- English

- 中文版

With a fairly constructive Friday trading session leading us into a weekend where rugby has dominated the proceedings and markets-related news limited to Brexit developments, we see an eerily quiet open on the FX open that suggests a calm open shortly in S&P 500, gold, crude and Aussie SPI futures. That said, it feels like the calm before a potential storm, where the event risk heats up with political twists and turns, key economic data and central bank meetings from the Fed, BoJ and BoC that should round out the event risk nicely.

The micro shares an increased focus too, with earnings from names like Google, Apple, Facebook and Exxon, adding to the 200-odd corporates who have already reported quarterly numbers in the US, with 81.5% beating the streets consensus forecast on EPS, and 63% on sales. These are good numbers, obviously set against a low bar, with aggregate EPS declining around 0.5%. Let’s see how these big players fare, and with the S&P 500 valued at 17.19x forward earnings, there isn’t as much room for error as there would be if the index were more in-line with the long-term average of 16x.

That said, we see new all-time highs (ATH) in US semiconductors, and importantly we are a whisker away from new all-time highs in the S&P 500, Dow and NASDAQ. Earnings aside, equity investors bid up stocks almost every time we hear positive narrative on the progress of ‘phase one’ of the US-China agreement, as we did on Friday with a call between USTR Lighthizer, Treasury Secretary Mnuchin and Chinese Vice Premier Liu He detailing further progress has been made ahead of the APAC Summit (16-17 November) – any further narrative hear this week should support risk. Still, if I look at the US equity markets, the bulls are in control, and we see cyclicals outperforming defensives, high beta names outperforming low volatility names and the 5-day moving average of the S&P500 advance-decline ratio in positive territory for 13 straight days.

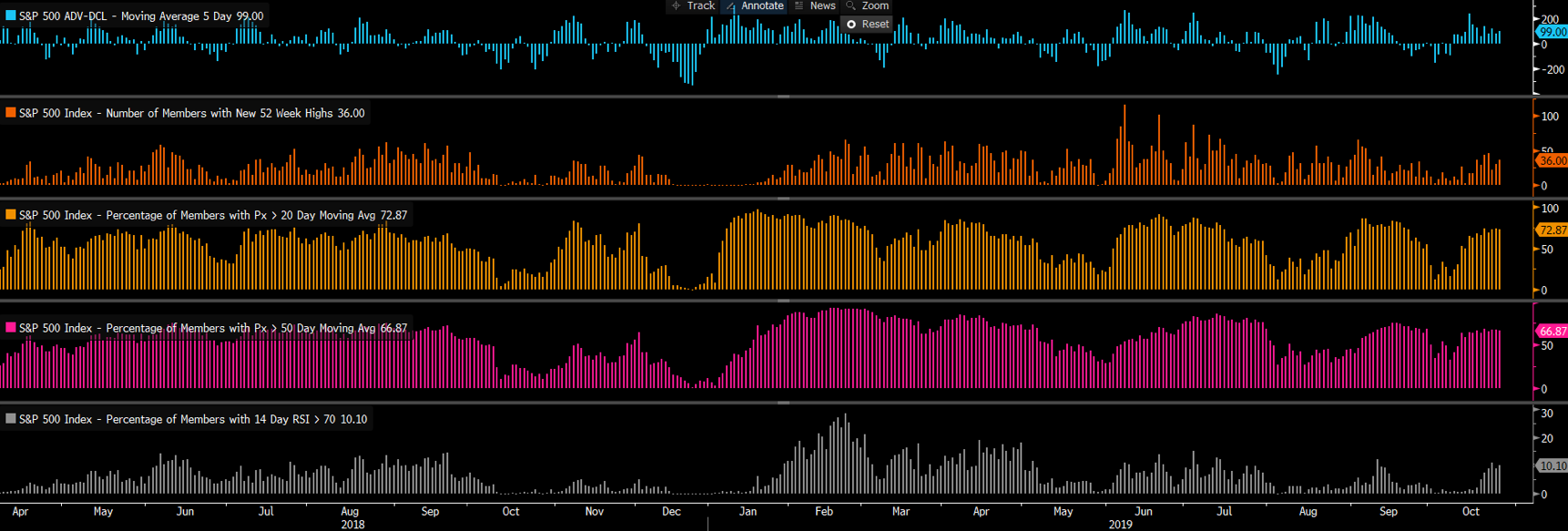

In fact, if I look at a basic market internals model, I do not see euphoria in the market at this stage and that gives me no real confidence to fade moves here, and we see (in order of panes):

Aside from comments on trade talks, global economic data will be widely in play this week, and on the whole, it is expected to improve. Don’t discount the impact China PMI (due Thursday) could have on broad sentiment, and while the market expects an unchanged read at 49.8, if this comes in above 50.0 (which is implied from the rise in the credit impulse), it will boost sentiment and lead us to believe we could see a better times in EU and US manufacturing. In the US, we get consumer confidence, Q3 GDP (consensus at 1.6%), Employment Cost Index, PCE deflator and non-farm payrolls, although payrolls will be significantly affected by the GM strike – hence the consensus is for a lowly 90,0000 jobs, and a 50,000 decline in manufacturing jobs. Personally, I am most keen to see the US ISM manufacturing (Saturday 1am AEDT), as traders are positioned for an improved reading of 49.0 (from 47.8), where, should we see a move above 50.0, it would take US 5-year Treasury’s out of the recent 1.55% to 1.64% range and see USDJPY into the 109.40 to 108.90 sell zone. How USDJPY acts into here, should it get here, should be on FX traders radars.

