- English

- 中文版

With the Federal Reserve communication breakdown from last Thursday and Friday now behind us, we’re left with a firmer belief that the Fed will cut 25bp. We talked on Friday about the New York Fed walking back on much of John Williams’s speech, and this was subsequently backed by a Wall Street Journal article (“Fed officials signal quarter-point rate cut likely at July meeting,” from 19 July 2019) detailing a 25bp cut was on the cards. I think we’re all on the same page, even if I feel the Fed should cut 50bp.

As we can see from the Bloomberg chart, the market has swung from a 66% chance of a 50bp cut on Thursday to now pricing an 18.5% chance. The flow of US data this week is mostly tier two, and unlikely to really sway the Fed’s thinking. Subsequently, it’s unlikely we’ll see rates and the USD getting too much action this week. It’s certainly not out of the realms of possibility that we get an upside surprise in Friday’s US Q2 GDP read, with the consensus calling for 1.8%. But even that’d have little impact on rate cut expectations.

At the very least, good GDP should compel the US president to be active on his Twitter account, talking up the US economy on a relative basis.

For a more detailed look at the economic data points, see the calendar.

A 25bp now seems signed, sealed and delivered. It therefore comes down to the outlook on the future trajectory of rates that’ll cause the market's response. But a 25bp cut isn’t going to cut the mustard or change anything too intently if US Q2 earnings fail to inspire, and the reports start to pick up this week.

Q2 earnings: the assessment so far

On Bloomberg consensus numbers, consider we’ve seen 77 (of 500) companies release quarterly numbers so far, with 77% beating earnings estimates — via an average beat of 4.9%, and 61% on the sales line. Not terrible numbers at all, but they don’t blow the lights out. Plus, it's harder to make a bullish case for equities here in the very short term.

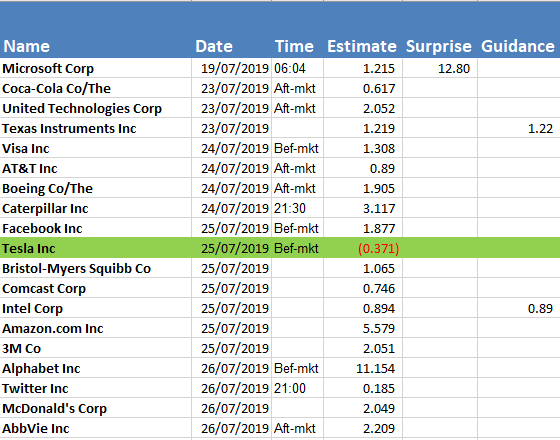

US corporate reports to consider

While we’ve some influential names this week, such as Microsoft, Caterpillar, Amazon, Facebook, Intel, Tesla and Alphabet, Tesla should get the lion’s share of attention from clients. But for those trading this name, my advice, as always, is to consider position size as an utmost priority. This is a name that can have some punchy moves on the day of earnings, with the average move in the past eight earnings release at 7.2%. In fact, if we look at the implied move (derived from options positioning), we see this now sits at 6.2%. The market expects a big move, so this has to be a priority when assessing one risk and correct position sizing.

Europe takes centre stage

Europe takes centre stage this week, with advanced PMIs due Wednesday, and the German IFO survey (18:30 AEST) seen shortly before the European Central Bank meeting (21:45 AEST) on Thursday. For macro traders, the ECB meeting is the highlight of the week, and puts the EUR and European equity markets front and centre. Trading the EUR this week is the focus of much debate, and even more so in EURGBP given we’re due to see confirmation on the Tory leadership tomorrow.

