- English

- 中文版

Bear market

We have witnessed three circuit breakers in the US stock market within seven trading days since 9 March, while more have been triggered in Thailand, Philippines, South Korea, Indonesia, Brazil, and the list goes on.

Much worse, massive sell-off has brought America’s longest-running bull market to an end, with more stock markets across the globe entering into the bear market (falling 20% or more from the recent highs for a sustained period)https://pepperstone.com/en-au/trading/instruments/share-cfds/

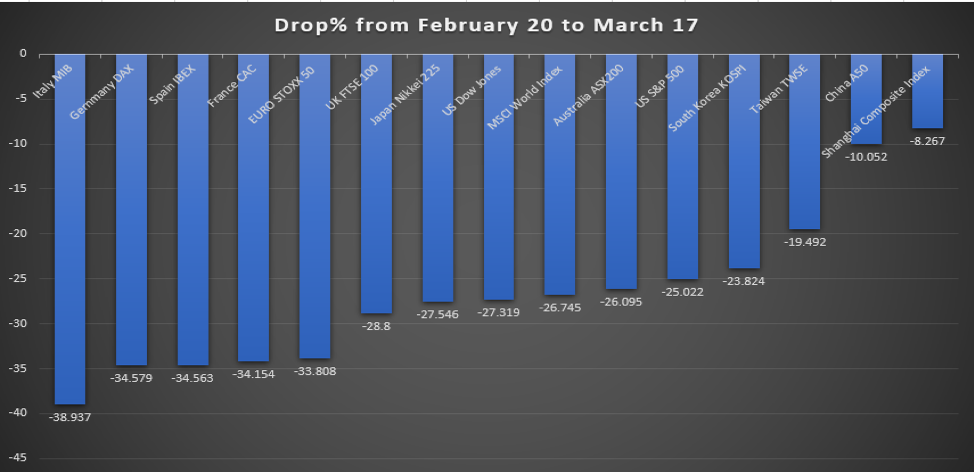

The chart below shows the performance of the main equity markets in the world during 20 February (record or recent high) and 17 March. It's interesting to find that the equity market in China, the epicenter of the coronavirus, stood out with the least loss of 8%.

Pepperstone Research

Not enough?

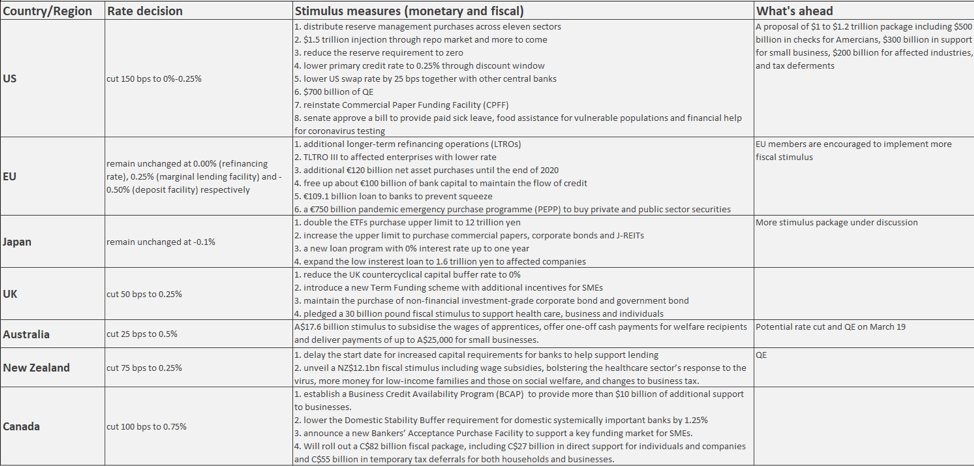

To stabalise the financial markets, global central banks have taken coordinated action (see the table below) since early March to cut interest rates and to inject liquidity into the market. The question, however, has been frequently asked whether these monetary policies are enough to save the global economy impacted by the virus. The answer is apparently no.

Global coordinated actions since 3 March

Pepperstone Research

Different from the GFC, which was a banking and liquidity crisis, the coronavirus is highly likely to transform our lifestyles, spending habits, and business activities. Therefore, it requires more fiscal stimulus to directly support the health care sector, affected companies, small business and low-income families.

The worst time is yet to come. Trump has warned that the US might head into recession as the virus could last until July or even August.

To slow down the virus from spreading, more countries are embracing stronger measures (closing schools, shutting borders, self-isolation, social distance, etc) to contain the virus. The sharper the containment measures taken and the deeper the economic hit in the near-term, the more confident we should be about the rebound after such measures are lifted.