Of course, all eyes fall on the FOMC meeting (5am Thursday), but it’s not really a debate on whether we get a cut, we will get one with fed funds futures pricing this at 90%, but whether the outlook and communication on its future rate-setting justifies the additional 20bp of cuts priced over the coming 6 months and 58bp over 12 months. It feels, on balance, that the Fed will continue with its view they will do everything to keep the expansion going, but further cuts are data dependant, even if the barriers are higher from here.

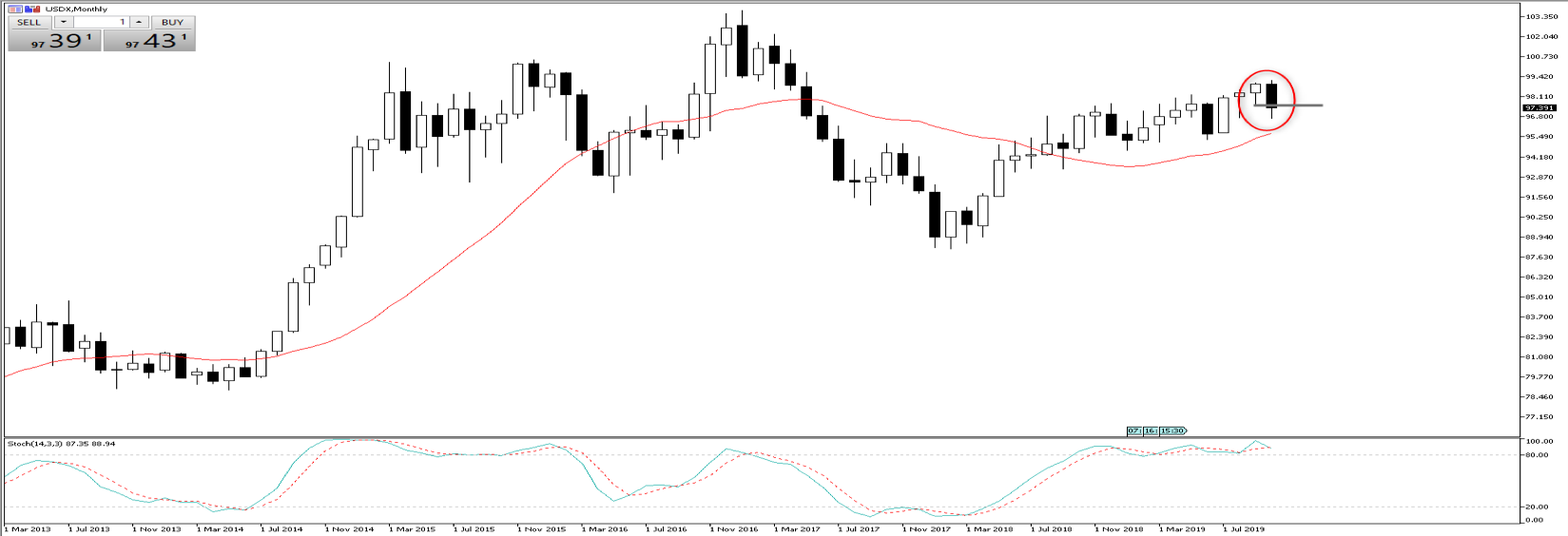

With just four trading days left in the month, the monthly chart of the USD index is eyeing a bearish monthly reversal… a close below 97.85 ensures that. It's rare we see these reversals play out, with price printing a higher high but closing below the prior months low, but when they compete, it can be fairly powerful. EURUSD would need to close above 1.1109 to form this same price action.

Here in Australia the weekend news flow has been around the limits of further rate cuts and how QE is being explored more openly, and there is no doubt that policy, once considered so radical here in Australia, is being fed into the narrative, so it doesn’t shock so intently if and when it rolled out next year.

The AUD is obviously yet to respond to a view on QE and is still a vehicle for trading a view on EM. That said, domestic data isn’t terrible, and US-China relations are converging; hence, the modest 19% chance of a cut on 5 November seems fair. All eyes on Q3 CPI (Wednesday 11:30 AEDT), where a number below 1.5% on trimmed-mean CPI would get this QE conversation going.

GBP is front and centre, and good luck to anyone trying to speculate on the pound this week as it promises to be an incredibly messy week in British politics. On the one hand, we watch for today’s (starts at 10am local) EU 27 meeting to finalise the new Brexit extension date, with France the clear headwind for the group to seamlessly push this out to 31 January. It would be unlikely if we saw a short-term extension to mid-November as per the French terms, although, it would be taken by Boris Johnson who would push for a new Withdrawal Agreement Bill (WAB) and a somewhat longer programme motion. We should also hear today that Boris Johnson’s 12 December election proposal will not see the light of day under the Fixed Term Parliament Act, with two-thirds of the Commons required to vote it through, with Labour saying they won’t play ball until No-deal is fully taken off the table - to do this, we either need to revoke A50 or pass Johnson’s Brexit Agreement. We’ve heard the Lib Dems and SNP have proposed a bill to hold an election on 9 December, which would require a simple majority in the Commons, subject to amendments, and this is subject to Johnson not being able to pass his Withdrawal Agreement Bill (WAB) which would give the Tory party further momentum in the election, and it is unclear (from what I have seen) that Johnson will go for it under these terms.

The bottom line is unless Johnson shows interest in the LD/SNP plan, then we are in firm stalemate territory, and we have to consider what on earth breaks the deadlock. Cries that Johnson could resign and call a vote of no-confidence have been made, while calls for Tory strike of sorts have also been in play, so the Brexit script has much more to play out here. 1-week GBP implied vol has pulled right back and will stay relatively low this week, that is, unless, we get some sort of breakthrough. The backdrop behind all of this has to be the EU’s extension.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.