- English

- 中文版

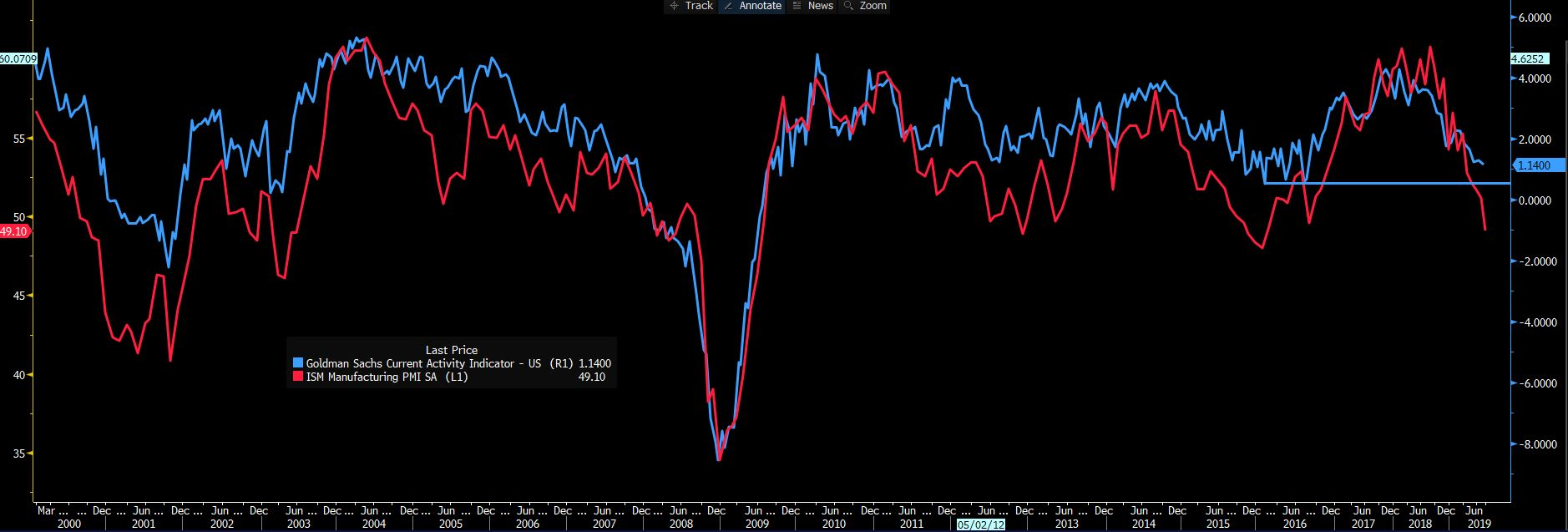

It’s hard to go past the US ISM manufacturing print, as the recent regional manufacturing data points had given us a belief that the national print would at least be in expansion. But that wasn’t the case, and the reality of the index dropping to 49.1 — the first contraction since August 2016 — is that the idea of the US economy is the shining light and an island onto its own has been questioned.

We know manufacturing is highly cyclical, but we can see that every subcomponent in the index is below the 50 expansion/contraction level. That’s a worry. Just take a look at the correlation with the Goldman Sachs current activity indicator, with manufacturing PMI data a major contributor to the read.

