- English

- 中文版

How the Fed can help the dollar

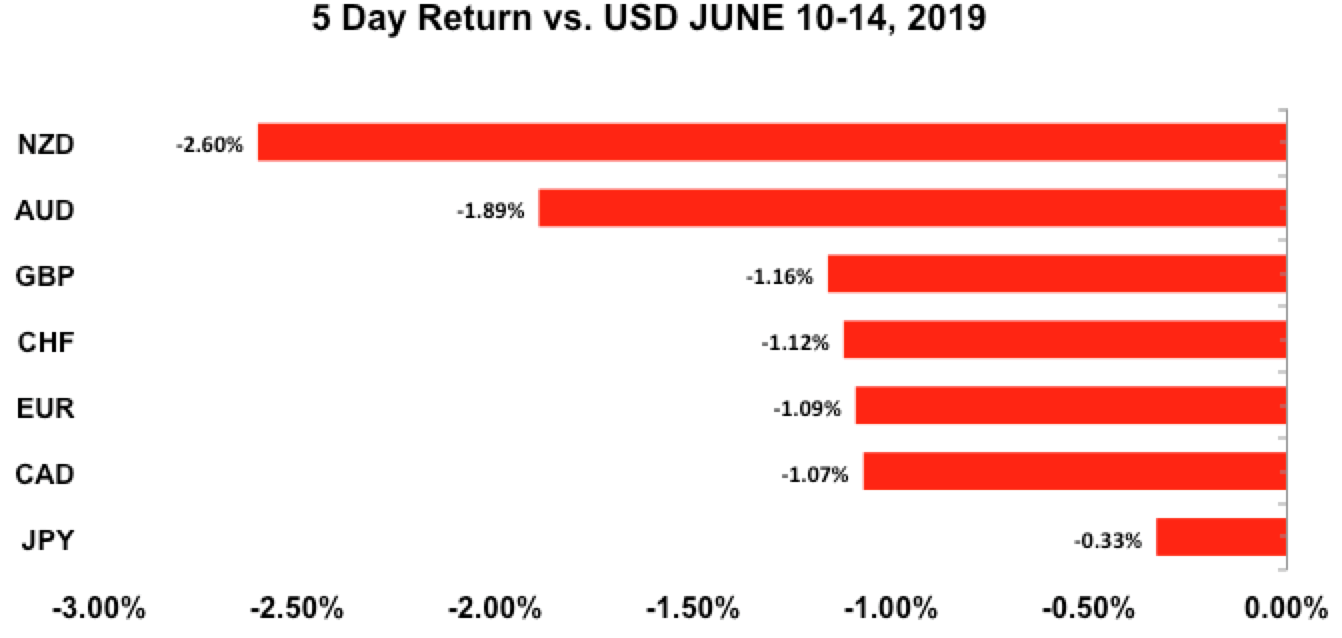

The New Zealand and Australian dollars were hit the hardest by the dollar’s rise, and we continue to expect them to underperform. The Canadian dollar should be the most resilient. Sterling, however, could recover if the Bank of England talks about rising interest rates sooner than the market expects. Either way, hold onto your hats as this will be a very active week in currencies, with data significant enough for breakouts to turn into sustainable trends.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- PPI MoM 0.1% vs 0.1% expected

- PPI YoY 1.8% vs 2% expected

- CPI MoM 0.1% vs 0.1% expected

- CPI YoY 1.8% vs 1.9% expected

- Jobless claims 222,000 vs 215,000 expected

- Retail sales 0.5% vs 0.6% expected

- Retail sales ex gas and auto 0.5% vs 0.4% expected

- Industrial production 0.4% vs 0.2% expected

- University of Michigan Consumer Sentiment 97.9 vs 98 expected

Data preview

- Federal Reserve rate decision: Given Jerome Powell’s cautious comments, the tone of Fed statement could be less hawkish.

- Empire State Manufacturing Index: Beware of weakness, because the strong dollar and weaker global growth could dampen manufacturing activity.

- Housing starts and building permits: Housing data is hard to predict, but decline in stocks could hurt activity.

