- English

- 中文版

FX Outlook: Will ECB underdeliver?

Although Fed officials have shared their doubts, investors largely ignored their less dovish comments. And their singular focus on Fed easing is why we believe that further US dollar weakness is likely. With that said, the primary focus this week will be on the euro and the European Central Bank’s monetary policy meeting. The market expects a huge stimulus package, but ECB President Mario Draghi could underdeliver.

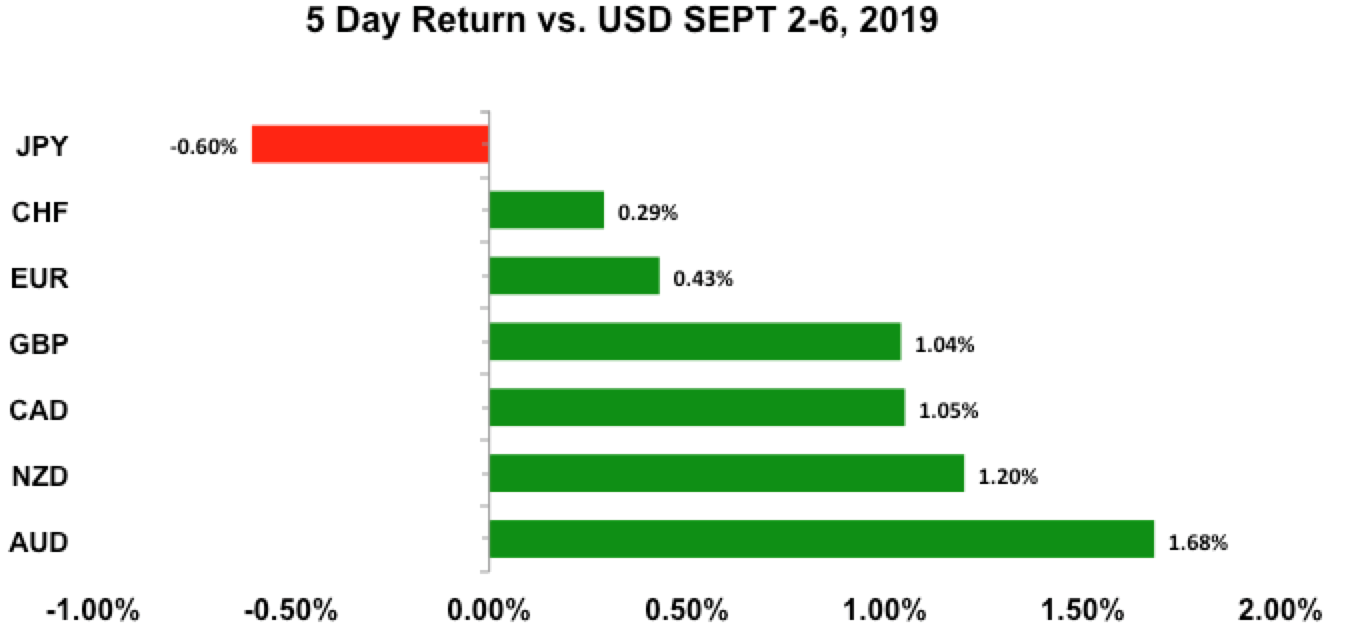

The Australian and New Zealand dollars were the best performers last week, while the Japanese yen was the worst. We expect more outperformance from AUD, NZD and CAD, but USD/JPY could turn lower.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

EURO

Data review

- German manufacturing PMI revised down to 43.5 from 43.6

- EZ manufacturing PMI no revisions to 47

- EZ PPI 0.2% vs 0.2% expected

- German services PMI revised up to 54.8 vs 54.4 expected

- German composite PMI revised up to 51.7 vs 51.4 expected

- EZ services PMI 53.5 vs 53.4 expected

- EZ composite PMI 51.9 vs 51.8 expected

- EZ retail sales YoY 2.2% vs 2% expected

- German factory orders -2.7% vs -1.4% expected

- German industrial production -0.6% vs 0.4% expected

- EZ Q2 GDP 0.2% vs 0.2% expected

Data preview

- ECB expected to ease aggressively in September

- German trade balance: Although there was a minor rebound in PMI manufacturing, the sector is still in deep contraction.

- German CPI revisions: Revisions are difficult to predict, but changes can be market-moving.

- EZ industrial production: Continued declines in German IP point to softer EZ manufacturing activity.

Key levels

- Support 1.0900

- Resistance 1.1100

Will euro rise or fall on ECB?