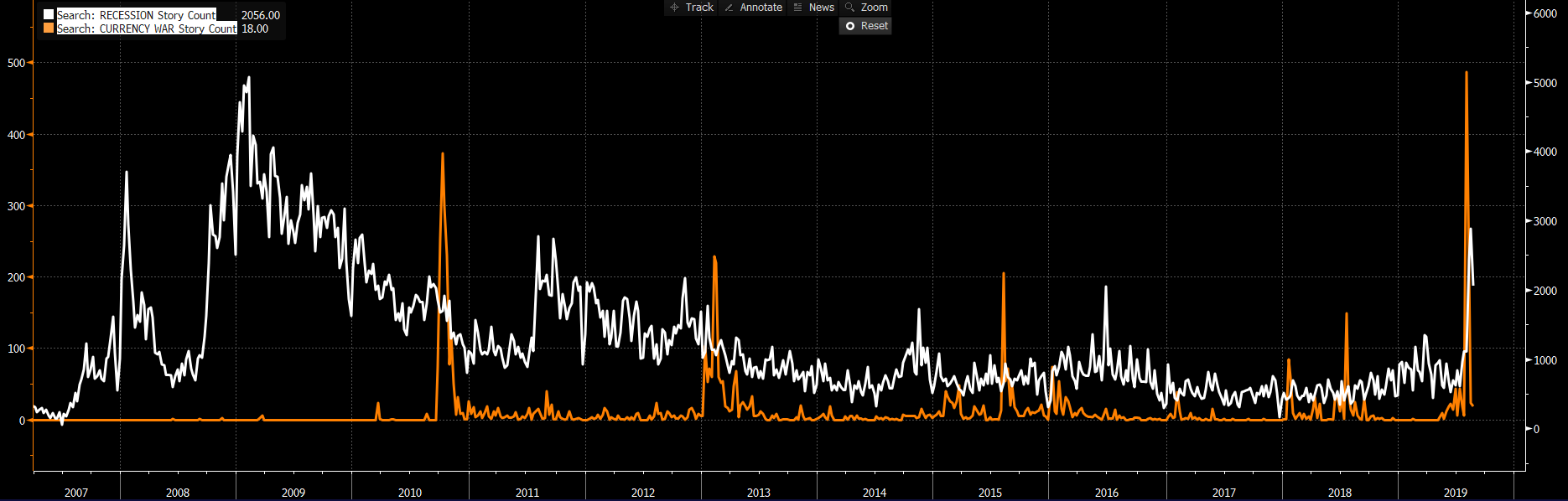

The world searching for a recession

The word recession has crept into the narrative yet again. One way I can visualise this is to search using Google Trends for keywords. Alternatively, I can look at the story count on Bloomberg. Here, I’ve scanned for the story count for “recession” (white) and “currency war” (orange). It seems Bloomberg editorial has been putting pen to paper and focusing on the currency war angle, which is a reflection of its readers’ interest.

Of course, the aforementioned news flow has benefited the usual suspects: gold, silver, JPY, implied volatility (the VIX index closed at 19.66%), rates and bonds. It’s all one big correlated trade. With small caps underperforming once again (the Russell 2000 / US2000 closed -1.5%) and the S&P 500 eyeing a retest of 2900, Asian equities are holding in okay; while the ASX 200 is lower by 0.8%, the Hang Seng and Nikkei 225 are flat.

I’d also add that overnight we heard from St Louis Federal Reserve President James Bullard, who changed his call to a 50bp cut (from 25bp) in the September FOMC meeting. As a result, we’ve seen buying across the Fed fund futures curve — with the market now pricing a 25% chance of 50bp cut. This has taken US two-year Treasurys -5bp lower to 1.44%, with small selling in the USD.

The message from Dr Copper

Take a look at high-grade copper. If copper has a PhD in economics, then maybe this is telling us a message.