- Philadelphia Fed index: We’ll have to see how Empire State fares, but we’re looking for weakness given the stronger dollar.

- Existing home sales: potential recovery as talk of rate hike eases.

Key levels

- Support 108.00

- Resistance 109.50

How will the Fed deliver?

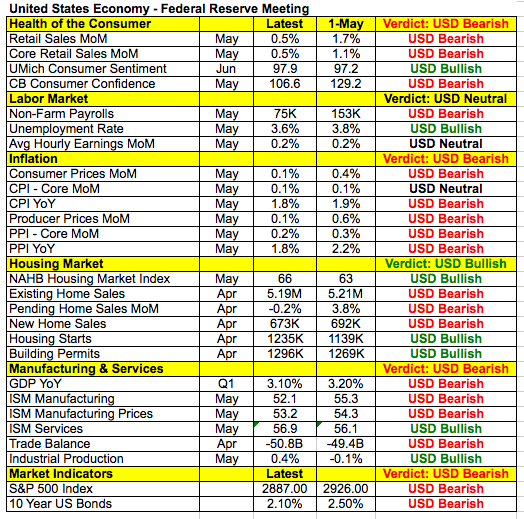

The June Federal Reserve meeting is the most important event of the month. Central-bank rate decisions are always significant, but the Fed will also be updating their economic projections and dot-plot forecasts. Fed Chairman Powell will hold a press conference where reporters will undoubtedly pressure him for details about his recent comments. Earlier this month he said the economy is growing, but, given trade developments, the Fed will “act as appropriate to sustain expansion.” While he never used the words “rate cut,” investors rushed to price in easing. Fed fund futures are calling for a 95% chance of a quarter point cut in September. Back in March, the dot-plot forecast dropped from two to zero rate hike this year. At the time, 11 out of 17 policymakers felt that additional tightening wasn’t needed in 2019. This dramatic shift was a result of their concerns for low inflation, household spending and business investment. In May, Powell put on a brave face and dismissed talk of easing by saying policy stance is “appropriate right now,” and “we don’t see a strong case for moving in either direction.”

How the US dollar reacts will depend on whether he repeats this line or replaces it with language that validates the market’s forecast for a rate cut. In reality, we think that unless stocks fall another 15% to 20%, or job growth turns into job losses, the Fed will keep interest rates unchanged for the rest of the year. There hasn’t been a significant slowdown in the labour market, retail sales increased in May, and spending in April was revised from negative to positive. Equities are still attracting buyers. Chinese data has been stable, and the strain on the US economy is only beginning to appear. The decline in US yields also helps the economy. For all these reasons, Powell may not be particularly dovish, because even when he suggested that they could take steps to sustain the expansion, he described the economy as growing, as well as said that unemployment is low and inflation stable. The Fed has no immediate plans to change interest rates, which should be the main takeaway from this month’s meeting. However, we could be wrong and Powell could talk about the possibility of easing because there’s been widespread deterioration in the economy since the last policy meeting, according to the table below. The remaining six policymakers that favoured a rate hike in 2019 could also flip their views.

When it comes to trading FOMC, the main focus should be the dot plot and Powell’s guidance. If three or four additional policymakers support no hikes this year, or if some members favour a cut, we could see the dollar fall sharply, especially if that forecast is reinforced by cautious comments from the Fed chair. In this scenario, USD/JPY will drop as low as 107.50, and EUR/USD could break above 1.1350. But if Powell puts on a brave face, emphasises the areas of strength in the US economy, and the dot plot / economic projections remaining mostly unchanged, we could see a significant recover in the greenback that could take USD/JPY above 109 and EUR/USD below 1.12.

EURO

Data review

- Revisions to German CPI 0.2% vs 0.2% expected

- EZ industrial production -0.5% vs -0.5% expected

Data preview

- German PPI: likely to be weaker given lower CPI and wholesale prices

- EZ trade balance and EZ CPI: potential downside surprise given drop in German inflation and trade balance

- German ZEW survey: We’re not looking for any material improvement in sentiment given global uncertainty.

- EZ and GE PMIs: likely to be weak given softer German industrial production and factory orders

Key levels

- Support 1.1100

- Resistance 1.1300

Near-term top in euro?