This week’s monetary policy announcement is the European Central Bank’s biggest meeting of the year. Although Draghi steps down late October, this is his last opportunity to make big measures to support the economy because next month will be his farewell address. Investors are heading into the September meeting with big expectations. There’s been widespread deterioration in the eurozone economy and talk of recession in Germany. Euro hit a two-year low last week against the US dollar, while German bund yields tumbled deeper into negative territory. Draghi promised a combination of measures in July and, as the data worsened, investors prepared for a massive dose of stimulus. They expect the ECB to deliver, but we fear that they could underwhelm.

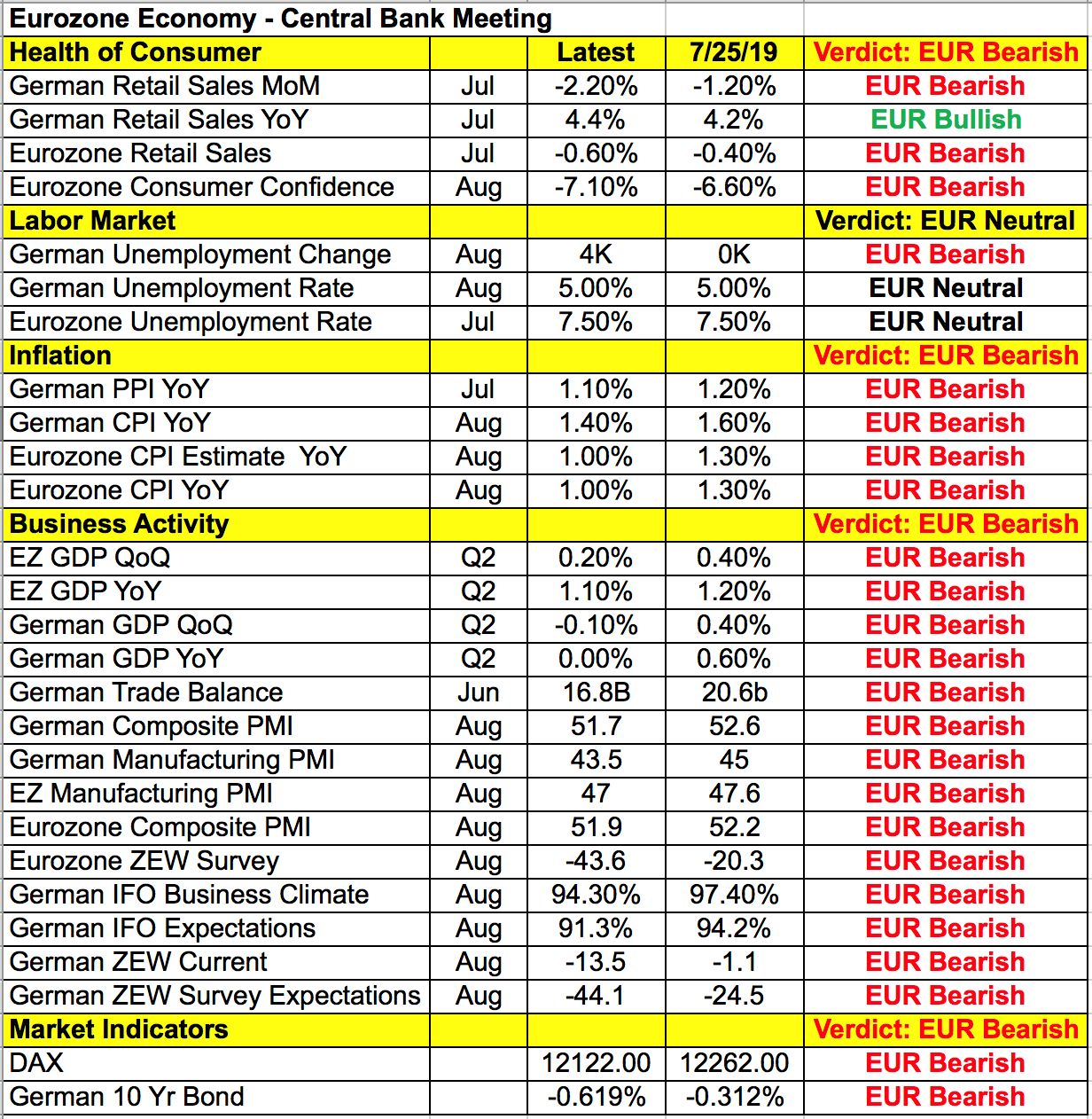

First and foremost, there’s no question that the eurozone economy needs help. There’s a sea of red in following table that compares the changes in the economy since the ECB’s last meeting. Retail sales, inflation employment, trade and manufacturing activity slowed across the region. In Germany, growth contracted in the second quarter. The region’s largest economy is crippled by weak global growth and a collapse in manufacturing. Not only did the PMI manufacturing index fall for the eighth month in a row, but it reached to its weakest level in seven years. The Bundesbank said there’s a very good chance that Germany will fall into a technical recession in the third quarter. With a tense trade war and weakening US and global growth, the grim outlook for the region is why the ECB needs to find ways to stimulate the economy.

