- English

- 中文版

What does China's 'long march' mean for currencies?

Unfortunately, if China refuses to cooperate, Sino-US relations will worsen, and the US could move forward with new tariffs on USD$300B of Chinese goods. China’s economy would be hit hard, however last week’s broad decline in the greenback and sell-off in stocks reflects the market’s concern for US companies and consumers. So far, the Federal Reserve has been upbeat, but in the second half, earnings could take a tumble, exacerbating the slide in equities. If China is bracing for slower growth, so will other countries. No one will be talking about rate hikes and instead, more central banks could resort to easier monetary policies. The currencies that will suffer the most are the ones whose central banks are looking to lower interest rates the quickest. While the Federal Reserve is not in a position to cut rates, the US dollar could fall if the market thinks that they will pare their optimism and signal plans to keep policy steady for a longer period of time.

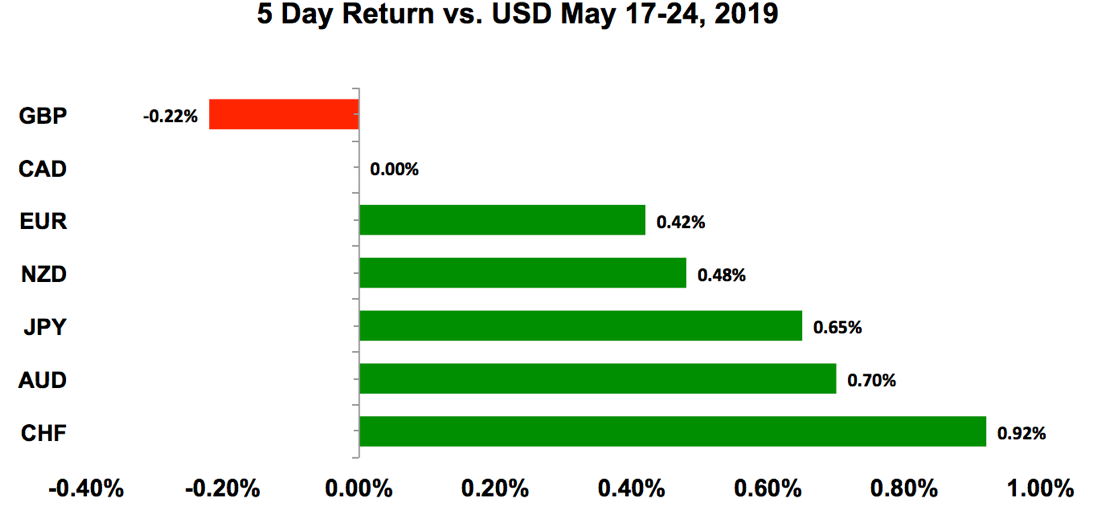

Meanwhile, we continue to operate in a headline driven market. Investors will be watching Sunday’s European election results closely and will keep an eye on nominations for a new UK Prime Minister. US markets are closed on Monday for Memorial Day so liquidity will be lower, but with the election results out, this could mean greater and not lower volatility for currencies. The Swiss Franc and Australian dollars were the best performers last week while sterling lagged behind. With the markets focused on Europe, we could see a further near-term recovery in AUD and NZD.

Weekly Trade Ideas: Don't miss these market moving opportunities identified by BK Forex.

US DOLLAR

Data Review

- Upbeat FOMC Minutes – Saw drop in inflation as transitory, diminishing risks from global growth

- Existing Home Sales 5.19M vs. 5.35M Expected

- Jobless Claims 211K vs. 215K Expected

- New Home Sales 673K vs. 674K Expected

- Durable Goods Orders -2.1% vs. -2% Expected

- Durable Goods Ex Transport 0% vs. 0.1% Expected

Data Preview

- Consumer Confidence – Difficult to predict because slide in stocks should dent sentiment but UMich reported stronger data

- Second Q1 GDP releases – Revisions to GDP are difficult to predict, but changes are often market moving

- Trade Balance – Stronger dollar may have dampened trade

- Personal Income & Spending – Potential downside surprise because of lower earnings and retail sales

Key Levels

- Support 109.00

- Resistance 110.00

Near term correction in the US Dollar?