The bulls are losing control of the euro. After consolidating at two-month highs for most of the week, we’re seeing signs of a near-term top. EUR/USD dropped below 1.13 and extended its losses following last week’s better-than-expected US jobs report. Although the European Central Bank ruled out an interest rate cut, the currency could not escape political and economic woes. The only piece of eurozone data released last week was industrial production, and the decline sets expectations for softer PMIs and ZEW. We expect investor confidence to soften as manufacturing activity slows. Politics is also hurting the euro as President Trump’s threat of sanctions on Germany gives euro traders plenty of reasons for concern. It isn’t clear how far the US president will take this threat or when it’ll be mentioned again, but Trump told reporters last week that the gas pipeline between Germany and Russia “really makes Germany a hostage of Russia if things ever happened that were bad.” Many nations are worried that should Germany move ahead with the pipeline, it’d allow Russia to easily cut off energy supplies to Ukraine or pressure Western European nations in their favour. President Trump also threatened to cut American troops because “we’re protecting Germany from Russia, and Russia is getting billions and billions of dollars in money from Germany.” Deteriorating US-European relations isn’t good for the euro, and softer economic reports this week would compound the currency’s losses.

AUD, NZD, CAD

Data review

Australia

- NAB Business Confidence 7 vs 0 previous

- Westpac Consumer Confidence 100.7 vs 101.3 previous

- Consumer inflation expectations 3.3% vs 3.3% previous

- Employment change 423,000 vs 16,000 expected

- Unemployment rate 5.2% vs 5.1% expected

- Full-time jobs 24,000 vs -0.3K previous

- China trade balance $41.65b vs $22.3b expected

- Chinese exports 7.7% vs 4.7% expected

New Zealand

- Card spending -0.5% vs 0.5% expected

- PMI manufacturing 50.2 vs 53 previous

Canada

- Housing starts 202.3K vs 207.5K expected

- Building permits 14.7% vs 1.8% expected

- New housing price index 0% vs 0% expected

- Existing home sales 1.9% vs 3.6% previous

Data preview

Australia

- RBA minutes: Minutes are likely to be dovish as they explain the recent rate hikes.

New Zealand

- PMI services: likely to be weaker because manufacturing activity slowed

- Q1 current account balance: likely to be stronger as trade activity stabilised in the first quarter

- Q1 GDP: Even though trade activity stabilised in Q1, retail sales was very weak and so downside risk likely.

Canada

- Consumer price index: potential upside surprise given rise in the price component of IVEY PMI

- Retail sales: Labour market gains should boost spending.

Key levels

- Support AUD .6800; NZD .6450; CAD 1.3250

- Resistance AUD .6900; NZD .6550; CAD 1.3450

AUD: How much further can it fall?

There are plenty of reasons to be bearish with the Australian and New Zealand dollars, which is why both the currencies have been under significant selling pressures. The Aussie and the kiwi fell every day last week, and could very well hit fresh year-to-date lows in the days ahead. On a fundamental basis, there’s very little incentive to own these currencies. Their yields may be higher than other countries, but they’re also the only major central banks actively lowering interest rates. The market is pricing in another quarter-point cut for both countries, and, if data continues to weaken, the Reserve Bank of Australia could cut twice more this year. Last month, Australia added 42,000 jobs, but almost all of the gains came from the lower value part-time jobs, with full-time jobs only expanding by slightly more than 2,000 in May. The market read the news as a disappointment, especially since the unemployment rate climbed from 5.1% to 5.2%, with traders betting that the RBA may be forced to cut rates once more in August to avert a further slowdown in demand. Labour demand in Australia has been surprisingly robust despite global trade tensions, which have put its export-led economy in danger. But the latest news suggests that the jobs engine may be finally sputtering, as the escalating tensions between the US and China are starting to take their toll on business investment and confidence. This week’s RBA minutes won’t help the currency, as they’ll explain why the central bank decided to ease. So, unless US-China trade relations suddenly improve, the Australian dollar is destined for further losses. Technically, the main support level is the 2019 flash crash low near .6750.

