- English

- 中文版

In hindsight I was incorrect, because when we heard Williams’s speech, there was little doubt it gave us the impression that a 50bp cut was on the cards. The Fed acting aggressive in setting policy for more worrying outlook sounds like 50bp, as do comments that it’s better to take preventative measures than to wait for disaster to unfold. When you only have so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress.

I guess it’s hard to hear these words, knowing that there’s a blackout period from next week, and not feel they were designed to guide the market to that the Fed had to do something big on 31 July.

The debate on 25 or 50 rolls on

The fact, then, that the comments promoted a broad USD selloff largely driven by a move in rates pricing the chance of a 50bp cut from 33% to 67%, with equities and gold following closely. This feels like it was the right reaction. We saw economists alter their base case for Fed action to 50bp — another sign behind the conviction Williams’s words were a key signal.

The NY Fed's message to the market: ‘calm the farm’

What happened in the early Asia session has been all the talk on the floors this morning, with the NY Fed putting out a statement that Williams’s words were aimed at an academic level and not a “cat out of the bag” type policy guidance on behalf of the broader Fed. This seems incredibly important. Aside from calls that the Fed should be more in tune with markets, there are two schools as to where we stand. Firstly, we should genuinely take it at face value that the market overreacted, and the insurance cut we should expect is more realistically 25bp. Secondly, Williams actually poured his heart out and gave us perhaps too much insight into the potential actions from the Fed in the July meeting, as well as where the broader committee was now concerned that they lacked the shock factor to positively move markets. That being, if they cut by 50bp when it isn't fully discounted, we could see asset prices react positively and, importantly, the USD head south.

Asian markets are giving us a message

I’m sympathetic to both accounts, as the domestic data on balance warrants no change, although, given the external picture I’ve been arguing that the Fed was better off going hard than bringing a knife to a gunfight. There’s clearly some impetus lost now, but what’s important is the market reaction through Asia. Granted, the odds of a 50bp cut now sit at 39.5%. But we’re seeing the USD remain soft, notably against the AUD, where AUDUSD is eyeing a retest of the post-Williams speech high of 0.7082. Gold fell back into US$1,440, but it’s finding a base and looks likely to head back into US$1,450. Asian equities are clearly bid, with the Nikkei 225, Hang Seng and ASX 200 up 1.7%, 1.1% and 0.7% respectively. S&P 500 futures are up 0.4%, despite US Treasury futures up 3bp.