Although the US dollar hit fresh multi-month highs versus the euro, sterling, Australian, and New Zealand dollars this past week, it actually ended the week lower against most of the major currencies. This reversal has many traders wondering if there could be a steeper near term correction in the greenback. Fundamentally, the US economy is performing better than its peers. Slower global growth will hurt this economy less than the Eurozone, Australia, or New Zealand. However, even though the FOMC minutes were upbeat, the cracks are beginning to show according to the latest economic reports as home sales and durable goods orders decline. There’s very little market moving US data next week but the ones that are scheduled for release could hurt more than help the US dollar. The risk is to the downside for consumer confidence because stocks have fallen. Personal income and spending could also soften due to lower earnings growth and retail sales. Technically USDJPY rejected the 20-day SMA and is trading below 110, which opens the door for a move down to 109. But the primary catalyst for a near-term correction in the US dollar should be short-covering. Euro is a tougher call because of the unpredictability of the European elections, but GBPUSD, AUDUSD, and NZDUSD should bounce.

EURO

Data Review

- GE PPI 0.5% vs. 0.3% Expected

- GE PPI YoY 2.5% vs. 2.4% Expected

- ECB Current Account 24.7B vs. 27.9B Previous

- GE GDP Confirmed at 0.4% for Q1

- GE PMI Manufacturing 44.3 vs. 44.8 Expected

- GE PMI Services 55 vs. 55.4 Expected

- GE PMI Composite 52.4 vs. 52 Expected

- EZ PMI Manufacturing 47.7 vs. 48.1 Expected

- EZ PMI Services 52.5 vs. 54 Expected

- EZ PMI Composite 51.6 vs. 51.7 Expected

- GE IFO Business Climate 97.9 vs. 99.1 Expected

- GE IFO Expectations 95.3 vs. 95 Expected

Data Preview

- EZ Economic Confidence – Likely lower with trade tensions and EU Elections

- GE Unemployment – Potential downside risk as PMIs report weaker job growth in manufacturing and services

- GE CPI – Potential upside surprise given stronger GE PPI & wholesale prices

- GE Retail Sales – Recovery expected after last month’s decline

Key Levels

- Support 1.1100

- Resistance 1.1300

Watch for Gap EURO Open on EU Elections

When the markets open on Monday, we could see a big move in the euro. After hitting two-year lows last week, EURUSD traded back above 1.12 ahead of European election results. Elections will be held in 28 countries across the European Union for seats in the 751-member European Parliament. This Parliament will make crucial decisions for the Union over the next five years that will include border control, national autonomy, and Britain’s relationship with the EU. This is the world’s second largest democratic vote (after India’s general election) and while turnout tends to be low, the races are tight. This year, we could see greater than usual participation. The nationalist euro-skeptic movement is growing and many investors are worried that populist parties could make strong headways. By market open on Sunday, we should know whether anti-EU parties gained enough seats to block legislative business. While it is widely believed that anti-EU sentiment will be negative for the euro, populism hasn’t been negative for currencies. Just take a look at the US and Australia: protectionist policies helped rather than hurt the greenback while the Australian dollar surged after the surprise victory by Prime Minister Scott Morrison. Populism is going strong and it hasn’t been a crushing blow for any of these currencies. Does that mean the euro will rise if there’s strong support for Eurosceptic or anti-European groups? It is hard to say but what’s clear is that we can’t assume that their victory will be negative for the currency.