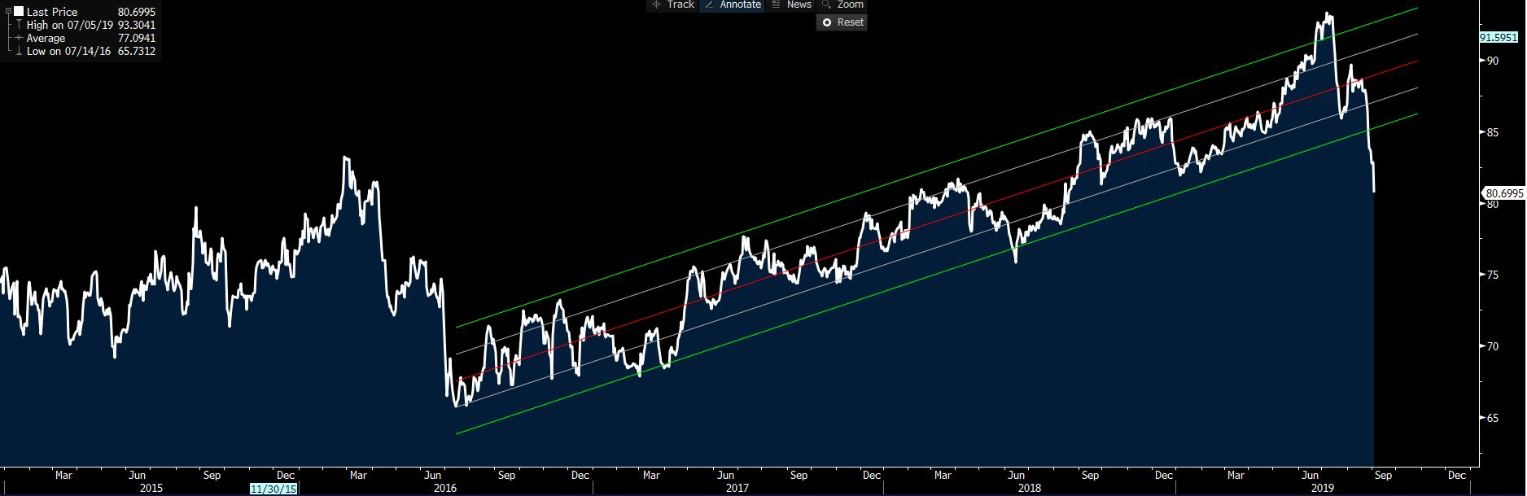

The USD index (USDX) has failed to close above trend resistance. For those trading EURUSD (given the EUR contributes a 57% weight to the USDX basket), we’ve seen a pronounced pin bar reversal on the daily. A higher high through today's trade would be interesting given the love for the USD. We react to price moves.

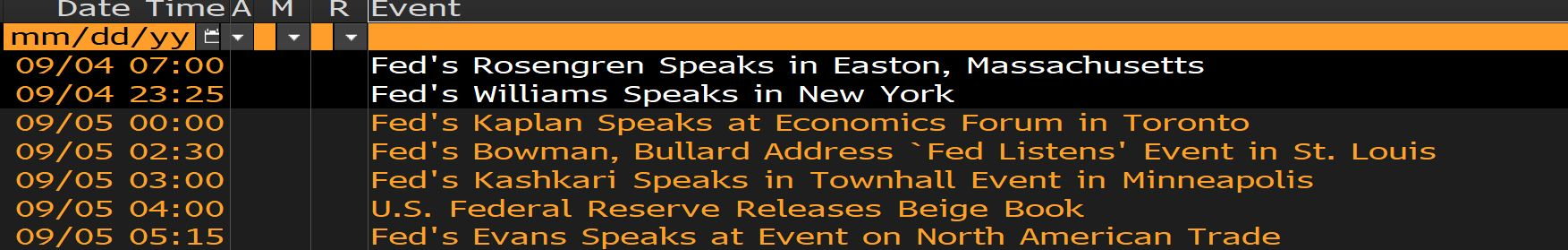

Fed speakers to focus on

One key aspect will be the upcoming Fed speaker fest. The highlight will be New York Fed President John Williams, who some will recall was so dovish in the lead-up to the August FOMC meeting and that the New York Fed had to put out a statement shortly after his speech to walk back his view. Clearly, the market will be looking to see how he sees the world and whether his communication with the market improves.

It does feel to me as though there’s further USD upside at least in the short term. Aside from the manufacturing data and woeful University of Michigan consumer confidence report last week, we’re yet to see fragility feed into CB consumer confidence report (red line), consumption statistics, or service sector reads. One suspects this will presumably be more affected should cracks emerge in labour market reads. It makes this week’s US ISM services and payrolls report just that bit more important. Expect markets to be sensitive to these reads.

Silver is flying

As mentioned, there’s been some love for precious metals and a focus away from gold (to an extent) towards silver. If this hasn’t come across your radar, take a look at the daily chart of silver (USD denominated) — it's flying.

Just look at the gold/silver ratio, it’s getting chopped up. That’s usually a bullish sign for precious metals.

Staying in FX, we’ve seen a renewed bid in the AUD largely as a result of a less-dovish-than-feared RBA meeting. But today’s Q2 GDP print, while in line with estimates at 0.5% QoQ, has seen a further position adjustment from AUD shorts. AUDCAD has had a strong move, putting in a sizable bullish outside-day reversal, with price eyeing a move into the 0.9050 and the top of the trading range it's formed since late July.

Consider we have the Bank of Canada meeting tonight (00:00 AEST), and while the market puts a 6% chance of a cut, CAD traders will feed off the tone (and the level of flexibility reserved for a cut in the October meeting). One to watch.

Of course, GBP has been well traded, with better GBP buyers emerging notably on the run below 1.2020. Even though there’s been a small bid in the sterling, I don’t think it necessarily surprised that UK parliament passed a motion facilitating an extension of the Brexit timetable. That should be formally approved Wednesday, and will then require the blessing of the EU. There’s much to write on the subject, but the thought turns to a snap election called for 14 October — and whether Opposition leader Jeremy Corbyn (of the UK Labour Party) accepts this challenge or refuses, with the view to battle a general election early in 2020.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.