- English

- 中文版

The focus now turns to the G7 finance minister meeting (1pm France time), led by Mnuchin and Powell, who will be discussing the coronavirus, although it seems highly unlikely we’ll get a decisive plan other than the group plans to use all available tools. But a united and determined front, which also includes supportive comment from the World Bank and IMF, is a front the markets take solace in - the devil, it seems, is now in the detail and this will offer the degree of confidence that the turnaround in risk has legs.

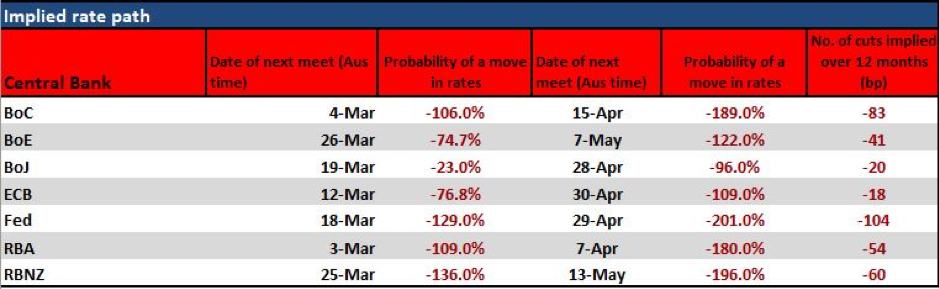

We can look at the rates markets and see some punchy expectations being priced into markets and we’re not just talking 25bp, but in Canada, Australia, NZ and the US, we’re seeing the possibility of a 50bp cut – and that is not insurance. I felt things had perhaps gone too far, but the fact that the ECB president Christine Lagarde has just detailed that “we stand ready” to take appropriate steps, suggests that this really is a coordinated stance from central banks. Throw in likely OPEC measures this week to address supply, and governments addressing fiscal stimulus, and you have a united front that is aimed at addressing financial conditions.

We’re certainly staring at a brighter picture for the Asian open as a result, with US equities finding solace from the coordinated central bank action, effectively hitting a market that had become wildly oversold and pessimistic, where my equity pessimism model had reached extremes on Friday. What we needed was a reason to buy and central banks have been that reason - nothing has really changed in the coronavirus stakes from a global standpoint, although it feels as though the market is sensing that China has things under control and is a reason in itself to be long the CN50 and even CNH.

The moves have been staggering though, with the Dow, S&P 500 and NASDAQ gaining 5.1%, 4.6% and 4.9% respectively, with volumes through the S&P 500 some 68% above the 30-day average. Implied vol has fallen aggressively, with the VIX index losing 6.7 vols to sit at 33%. US Treasury’s are lower on the session, but when we talk about equities being oversold, we can make a more convincing case that bonds are over-loved, and the 2-year is up an incredible 17bp off the earlier low.

In fact, I am sure we’d be tracking towards the flatline in yields if it weren’t for the US ISM manufacturing (50.1 vs 50.5), but the numbers were poor and caused some buying in rates before the selloff resumed pushing yields higher. We find the USD is also finding good sellers here, with the USDX -0.6%, with EURUSD driving this and making a tilt at the December highs of 1.1241, although Lagarde’s comments may weigh on the EUR in the near-term. This is not just about high implied volatility driving an unwind of carry and income positions (EUR positive), but the markets are seeing USD vulnerabilities by what is priced into rates markets and the fact the market senses a Fed who may go hard at 18 March meeting and cut by 50bp.

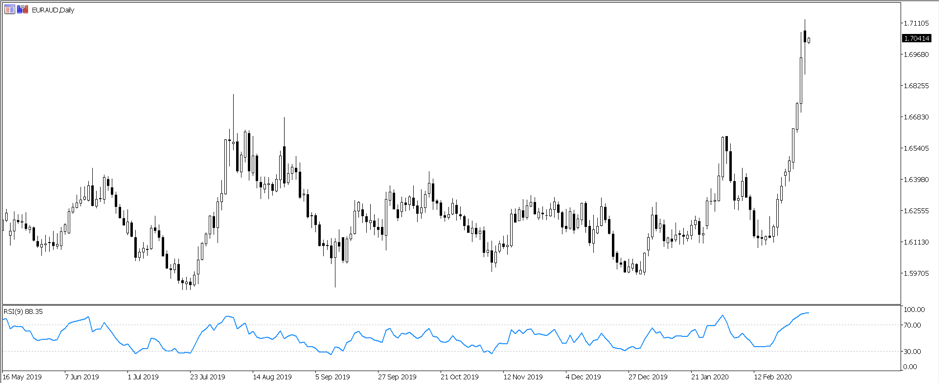

Our EUR flow has been focused on EURAUD of late, although it would not surprise to see traders reduce exposures into today’s RBA meeting. With a small chance of a 50bp priced, it feels that the argument should be whether the bank cut by 25 or not at all. A 50bp cut seems too much, despite the threat of bushfires and coronavirus to the Australian economy and we see the economists split at 16 for the cut, 18 for the hold. Given what’s priced, the RBA needs to ease today or risk the AUD spiking 70-80 pips off the bat, and even if they offset this with clear guidance for a cut in April, this will not meet a market largely pricing a second cut by that meeting. If running AUD exposures, this is a significant event risk and overnight implied volatility in AUDUSD and AUD crosses will be sky high into this event. Expect movement.

We’ll cover the BoC meeting later in the week, but if the RBA go today, then a 25bp cut is all but assured as it goes some way to confirm the united policy front by central banks, and even with a cut pencilled in in Canadian rates, in this backdrop, especially with WTI crude rallying 5.9% on the session, we can see the positives in owning the CAD and feel selling rallies in AUDCAD on the session is compelling.

We have our eyes on Super Tuesday through the US and into Asia trade tomorrow, with some 34% of delegates on offer. Klobuchar and Buttigieg have both ended their campaign and backed Biden, so rightfully he has seen his odds of the nominee come right in and suddenly it’s the Biden vs Sanders showdown into July. Sanders is expected to do well through most of the 14 states set to vote tonight, but whether he’s on track to get the magic 1991 pledged delegates and win the nominee outright seems a tall order. Whether the market is feeding off Biden tailwind is a point of debate.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.