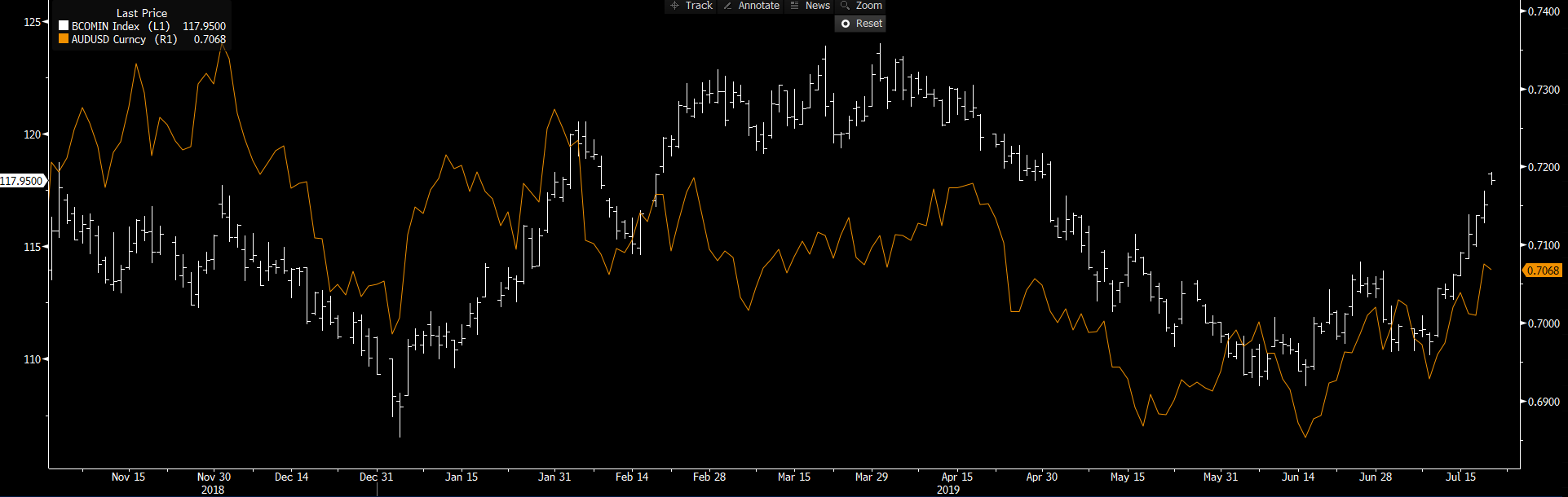

Commodities are also looking good, and it’s a surprise to see copper up 1.8%, with Brent crude +2.1%. We’re starting to see better buying coming back into iron ore futures. In fact, if we look at the Bloomberg industrial metals index, this has had a cracking run in the past two months, and is usually a good indicator of gains in the AUD.

"White: Bloomberg industrial metal index. Orange: AUDUSD. (Source: Bloomberg.)"

A new race to the bottom?

This may be premature, but it feels like the market is back on with the race-to-the-bottom trade. Consider if the Fed does go 50bp, which is a lesser proposition given the NY Fed statement, it’d nonetheless give the European Central Bank increased incentive to go hard in next Thursday’s meeting. The market has already discounted a 52% chance that the ECB takes its deposit rate — effectively the charge it passes to European financial institutions to park excess reserves on its balance sheet — down to -50bp. And, that’d be considered punchy relative to expectations a week or so ago. We saw the Bank of Korea cutting yesterday, which was somewhat out of consensus. The implied chance of the Reserve Bank of Australia cutting in November has also pushed up to 65%.

Let’s see if there are any material changes from the Bank of Japan when they meet 30 July. Because if they offer guidance, that they’re ready to do more post-ECB, we just need more from the People’s Bank of China, and markets will ride a new wave of liquidity. A few hypotheticals, but it’s not out of the realms of possibility.

EURAUD short positions looking compelling

I like EURAUD shorts here into the ECB meeting. The technical setup looks bearish, and it feels like the AUD has been the best performer in the past two days for a reason — that being, there’s more to come. Rallies offer an opportunity to fade (in my opinion), and I’m happy to close and admit I’m wrong on a close through 1.6034. Happy to start with a small position, but if this kicks lower, I’d be adding. As in life, if something is working, you try and do more of it.

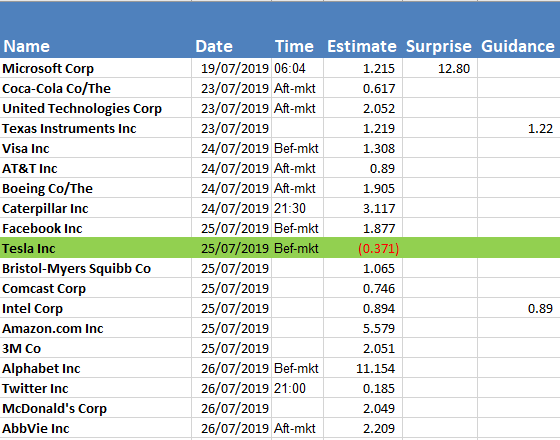

"Q2 earnings due next week for clients to trade"

With limited US corporate earnings in play in a few hours, the focus turns to speeches from Fed members James Bullard (01:10 AEST) and Eric Rosengren (06:30 AEST). Both are voters. We’ve also heard from Bullard of late, which makes it interesting because, if his caution increases — when he’s already stated 25bp is the best course of action — then some may take this to mean 50bp is on the cards. That’s one to watch.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.