- English

- 中文版

The leads for Asia are hardly uplifting, although we should see a mixed open, with the ASX 200 called up 24p (6684), while the Hang Seng and the Nikkei 225 should open a touch weaker. China A50 futures are up smalls from the cash close, and we watch to see how traders act on the open, in a market where the bulls have had full control.

The tape in the S&P500 is interesting and portrays a market that is a buyer of dips, not sellers of rallies and that, in itself, offers insight into market semantics. I guess we can look at other market measures, such as the VIX index which is glued to 13%, or the CBoE put to call ratio, which has ticked up a touch today at 0.80 but is still below 1.00 - thus the demand for calls and upside structures, remains the play. Still, the S&P 500 tracked into 3065, filling the gap to Fridays high, before the buyers pushed us back to the flatline.

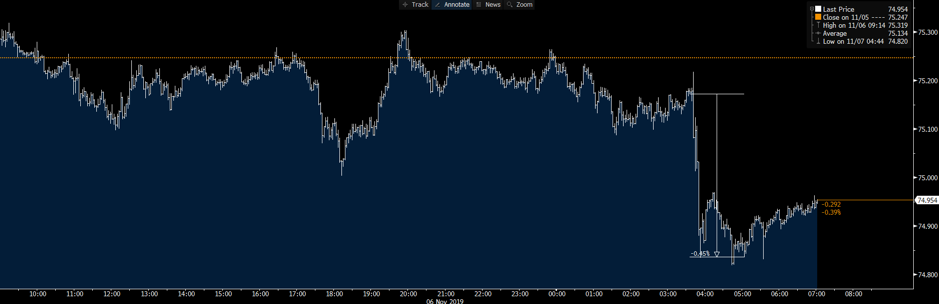

The session has been marked with speculation as to the safe passage of a ‘phase one’ agreement on trade. Around 03:40 AEDT, we saw headlines (source: Reuters) that a US-China deal may be delayed until December. This caused a few to act, certainly in our go-to trade proxy, USDCNH, where we saw a move from 6.9967 to 7.0187, which in turn caused the China proxies (in G10 FX) to find sellers, with AUDUSD losing a quick 25-pips into 0.6869, while AUDJPY fell 0.5% off the bat.

In equities there has been a minimal reaction and granted, a few longs may take some off the table, but given the bullish trend and the increasing liquidity suggests shorting on this headline alone seems a low risk-to-reward trade-off. Even if the markets are pricey from a valuation perspective.

That may change if we genuinely believe a deal is not going to come to fruition, or given how far we’ve come, one suspects it’s not even a question of whether it happens but more what it does or doesn’t look like.

As the session wore on new headlines emerged clarifying that a deal may be signed after the NATO London Summit (3 and 4 December), while talk from FOX was that the US was asking for President Xi’s travel schedule to assess where a deal could be signed. We are trading noise, or at least trying to avoid it. However, it leads us to a punchy December, where traders should be winding down, not having to contend with trade talks or UK elections.

It’s fixed income, where the real action is taking place, because when we look at the percentage moves on the day in G10 FX, it highlights a lack any kind of pulse, with the DXY unchanged on the day. Here, we see the UST 5- and 10-yr -4bp at 1.62% and 1.81% respectively, where bond traders have had very little US economic data to work with, and the focus has been on a strong 10-year bond auction, with the US Treasury offering $27b in 10-year paper with a solid bid-to-cover ratio of 2.49%. A sign that demand is not waning, despite some optimistic signs that have seen traders reduce their recession hedges.

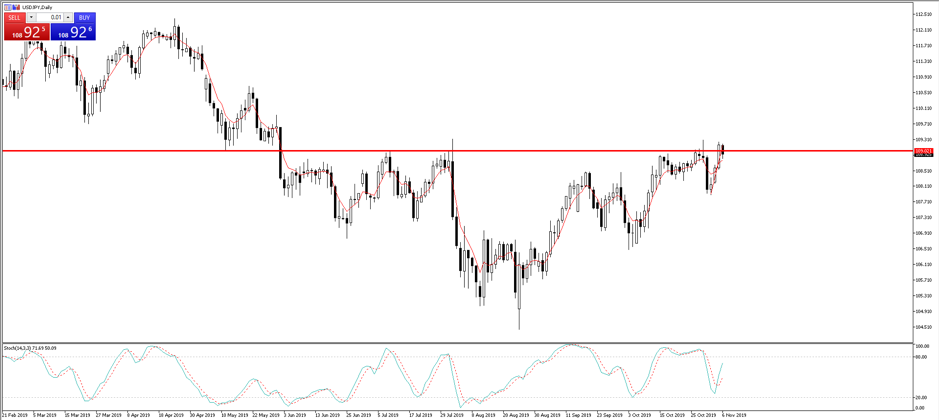

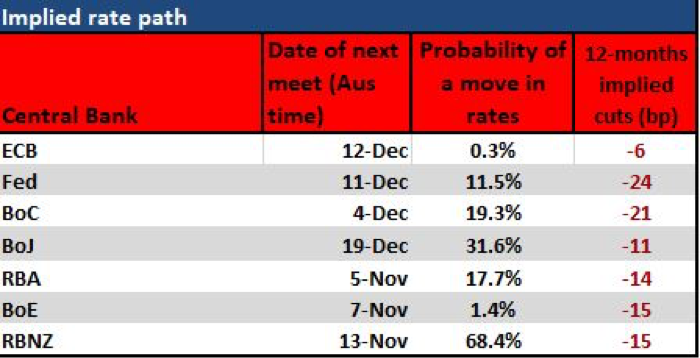

We’ve seen a slight move lower in ‘real’ yield as well, which has promoted a better bid in gold, with the yellow metal once again showing that there is someone or something supporting the $1480/70 area with a steely determination. The 3m10yr US Treasury curve has had a strong steepening of late, moving from -55bp in August to +31bp yesterday, but traders have faded this move a tad and we see this flatter by 4bp. Whether this has legs is yet to be seen, but a world where curves are steepening, rate cuts are coming out of the market (we now see 37bp of cuts priced through to December 2020) and real yield is moving higher is one most would have laughed at two or three weeks ago.

One aspect that has got more attention has been recent commentary from German FM Scholz, who wrote an opinion piece (https://www.ft.com/content/82624c98-ff14-11e9-a530-16c6c29e70ca) in the FT, detailing “The need to deepen and complete European banking union is undeniable. After years of discussion, the deadlock has to end.” The argument for a deeper banking union is a genuine EUR positive, even more so if we feel this isn’t an isolated view from the German FM. However, whether this actually resonates with the wider German electorate is something strategists will be watching with great interest. It’s also incredibly interesting to see this shift coming at a time when Christine Lagarde has literally just started her role at the ECB.

EURUSD has tracked a range of 1.1093 to 1.1065, so this news is hardly resonating yet

We also see oil prices 1.3% lower at 56.51, with gasoline getting a bit of a working out from the sellers, while copper is also lower by 1.1% at $2.66l p/lb. Iron ore futures sit at 622.5, down 0.4%.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.