Why China outperformed

1. Virus under control

While new cases are growing exponentially in the rest of the world, China seems to have the coronavirus under control. Strong measures, which appear to have quelled the virus outbreak in China, are gradually being relaxed. More people are returning to work and factories are resuming production. Take Apple as an example. It has announced it will re-open previously closed stores in China (while keeping closed all stores outside of China)

2. Stimulus already in the place

Measures deployed by Chinese authorities since early February has helped stabilise its stock market. The PBOC has injected 2.8 trillion yuan through 7 and 14-day reverse repo since February 3, pushing the rate lower to 2.4% and 2.55% respectively. The balance of the Medium-term Loan Facility (MLF) has increased to more than 4 trillion yuan, with the 1-year rate down to 3.15%. The central bank this week has further lowered the bank reserve ratio requirement (RRR) to free up 550 billion yuan in the banking system.

Easing measures coupled with massive fiscal stimulus (tax cut, local debt issuance, transfer payments, new infrastructure investment, etc.) has boosted the market sentiment and confidence.

3. Valuation

The already dead US bull market that began in 2009 was mainly driven by liquidity and buyback policy, with the P/E of S&P 500 falling from 24.5x (20 February) to 17.3x (15 March) during global sell-off fuelled by oil price collapse.

By contrast, the P/E of CSI 300 was sitting at 12.7x on January 4 before the downward trend, and slightly decreased to 11.7x, which looks more appealing than the US and European indices.

4. Clarity

China has reported dire economic data for the period of January to February, with industrial output -13.5%; retail sales -20.5%; fixed-asset investment -24.5%; unemployment rate 6.2%. The economy in the first quarter is therefore expected to contract for the first time since comparable data began in 1989.

Given life is back to normal in China, markets expect a V-shaped rebound in the following quarter, which occurred after the SARS outbreak and the GFC.

On the other hand, the falling US retail sales for February (-0.5% against 0.2% exp) indicated the consumer spending had slowed even before containment measures began. The upcoming data in the US and EU will start reflecting the negative impacts of the recent shutdowns. They will no doubt get worse, yet we just don’t know to what extent.

Sometimes fear and uncertainty of the data are worse than the bad reality.

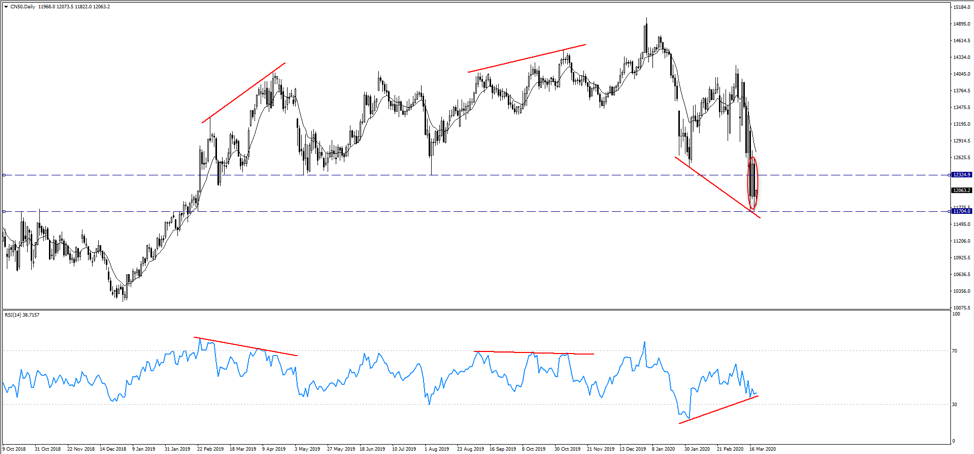

CN50

For those who have limited ways to directly invest (long or short) in China’s equity markets due to capital controls, Pepperstone provides clients with the ability to trade the CN50, an index CFD that is priced off the China A50 index, a benchmark listed in the Singapore Future Exchange, including the largest 50 Chinese A-share companies by market capitalisation.

The bearish engulfing pattern suggests CN50 will remain under pressure in the short term should the virus continue to spread across continents and VIX remain significantly high. The price action is just capped by the 10 EMA, with the RSI firmly moving south below 40. The immediate support level appears at 11704.

However, given the positive factors mentioned above, the index might continue to be the best house in worst neighbourhood (faster increase or slower decline). The bullish divergence even shows the signs of reversal.

MT4 CN50 daily chart

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.