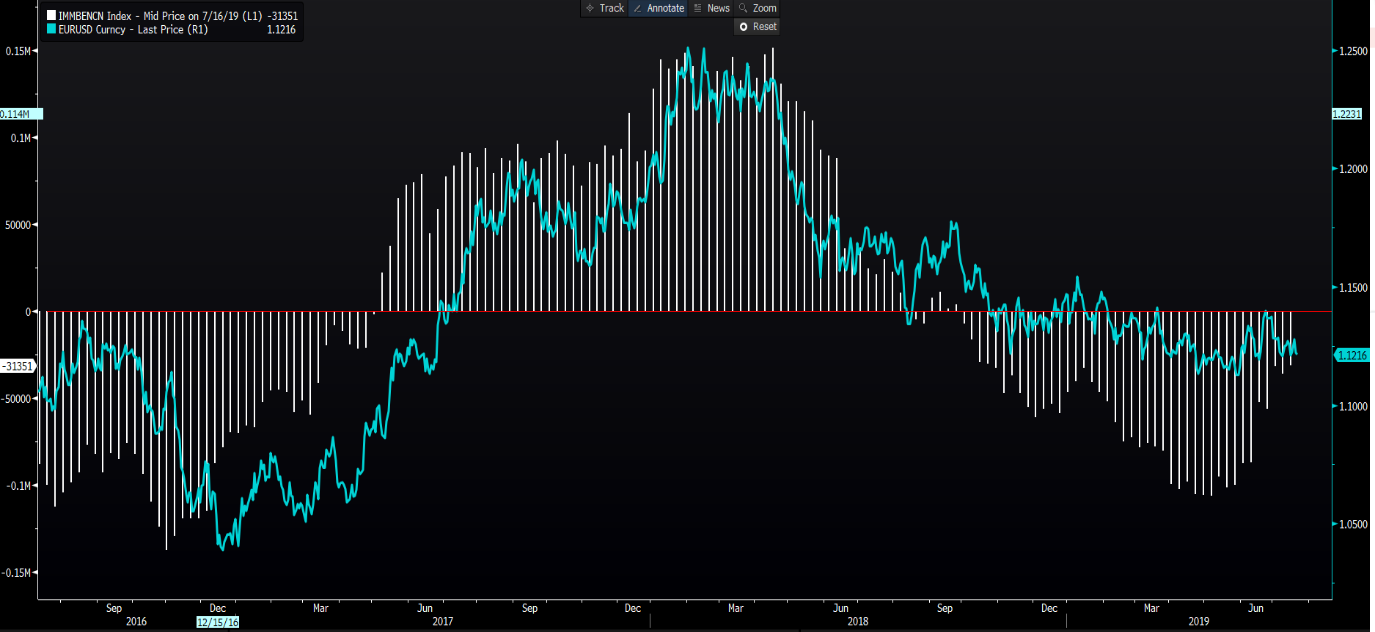

Consider the market is already discounting an element of easing in the EU rates markets for this meeting, so, at a simplistic level, EURUSD could initially rally if they don’t cut, which seems likely. If we look EUR positioning, and for that we turn to the weekly Commitment of Traders report. Here, we see net shorts (on EUR futures) have been significantly reduced of late. But we know leveraged traders are still short of EURs, so ECB President Mario Draghi needs to bring his dovish A-game, or we could be staring at a higher EUR driven by selling in the German bund.

I suggested EURAUD shorts last week, and continue to feel there’s juice in the downside. But in the vision of managing risk, I’d be reducing exposures into the ECB meeting. It’s the tone of Draghi’s statement that’s really what we want to hear, with key changes to the outlook for interest rates, as well as a strong signal that asset purchases are back on likely in September. Will any renewed asset purchases include equities?

Event risk to consider in China and Australia

There’s little data to drive in China or Australia, either, although we hear from Reserve Bank of Australia member Christopher Kent (Tuesday 08:30 AEST) and Governor Philip Lowe (Wednesday 13:05 AEST) and they may move the AUD around a touch. That said, the market really only sees a move of some 48 pips in AUDUSD on the week (up or down), and we continue to watch moves in iron ore futures and copper.

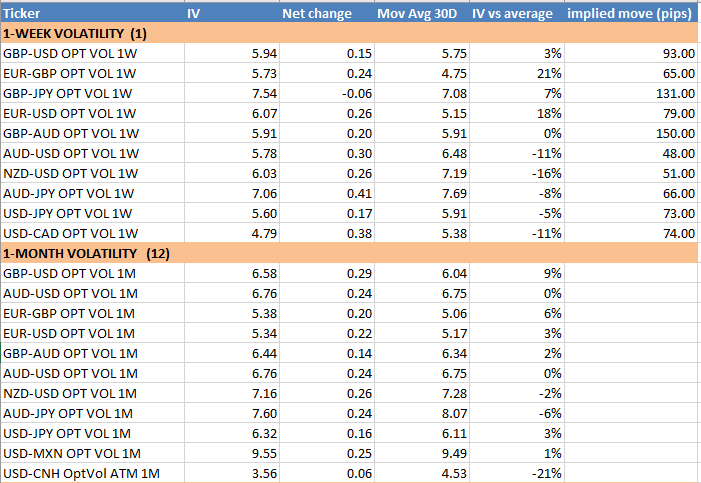

Implied volatility as a core consideration for your trading

I always like to consider the expected moves in FX markets, gold and equities at the start of each week. Implied volatility is really the collective thoughts on traders’ perceived future movement in an instrument from the mean of the data set over a predefined period. It’s expressed as the one standard deviation (annualised) change. It provides insight about the level of concern around upcoming event risk. That’s key in determining if the event risk is considered a volatility event and, if so, to what extent could price move.

Looking at the above Excel table, we can see one-week IV subdued even in EUR and GBP pairs. That said, EURGBP vols are a touch higher relative to its 30-day average. There, we can see the implied move over the week is 65-pips, suggesting the market sees a range of 130 pips. EURUSD vols have picked up a touch from last week, but we can see they’re still in line with the 30-day average.