Politics will continue to overshadow economics in the coming week. Euro traded higher despite softer data. According to the latest reports, service and manufacturing activity expanded at a slower pace in Germany and the Eurozone. The German IFO report also declined with the business climate index falling to its lowest level since 2014. The trade war weighed heavily on business sentiment and according to IFO President Fuest, “there is reason to worry, particularly about the manufacturing index.” Markit Economics also noted “subdued business growth amid stagnant demand.” The euro fell in response but the decline in the US dollar sparked a wave of end-of-week profit taking that helped EURUSD end the week higher. German labour market, inflation, and retail sales numbers are scheduled for release this week – we are looking for softer labour market numbers but a recovery in inflation and spending.

AUD, NZD, CAD

Data Review

Australia

- RBA Lowe Puts June Cut on Table if “No Further Jobs Improvement”

- Westpac Leading Index -0.09% vs. 0.28% Previous

New Zealand

- PMI Services 51.8 vs. 52.9 Previous

- Credit Card Spending 4.5% vs. 5.1% Previous

- Retail Sales ex Inflation Q1 0.7% vs. 0.6% Expected

- Trade Balance 433M vs. 450M Expected

Canada

- Retail Sales 1.1% vs. 1.2% Expected

Data Preview

Australia

- Building Approvals – Potential rebound after last month’s sharp decline

New Zealand

- ANZ Business & Consumer Confidence – Could be dampened by trade tensions

Canada

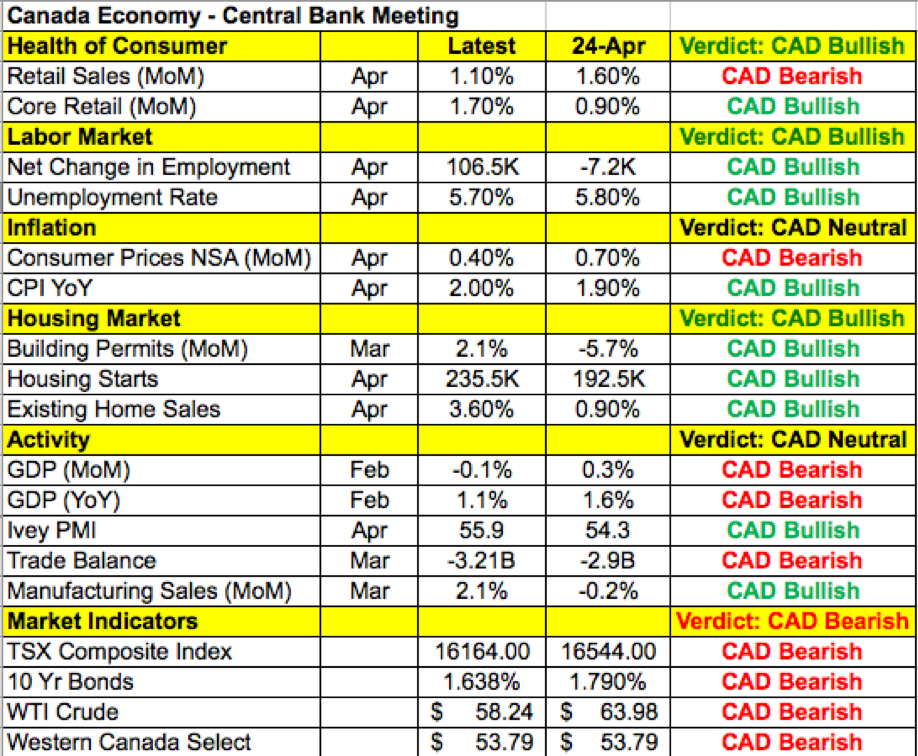

- Bank of Canada – Data improved but trade tensions and equity market volatility could keep central bank cautious

- Quarterly & Monthly GDP – Difficult to predict as weaker trade balance offsets stronger retail sales

Key Levels

- Support AUD .6850 NZD .6500 CAD 1.3400

- Resistance AUD .6950 NZD .6600 CAD 1.3500

What to expect from the Bank of Canada

The second-best performing currency last week was the Australian dollar. This is remarkable considering that Reserve Bank of Australia (RBA) Governor Lowe said it will consider a rate cut in July. They considered two scenarios where easing is appropriate, which is likely if there is no further jobs improvement. For the past few weeks we have argued that the RBA has no choice but to ease after the new Chinese tariffs and we are looking for not one, but two rate cuts this year. The only reason why AUD shrugged off these dovish comments is because easing is widely expected and the slide in AUDUSD from 72 cents to .6850 represents the market’s discount. With the US dollar pulling back and the RBA decision a few weeks away, profit taking and short covering could carry AUDUSD higher in the near term. The same is true for NZDUSD, which rebounded despite lower credit card spending, service sector activity, and trade balance.

