped up US shale producers.

A vicious price war instantly broke out as Saudi-led OPEC and Russia ramped up supply towards maximum production, drowning global markets in crude oil no one needs right now. Price was already moving towards $40 a barrel on the pandemic demand shock, then quickly slid towards $20, a point where major US oil producers struggle to run a profit.

The surplus is becoming so large that experts think the world could soon run out of room to store the excess oil.

Markets are expecting a daily supply cut of up to ten million barrels. Kuwait has signalled the target is as much as 15 million. Reports are that Russia is willing to cut up 1.6 million barrels per day, but after their stand against US shale, cuts will likely be dependent on what the white house can offer.

US a key player

No US energy producer can make their books balance with oil below $30 a barrel, with major producers like Chevron (CVX.N) and Exxon-Mobil (XOM.N) slashing costs to try cope with the downturn. So Russia has got what it wanted and forced President Trump to the negotiation table.

Trump has threatened tariffs on oil imports to protect US producers, but has said he shouldn’t need to implement them provided OPEC+ delivers the daily supply cut of 10-15 million barrels he expects.

Russia doesn’t want to prop up US energy producers at its own expense, so the potential daily cut of 1.6 million barrels will be hinged on meaningful cooperation from the USA. If Russia isn’t happy, the entire meeting could be jeopardized, the price war prolonged, and crude prices sinking again towards $20 per barrel.

Oil prices and stock markets and commodity currencies

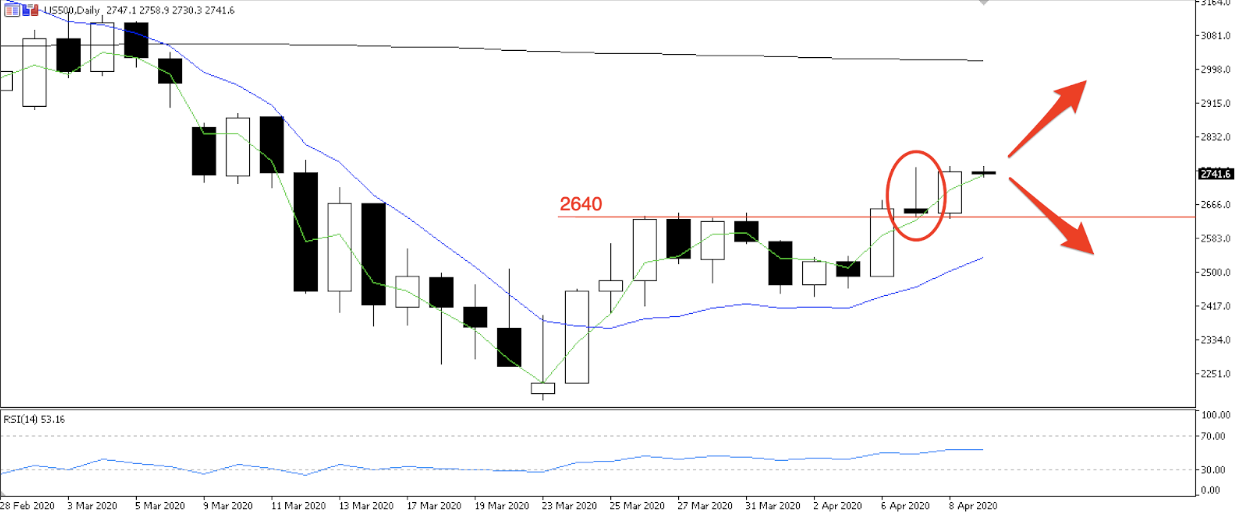

Arguably a big driver of risk in markets this week has been the oil rally towards $30 a barrel. A graveyard doji candle formed on US equity indices Tuesday, circled on the S&P 500 (US500) daily chart below, the same day oil prices fell amid supply cut uncertainty. Typically an ominous sign, the graveyard doji couldn’t stop US stocks rallying on Wednesday alongside a rally in crude prices.

Daily chart: The US500 continues to make wild price swings, with a risk on mood helped by rising oil prices. Resistance at 2640 has become support. Bearish graveyard doji candle formation on Tuesday circled in red. Chart source data: Metaquotes MT5

"Daily chart: The US500 continues to make wild price swings, with a risk on mood helped by rising oil prices. Resistance at 2640 has become support. Bearish graveyard doji candle formation on Tuesday circled in red. Chart source data: Metaquotes MT5"

Higher oil prices are welcome news for US stocks. Many major companies are tied to higher energy prices, right from the energy producers themselves, to machinery providers like Caterpillar (CAT.N), and the big banks who finance exploration and drilling projects.