All of this is true for the New Zealand dollar, as well. But unlike the Aussie, GDP is scheduled for release this week. New Zealand has been hit hard by the slowdown in China’s and Australia’s economy — manufacturing activity stagnated for the first time in four years, with the PMI manufacturing index slipping to its lowest level since March 2011. First-quarter GDP numbers will be the main focus and, given the recent rate cut, softness in spending and weaker manufacturing growth should have slowed in the first three months of the year. NZD/USD is trading just above eight-month lows, and a less dovish Fed could put the pair on a track to test its 2015 low near 62 cents.

While USD/CAD bounced off its June lows, the Canadian dollar is one of the most resilient currencies. The underlying economy is strong, the housing market is steady, and labour gains are driving the economy. We’ll get a chance to see how jobs affect spending this week, with retail sales due for release, and we have every reason to expect improvements in spending. Consumer prices could also increase, driving USD/CAD lower as prices rise according to IVEY PMI. Although the outlook for USD/CAD will be dictated by the market’s reaction to FOMC, we continue to expect the Canadian dollar to outperform other currencies, like the EUR, AUD and NZD.

BRITISH POUND

Data review

- April GDP -0.4% vs -0.1% expected

- Industrial production -2.7% vs -1% expected

- Manufacturing production -3.9% vs -1.4% expected

- Visible trade balance -12.1b vs -13b expected

- Jobless claims 23.2K vs 19.1K expected

- Average weekly earnings 3.1% vs 3% expected

- ILO unemployment rate 3.8% vs 3.8% expected

- RICS House price balance -10% vs -21% expected

Data preview

- Consumer price index: potential downside surprise as service and manufacturing sectors report lower prices

- Retail sales: potential downside surprise as indicated by weaker wage growth and sharp drop in retail sales, according to British Retail Consortium

Key levels

- Support 1.2500

- Resistance 1.2700

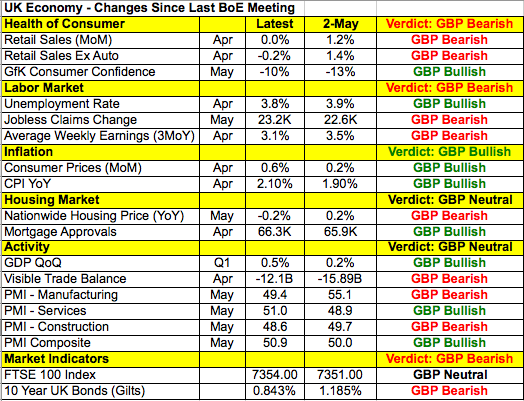

The BoE thinks rates could rise faster. Will that change?

This is also an important week for the British pound. Not only will the candidates for Tory leadership continue to be whittled down, there’ll also be a Bank of England monetary policy announcement, as well as retail sales and inflation reports scheduled for release. The UK political climate looks to be in utter chaos, with Boris Johnson now the early favourite for the Tory lead. But even if he were to win the leadership role, his chaotic and divisive rhetoric is almost certain to trigger a new election, which will only add to the Brexit uncertainty. At the same time, nearly every piece of UK data released last week missed expectations or weakened from the previous month. Industrial production declined and wage growth slowed while GDP contracted in April. This suggests that retail sales could turn negative after stagnating in April. Inflationary pressures are falling across the globe, so there’s a good chance of a pullback in year-over-year consumer price growth.

However, despite the deterioration, comments from Bank of England officials haven’t been exceedingly dovish. Everyone’s worried about a no-deal Brexit, but a number of policymakers, including BoE Deputy Governor Ben Broadbent and policymaker Michael Saunders, feel that rates may have to rise faster than the market expects. This is also a view shared by BoE Governor Mark Carney in the past, because the central bank’s base case (and ours, as well) is for a smooth Brexit. According to the table below, there hasn’t been any clear direction in the economy since the policy meeting. If the emphasis is on rate hikes, sterling could hit 1.28 versus the dollar, and .88 cents versus euro. But if they follow in the Fed’s footsteps and raise the possibility of easing, the GBP should fall to fresh year-to-date lows against both currencies.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.