Does Pepperstone offer Stop and Limit Orders?

We offer Buy and Sell Stop and Limit orders, which trigger market orders at the next best available price.

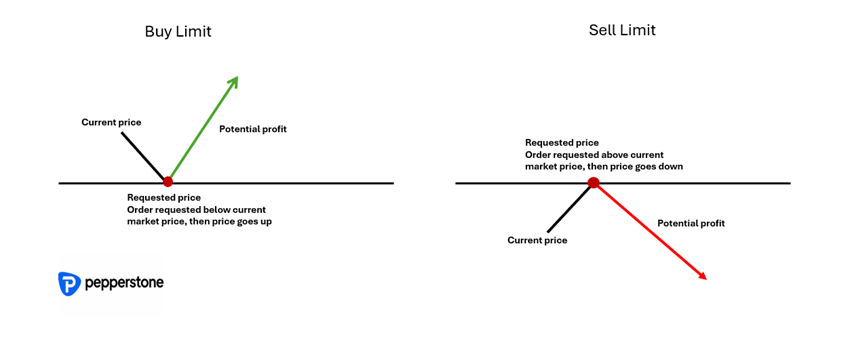

A Limit Order is an instruction to buy or sell a financial instrument at a better price.

1. Buy limit order is requesting to buy below current market price or to buy with cheaper price.

2. Sell limit order is requesting to sell above current market price or to sell with more expensive price.

A limit price gives traders the opportunity to maximize profit by entering at a more favorable price, or to minimize potential loss by ensuring the trade is executed only at the price they specify or better.

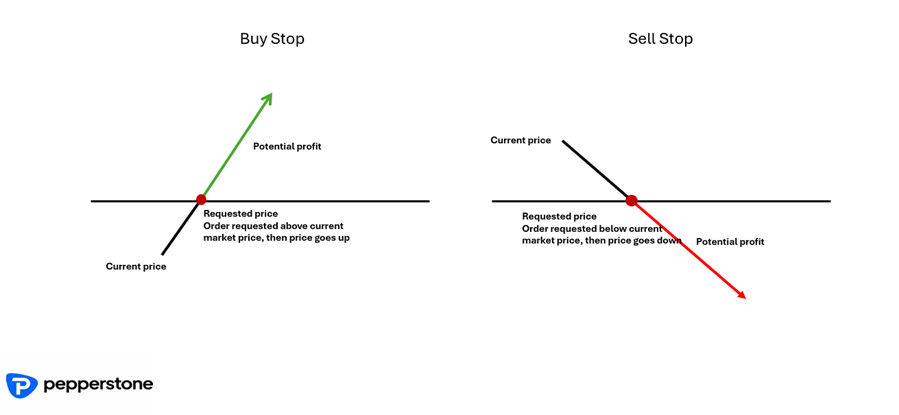

A Stop Order is an instruction to execute a trade once the market reaches a specific price level. It’s typically used to limit losses or trigger entries when momentum builds.

1. Buy stop order is requesting to buy above current market price or to buy with more expensive price.

2. Sell limit order is requesting to sell below current market price or to sell with cheaper price.

A stop order is often used by traders who want to enter a position only when the market shows strong momentum—for example, when the price breaks above a certain level. Even though the trade might be executed at a worse price than the current one, the trader is willing to accept that because the price movement confirms their strategy. It’s a way to wait for confirmation before entering, rather than guessing if the market will move.