The ECB has many options, including a rate cut, stronger forward guidance, a new program of asset purchases, and compensation for banks to relieve the negative effects of negative interest rates. The ECB prefers a combination of measures because they feel that a package is “more effective than a sequence of selective actions.” The market expects a minimum of a 10bp rate cut. If the central bank combines this with rate-tiering or a new quantitative easing program, EUR/USD will sell off aggressively. But if all they do is cut rates and strengthen their low-rate pledge, euro will soar in disappointment. With the euro so weak, less aggressive measures could trigger a sharp short squeeze in the currency. Unfortunately, there’s resistance to a package that includes QE — one of the strongest forms of easing. Bank of France Governor François Villeroy de Galhau is sceptical of the immediate need for QE, while German and Dutch policymakers also believe it’s too early for the move. Given the market’s lofty expectations, EUR/USD traders could be setting themselves up for disappointment. Yet, it’s likely as Draghi could opt for a stimulus package that doesn’t include the most aggressive measures to leave his successor, Christine Lagarde, with ammo to fight a deeper slowdown.

US DOLLAR

Data review

- ISM manufacturing 49.1 vs 51.3 expected

- ISM employment 47.4 vs 51.7 previous

- Construction spending 0.1% vs 0.3% expected

- Trade balance -54bn vs -53.4bn expected

- Beige Book: businesses still optimistic, economy expanded at modest pace

- Challenger job cuts 39% vs 43.2% expected

- ADP employment change 195K vs 148K expected

- Factory orders vs 1% expected

- Durable goods vs 2.1% expected

- ISM non-manufacturing 56.4 vs 54 expected

- Non-farm payrolls 130K vs 160K expected

- Unemployment rate 3.7% vs 3.7% expected

- Average hourly earnings 0.4% vs 0.3% expected

Data preview

- Producer prices: between rise in oil prices and uptick in price component of ISM, upside surprise is possible

- Consumer prices: will have to see how producer prices fare, but gas prices fell in August

- Retail sales: forecasts are low, but potential weakness given drop in Redbook retail sales

- University of Michigan consumer sentiment index: confidence should be dampened by equity market volatility

Key levels

- Support 106.00

- Resistance 107.50

USD: near-term losses, post-FOMC recovery?

Everything we heard from Fed officials suggests that they are reluctant to ease. In our note last week we highlighted all of the comments from Fed Presidents who casted doubt on the need for easing. This hesitance was reaffirmed last week by FOMC voter Eric Rosengren, who said that, “No immediate Fed action is needed if data stays on track.” FOMC voter John Williams feels that the baseline for the economy is continuing strong growth, and he won’t prejudge the outcome of the September meeting. Fed Bank of Dallas President Robert Kaplan agrees that it’s important to continue assessing data ahead of FOMC before judging what type of action to take. This contrasts sharply with a market that believes a 25bp rate cut on September 18 is guaranteed. In fact, Fed fund futures are pricing in an 85% chance of a follow-up move by December. All of this makes us increasingly worried that the market is misjudging the degree of Fed dovishness. The Fed may cut rates in September, but even if they lower interest rates, the accompanying statement could be less dovish.

Last week’s economic reports also support a more even tone from the Fed after a rate cut. Job growth slowed in August, according to the non-farm payrolls report, but average hourly earnings growth accelerated. Only 130K jobs were created, down from 159K, but earnings grew at a 0.4% pace versus 0.3% in July. This was the strongest pace of wage growth in six months. According to the Beige Book, businesses are still optimistic, though trade uncertainty nags. But their concerns haven’t stopped them from paying their workers more. Nonetheless the dollar has weakened, and is likely to remain soft until a strong reason convinces the market that the move in September will be the last one of the year. This week’s inflation and consumer spending reports could do just that. Economists are looking for lower prices and weaker spending, but forecasts are low, so there’s room for an upside surprise.