At 79 pips, this suggests (with a 68.2% level of confidence) that EURUSD should be limited to a 1.1132 on the downside, while price shouldn’t trade too far above 1.1290. I like to assess these volatilities when understanding if the market puts significant weight on the ECB meeting, which gives me clarity on how much risk I should be taking in each trade and, therefore, offers enhanced assessment on position sizing. The greater the expected move, the further the stop is. The further the stop, the smaller the exposure gets.

I’ll be doing a presentation in Noosa this Thursday 25 July 2019 on the subject, so I’d be happy to send the recording if it’s of interest.

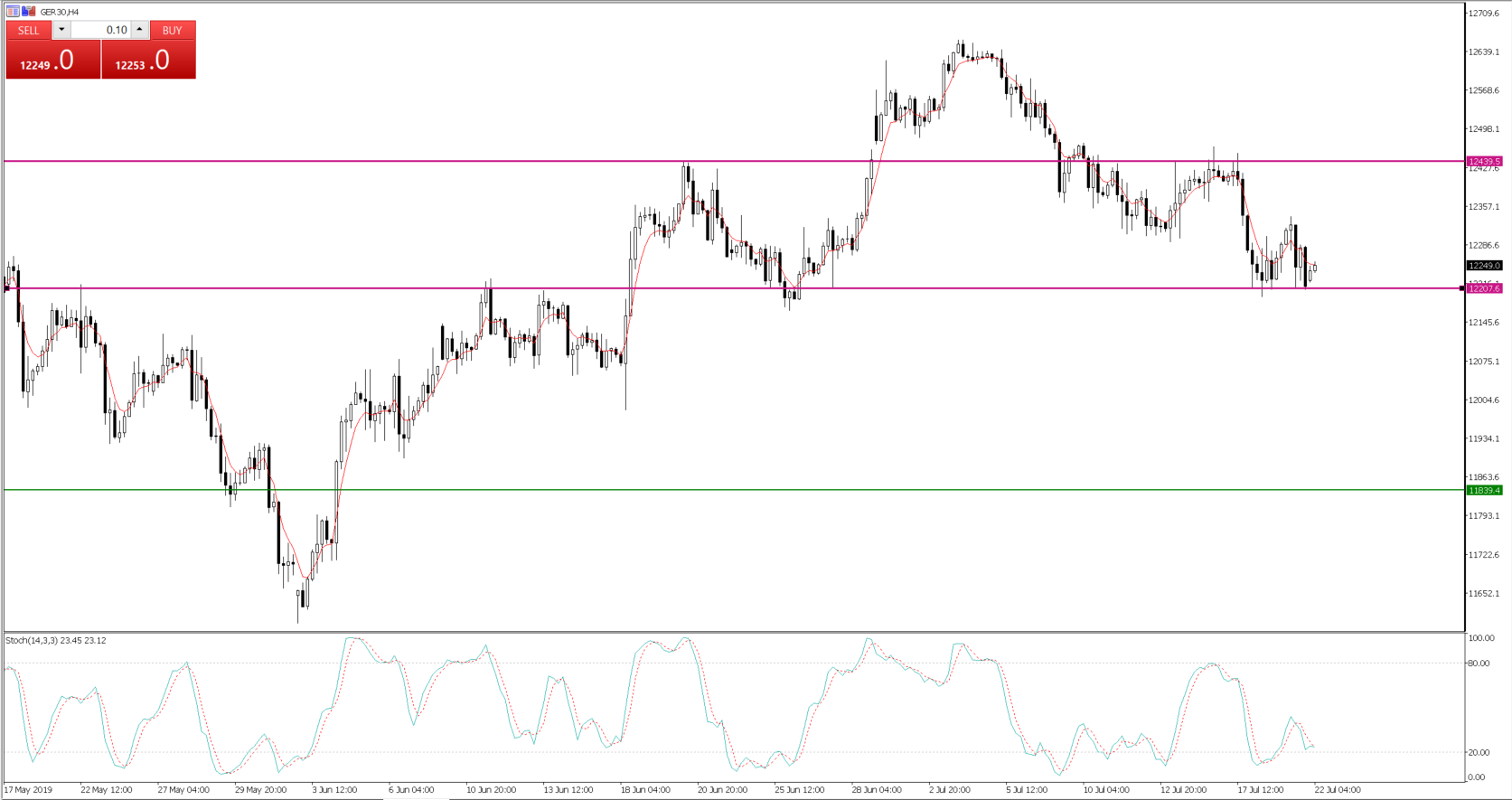

German DAX (GER30) at key juncture

Certainly, the German DAX (GER30) needs something inspirational here, and the 12,200 support needs to hold and form a base, or we could be focusing on a test of 12,000 fairly quickly. How price acts here is key. But this index is firmly on the radar as a break of 12,200, and I’d be firmly trading this from the short side. If we’re going to see disappointment from the ECB meeting, then the DAX will have a strong reaction than the EUR in my opinion.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.