A substantial supply cut and the benchmark index rallies, with the 200-day MA (black line) providing an ambitious target around the 3000 handle. Remember big daily moves are all part of bear market volatility as investors struggle to accurately price anything. I wouldn’t expect a big move higher to be long-lived, with traders finding newsflow to fade the level, particularly as forecasts are slashed ahead of earnings season.

In the event of no progress at tonight’s OPEC+ meeting, oil prices will fade recent gains, hurting equities in turn. Firm resistance at 2640 is shaping up as support, a key level to watch.

Another winner from a better feel to oil prices is the AUDUSD forex pair. The pro-growth antipodean currency AUD has received a strong bid higher this week as it recovers from lows not seen since 2002.

Investors treat the Australian dollar as a global risk proxy, so a rise in oil prices is welcome news for the commodity currency. Implied volatility in AUD remains among the highest, so traders will be anticipating a big move here dependent on today’s OPEC+ decision.

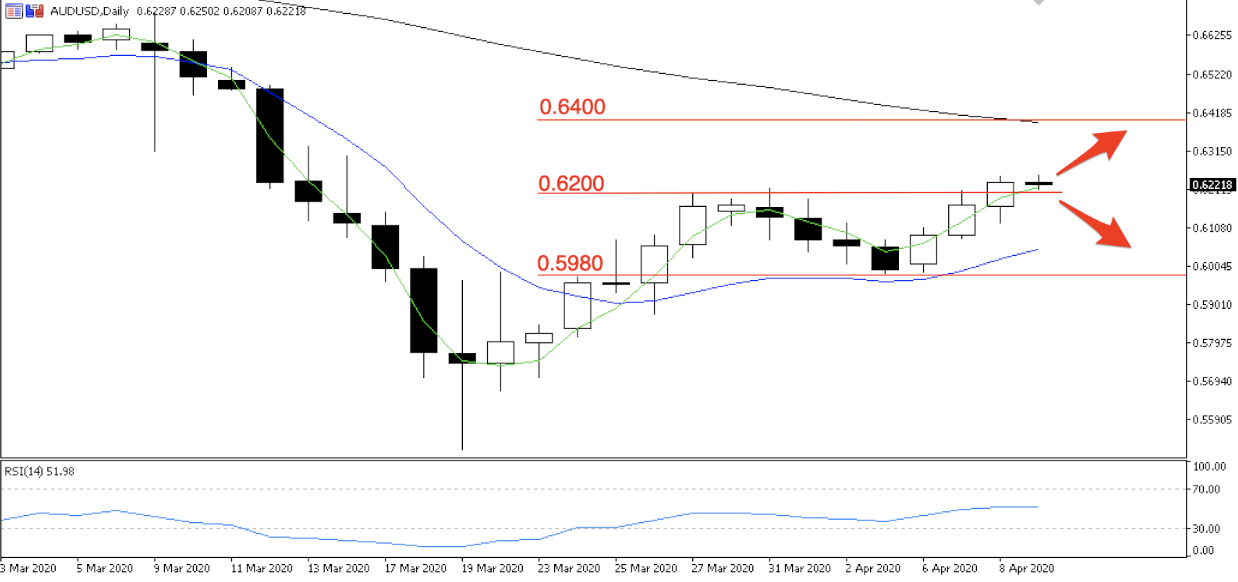

Daily chart: AUDUSD closed above 0.6200 resistance on a strong bid yesterday. Meaningful OPEC+ supply cuts tonight could extend the rally, whereas no deal could take the AUD below 0.62 once again. Chart source data: Metaquotes MT5

"Daily chart: AUDUSD closed above 0.6200 resistance on a strong bid yesterday. Meaningful OPEC+ supply cuts tonight could extend the rally, whereas no deal could take the AUD below 0.62 once again. Chart source data: Metaquotes MT5"

Meaningful supply cuts and the AUD could get another bid higher, the 50-MA (black) giving a target around 0.6400. But no deal would be a blow to the Aussie, which could be knocked back below the critical level 0.6200. Support beyond here is firm at 0.5980.

Petro-currencies like CAD and NOK could also see big moves tonight if the OPEC+ meeting results in more cuts than expected or, if no agreement can be reached, none at all.

Holiday weekend

Do consider your risk going into the long weekend and adjust position sizes accordingly. Negotiations are unpredictable and could drag out into the weekend, with a backup meeting ready for Saturday if no agreement is reached tonight. This is considerable gapping risk for when already volatile markets open next week.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.