AUD, NZD, CAD

Data review

Australia

- RBA left interest rates unchanged at 1% in no rush to ease

- PMI manufacturing 53.1 vs 51.3 previous

- Melbourne inflation Index 0% vs 0.3% previous

- ANZ job ads -2.8% vs 0.8% previous

- Current account balance 5.9bn vs 1.5bn expected

- Retail sales -0.1% vs 0.2% expected

- PMI services 51.4 vs 43.9 previous

- Q2 GDP 0.5% vs 0.5% expected

- Trade balance AUD $7268bn vs AUD $7000bn expected

- PMI construction 44.6 vs 39.1 previous

New Zealand

- Q2 terms of trade 1.6% vs 1% expected

- QV house prices 2.3% vs 2.2% previous

Canada

- Bank of Canada leaves rates unchanged at 1.75% in no rush to ease

- Trade balance -1.12bn vs -0.35bn expected

- Net change in employment vs 20K expected

- Full-time employment change vs 17.5 expected

- Unemployment rate vs 5.7% expected

- IVEY PMI vs 54.2 previous

Data preview

Australia

- Business confidence and consumer confidence: will be interesting to see if sentiment is dampened by Chinese growth

New Zealand

- Business PMI manufacturing: sharp drop in ANZ Confidence signals potential weakness in manufacturing

Canada

- Housing starts and building permits: could be better as Bank of Canada notes improvement in policy statement

Key levels

- Support AUD .6800; NZD. 6300; CAD 1.3100

- Resistance AUD .6900; NZD. 6450; CAD 1.3300

No rush to ease for Australia and Canada’s central banks

Unlike their European and American peers, the RBA and the BoC are in no rush to lower interest rates. Both central banks are open to the possibility of further easing, and are aware of significant risks abroad. However, they left policy unchanged because of encouraging signs in their domestic economies. For the RBA, inflation is expected to remain just under 2% over 2020, but growth should strengthen gradually to around trend. They also see upward pressure on wage growth and signs of a turnaround in the housing market that should support spending. Data has also been okay, while retail sales declined in July. The current account surplus was four times greater than expected. Service and manufacturing activity accelerated, as GDP growth and the trade balance beat expectations, validating the central bank’s neutral bias. Looking ahead, as long as there isn’t any trade war-related news bombs, we expect the Australian dollar to extend its gains and outperform its peers as investors find comfort in their immediate plans for steady policy. The New Zealand dollar should follow suit with terms of trade and house prices improving.

The same can be said for the Canadian dollar. According to the latest employment report, the labour market is on fire. More than 81K jobs were created in August, with a nice mix between full- and part-time work. This was the second strongest month of job growth this year and among the third best month for the labour market in the past five years. Reports like this validate the central bank’s neutral outlook. At the last monetary policy meeting, the Bank of Canada said they feel the “current degree of monetary policy stimulus” is appropriate. While they recognise that the escalating trade conflict is affecting Canada’s economy, they also feel that the economy is close to potential and inflation is on target. Growth in the second quarter actually exceeded their forecast, but the strength should be temporary. The housing market is recovering quickly thanks to low rates, and wages have picked up. Eventually, easing may be needed because the BoC believes the economy will slow in the second half. But after today’s jobs report, we know that near-term easing isn’t necessary. Looking ahead, we seek further weakness in USD/CAD, with a potential test of 1.31.

BRITISH POUND

Data review

- PMI manufacturing 47.4 vs 48.4 expected

- PMI services 50.6 vs 51 expected

- PMI construction 45 vs 46.5 expected

- PMI composite 50.2 vs 50.5 expected

Data previews

- Industrial production and trade balance: potential downside surprise given contraction in manufacturing

- Employment report: looking for major weakness because jobs were lost at fastest pace in manufacturing in 6.5 years. In services, it grew by the slowest pace since May.

Key levels

- Support 1.2200

- Resistance 1.2400

GBP recovers as Parliament squashes no-deal option

According to the latest economic reports, the UK economy is hurting from slower global growth and the threat of Brexit. However, none of that mattered this past week as Parliament took their strongest opposition to a no-deal Brexit. A bill aimed at stopping British Prime Minister Boris Johnson from sending the economy into economic chaos passed the House of Lords on Friday. It’s widely expected to receive royal assent on Monday, which would turn it into law. Johnson’s request for a general election was also rejected as the Prime Minister suffered a crushing defeat in Parliament. Sterling traders applauded the outcome by driving the currency higher, as this all but guarantees that Johnson will be forced to delay Brexit. The opposition has put forth the Benn Bill, which would prompt Johnson to ask for an extension until January 2020. Parliament needs to, however, act before they’re suspended in October. If approved, this bill also requires Mr Johnson to write to the European Council. If they respond with a different date, the MPs will decide within 2 days to accept or reject that proposed date. UK labour market numbers are scheduled for release this week, but they’ll continue to take a backseat to Brexit headlines.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.