- English

- 中文版

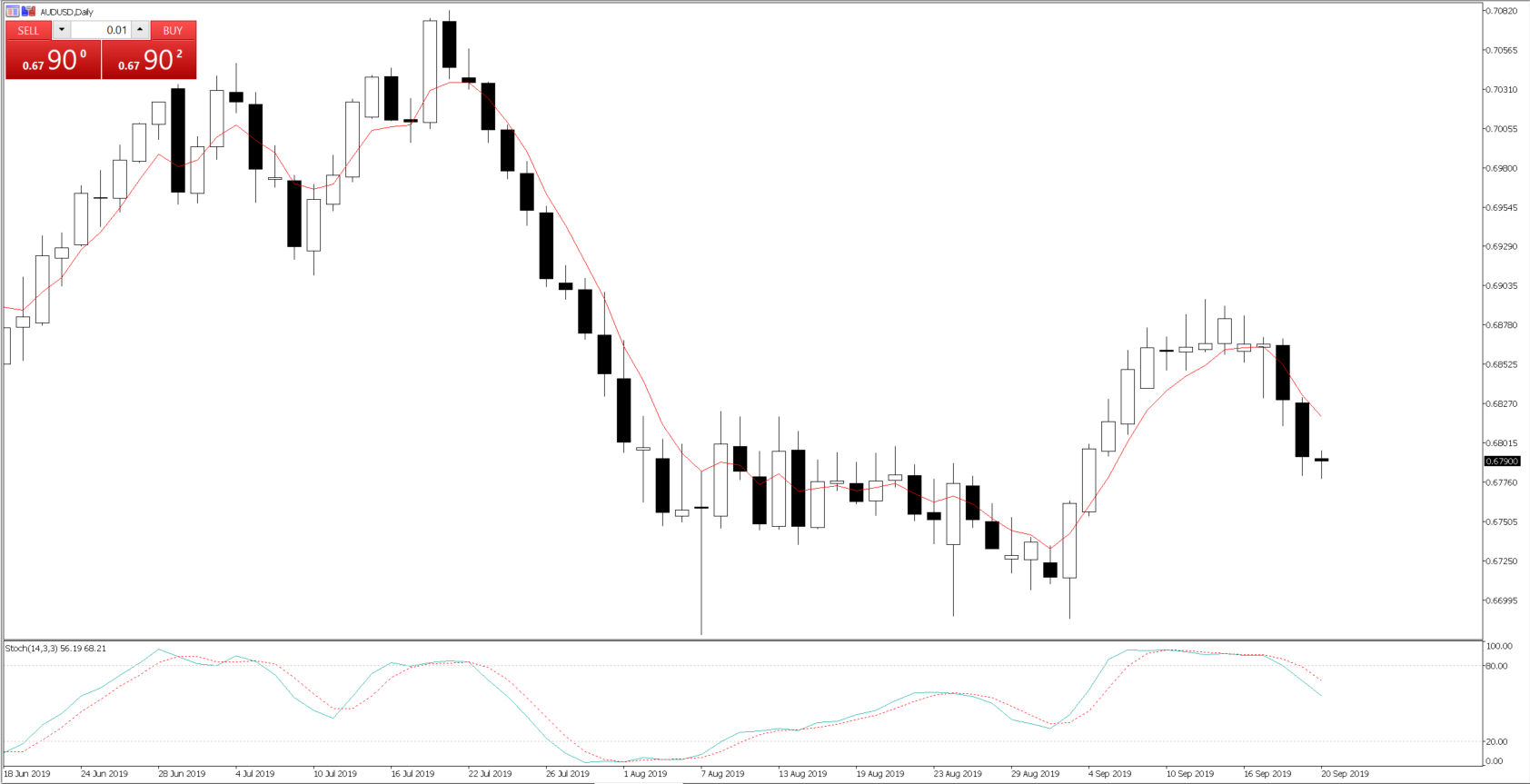

The view on an October rate cut has become mainstream not just among economists. But the rates market has gone some way pricing a cut above 80%. National Australia Bank and Citigroup moving their base case today for an October cut has resonated, with Aussie three-year Treasurys -3bp. In turn, it’s taken the AUDUSD through 0.6800, and we could be staring at a retest of the August lows. It’s also pushed the ASX 200 0.6% higher, and the index looks strong here.

Small gains have been seen in the Nikkei 225 and Hang Seng, while we’re seeing buyers in crude. In FX, USDCNH is flat on the session, although the preference is to trade this pair from the short side despite the People’s Bank of China cutting its prime rate across multiple maturities. Where this shows a commitment to massage funding costs and keep economics supported — the Chinese mainland indices are up 0.2% or so.

Central-bank divergence is growing

It’s been a big week for markets even if implied vols have declined. The message I’m getting is that we’re getting closer to the lower limits on rates, certainly in the US and Europe. Of course, the Federal Reserve can, and will likely, go lower. But the push onto fiscal policy is growing by the week. That makes Australia so interesting, because not only is the public failing to really respond to rate cuts — although prior cuts still need to fully filter through — but consumers are failing to respond to tax cuts. One could argue the economy needs a quick and hard smack, and that could be a 50bp cut and a message of future QE.

In the video above I explore these themes, but I look at the week that’ll be. What could be the drivers, pricing on interest rates, while taking a real look at implied volatility to gain a sense of how the market sees the week ahead.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.