- English

- 中文版

T.I.N.A is the idea that bad geopolitical news, poor economic data, or some other macro news flow results in lower bond yields and a subsequent hunt for relatively higher-yielding assets, such as equities or high yield credit.

Market participants have enough complexity in their trading without having to assess how assets will react to news, especially when logic often means so little. The fact that bonds rally (yields lower) on bad news and equities subsequently trade lower, makes life a touch easier. The TINA trade is seemingly over, and the equity market is sensing a message from the bond market, which to be fair isn’t particularly upbeat right now.

Economic data and the S&P 500

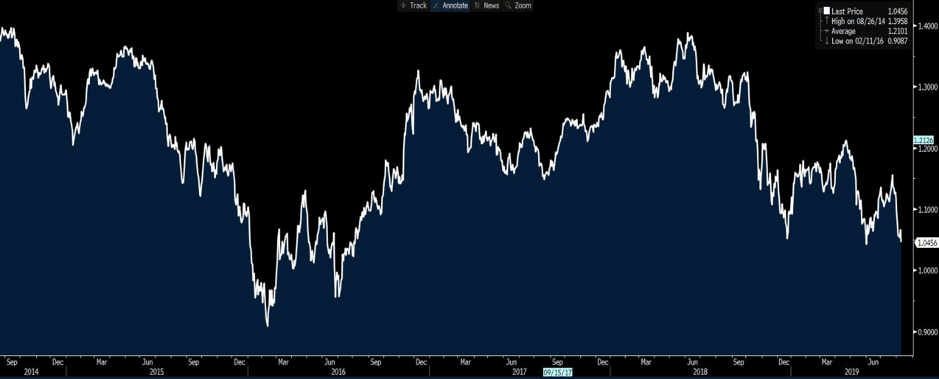

If I look at the relationship between the S&P 500 and the Citigroup US economic surprise index, we can see an interesting correlation. I have flipped the S&P 500 to highlight the relationship, but as US data has come in slightly hotter than expectations in recent weeks, with the Citigroup surprise index (white) increasing, equities have still struggled.

"White: Citigroup index. Yellow: S\u0026P 500 index."

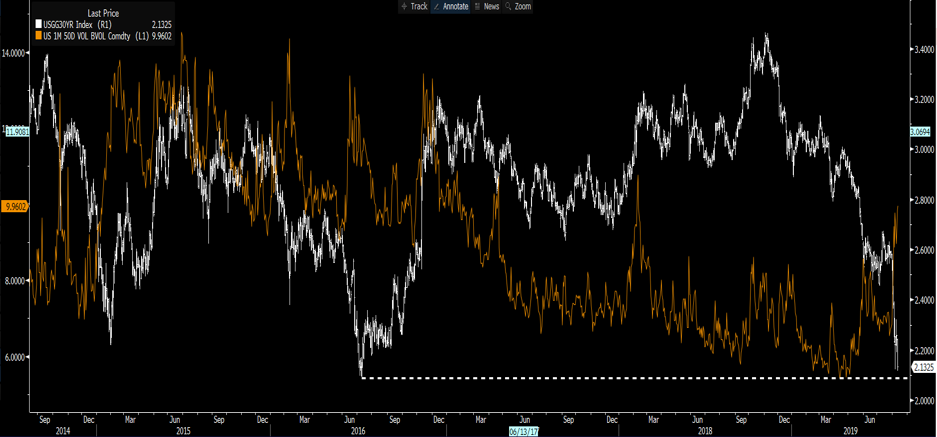

The question is, why are stocks falling when data is coming in somewhat better, and failing to rally when the data comes in worse? Well firstly, the flow into longer-maturity bonds has been relentless. We can see this here from the US 30-year treasury (white). The buying in the long-end has been one-way, with yields now at 2.14% and about to test the 2016 low of 2.08%. You can also see that US 30-year Treasury implied volatility has pushed to the highest levels since early 2018.

"White: 30yr Treasury. Orange: 30yr Treasury implied volatility."

Equities are no longer rejoicing at the lower yield environment. In fact, with the Fed’s recent formal communication, detailing a bank that remains reluctant to ease for a sustained period, any positive economic data that threatens rate cuts is seen as a negative. There are four rate cuts priced over the coming 12 months.

US CPI are near-term event risk

With this in mind, keep an eye on US CPI due at 22:30 AEST, with the consensus calling for headline CPI to push to 1.7% (from 1.6%) and core CPI to remain at 2.1%. The risks seem symmetrical but the market will be sensitive to this. From a simplistic perspective, a hotter number only reduces the need for the Fed to ease in September and this will be a headwind for equities. Put USDCHF (see below) on the radar. A weak CPI print will likely push yields lower, with the probability of a 50bp cut in September increasing from 31%.

"USDCHF"

With inflation on the mind, we can also see US five-year inflation expectations holding in at 1.80%. Until we see this instrument trending lower, the market will demand more from the Fed - but they may not get what they want.

Happy to stay cautious on risk assets

As previously stated, I think that while the Fed would be influenced by external factors, they are watching US and global inflation-expectations and financial conditions very closely. Neither variable, if we take these in isolation, are giving us any reason for the Fed to ease aggressively. That in itself makes me feel caution is still warranted. For the likes of gold, the JPY, and treasuries, despite being incredibly well-loved, they have further to go.

If I look at the S&P 500, where it feels as though the risk is, we head back to the August lows and a re-test of 2820. I would expect the bulls to defend this area again, but that depends on the news driving at the time, and if I knew that news flow that was driving us into that support zone then I would share. If I look at the S&P 500 high beta index vs low volatility index (denominator) ratio, which is a good way of visualising how defensive stocks are outperforming the theoretically more riskier stocks, we can see this working in favour of defensive stocks.

We can look at the US 10-year ‘real’ (or inflation-adjusted) Treasury, yielding 4bp and about to turn negative. We can see the US 2s vs 10s yield Treasury curve now a mere 5.9bp from inversion, with long-term yields lower than short-term yields. It's obviously a global issue, with Australia’s yield curve (2s vs 10s) now at 19bp and at the lowest since 2010. Calls for inversion here are growing by the day. Hardly a development in which equity is going to shine, and further confirmation the T.I.N.A trade is waning.

The geopolitical argument is real, which presents another reason why equities are failing to rally despite any better data. Traders are currently subject to a whole barrage of negative themes. At the epi-centre is an ever-deteriorating US-China trade relation, with Trump putting on the façade that he’s happy either way if the talks take place in September. The narrative in local Chinese press is defiant, with calls they can “defeat any challenge”, and that the “US should not underestimate China’s will”. Talk is we could see China place new restrictions on exports of rare earths to the US.

We have developments in Argentina, which are weighing on EM, while Hong Kong is clearly a bigger market issue as we watch to see how this unfolds. Traders are so short of GBP, with GBPJPY or GBPCHF getting taken to the woodshed and chopped up. We watch with bated breath at the reaction from Corbyn, when the commons come back from summer recess on 3 September, as a vote of no confidence seems almost inevitable.

Italian politics, or the woeful chart set-ups in the European banking, are also in the headlines. It’s hard to see how any of these factors could lead us believe that the worst is behind us.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.