- English

- 中文版

The Daily Fix: Looking at the markets through rose tinted glasses

In a world devoid of much positive news at present, the fact that new virus cases in Italy has risen by 4789 may not sound encouraging, but an 8% rise is the first single-digit increase in four days. In fact, the fatality rate has dropped for a second day. We can also see that Chinese road traffic is up 11% YoY, and stats showing people coming back to work also look quite positive too.

Small mercies at this stage, but we are seeing reasonable outperformance from the Italian Mib, with the index +3.9% in the past five days. The outperformance is partly attributed to the ECB measures, but we can also look at news that Germany is ready to back a plan for Italy to tap an enhanced credit line from the European Stability Mechanism (ESM).

As with any market right now, it’s less about stimulus and timing the case curve is key here to finding a bottom in risk.

As said yesterday, if I’m taking a long position in the MIB, I’m offsetting this by shorting another index and naturally, we want to look for the weakest link. That is either the FTSE 100 or Dow Jones at this stage. The Italian BTP/German yield spread is not offering much inspiration to the market, despite falling from 278bp to 195bp of late.

US markets have set an unconvincing scene for Asia, where traders were once again disappointed that Congress couldn’t vote through the stimulus bill, although we expect it to pass soon. Asia will be interesting and it would not surprise to see Asia rally out of the gates. We trade price, so if the buyers kick in I’ll join in for a ST trade.

Interestingly, we saw the rally off the lows in US equities coming at a time when we saw a decent sell-off in the USD, with the USD index -1.1% at its lows. Although the buyers have stepped back and the USD is closing 0.3% now. It seems clear that for risk markets to rise, the world wants a weaker USD and tighter corporate credit spreads. Staying in the credit space, and we saw Investment grade (IG) credit working well, which won’t necessarily surprise given the Fed are now buying IG debt. We see IG CDS index -29bp, pushing the HY-IG spread to new highs, which won’t inspire. Equities really want HY bonds to find better buyers.

Credit aside, and staying in my glass half full mindset (which is hard), we did see better breadth, with 20% of stocks higher on the day. While the VIX index lowered (-4.5 vols to 61.5%) for the third straight day, although those wanting to see a bottom in risk would want to see this far lower than 65%. ‘Real’ US Treasury yields are a further 14bp lower and we have gone negative again in both 5- and 10-year Treasuries, which is a positive for risk.

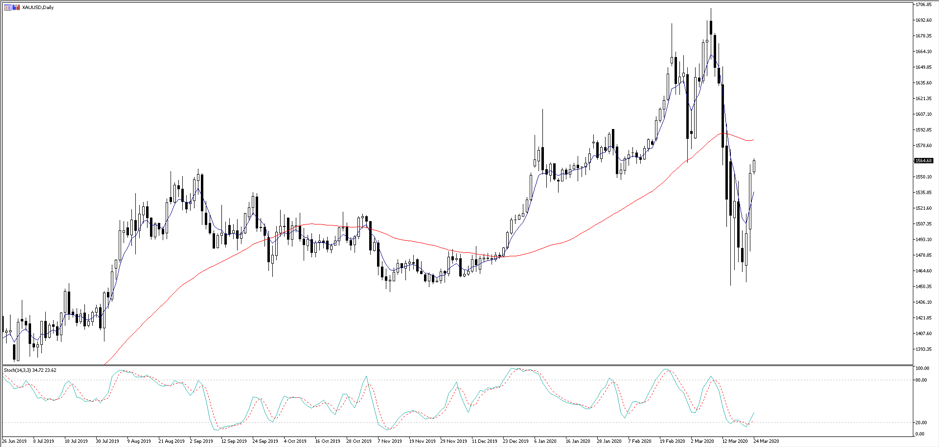

The move in real Treasury yield is seemingly good for precious metal too, with spot gold and silver pushing up 3.7% and 5.2% respectively. Even if you price gold in the strongest currency, which was the NOK, which we can attribute to the rise in crude, we see gold +2%. Options traders have certainly welcomed the move and we see gold's 1-month call implied volatility trading at a 0.77 vol premium to puts, after trading down to -2.89 yesterday – which in itself is an incredibly low number. Traders are backing the upside move again and we watch for a re-test of the 50-day MA at 1583.

The Fed effectively going all in, and enacting QE-unlimited will help here!

It will take some time to go over the full suite of measures announced by the Fed overnight, but they are not here to play games. They have pulled out the big guns, with a statement that they will purchase Treasury and mortgage debt in “amounts needed to support the smooth market functioning” – Whatever it takes. They have created a number of facilities to support credit markets, where two in particular stand out - the Secondary Market Corporate Facility (SMCCF) is important as the Fed will be able to access funds offered by the Treasury Department (from its Exchange Stabilisation Fund) and housed in a Special Purchase Vehicle (SPV). The Fed can lever this up and effectively buy Investment-grade corporate bonds from the market. The UST will get the rights here.

Another similar program called the Primary Market Corporate Credit Facility (PMCCF) has been set-up and again sees the Fed tap the SPV. But in this vein, we see them buying debt issued directly from the companies themselves. This is a very bold move, and it's good to see investment-grade credit respond. The would-be equity buyers though want to see tighter HY spreads and when that comes, assuming its married with a weaker USD, a lower VIX, range contraction and low volume in the pullbacks, we could say we are heading for a low. As mentioned the key though is timing a plateau in the case count.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.