USDCAD will be in focus this week with a Bank of Canada monetary policy announcement on Wednesday. According to recent economic reports, the Canadian economy is on fire. April was a record-breaking month for job growth, the housing market is strong, and core retail sales saw strong gains last month. Inflation eased on a monthly basis but is back at 2% year over year. Even the manufacturing sector reported stronger growth. Unfortunately, Canada does not exist in a silo and with the trade war between US and China heating up, oil prices falling sharply and equities sliding lower, the BoC is likely to err on the side of caution which would be a disappointment to CAD bulls. USDCAD tested 1.35 three times this past week and fourth could be the break.

BRITISH POUND

Data Review

- Prime Minister May announces plan to resign June 7

- Rightmove House Prices 0.9% vs. 1.1% Previous

- CPI 0.6% vs. 0.7% Expected

- CPI YoY 2.1% vs. 2.2% Expected

- PPI Input 1.1% vs. 1.3% Expected

- PPI Output 0.3% vs. 0.3% Expected

- Retail Sales 0% vs. -0.3% Expected

- Retail Sales ex Auto -0.2% vs. -0.5% Expected

Data Preview

- Q1 GDP – Potential upside surprise given improvements in trade and retail sales during the first quarter

- Trade Balance & Industrial Production – Potential upside surprise given Carney’s optimism

Key Levels

- Support 1.2600

- Resistance 1.2700

Prime Minister resigns – What does it mean for GBPUSD?

The worst performing currency last week was the sterling. Softer than expected inflation drove GBPUSD to its lowest level in four months, however political uncertainty was the main reason for the pair’s slide. That has now been lifted as we know that Prime Minister May bended to the calls for her resignation. She announced that she will resign on the seventh of June, paving the way for a new leadership election of Tories and a new UK PM to deal with the Brexit drama. Ms May who managed to alienate every faction of UK politics in her quest to deliver a Brexit without consequences was widely reviled by both her party and the opposition. Her departure is cheered but many investors are worried the Tories may elect an even more extreme Brexit leader such as Boris Johnson who could pull the UK out of the EU with no deal whatsoever.

The uncertainty of Brexit will now be replaced by the uncertainty of Tory leadership contest as political headlines will continue to dominate trade in cable. The political situation in cable is made even more toxic by the strong showing of the Brexit party in this week's EU elections and the utter failure of Labour to provide a credible alternative to Ms May's proposals. Labour, which itself is torn between Brexit and Remain forces and is hobbling along under the limp leadership of Jeremy Corbyn - a political figure who is detested almost as much as Ms May - could suffer massive defeat in EU elections, creating a vacuum in UK politics. All of this creates an unstable brew of rivalries and minority fractions in UK Parliament and perhaps creates the prospect of a Boris Johnson leadership going forward. Mr Johnson, a long-standing figure in UK politics with a clownish reputation, is hardly the type of politician to bring calm and order to the markets.

For now, cable has taken the news in stride and the next moves in the pair will be governed by the next round of speculation regarding Tory leadership. The 1.2500 figure will be the key psychological support for the pair while upside will be capped by 1.3000. The reality on the ground is that the UK remains in the EU. Despite the seemingly looming deadline from the EU, that date will likely be extended by the Europeans who have no interest in seeing a chaotic sudden rupture with the UK. Still, the sense of uncertainty has certainly taken its toll on UK business investment and consumer demand, so cable is unlikely to get any lift from eco data as the trade in the pair remains purely political.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.