- English

- 中文版

Margin FX Outlook: What Fed cut means to US dollar outlook

None of the major central banks are in a rush to ease again, which is one of the main reasons why the US dollar strengthened after the FOMC meeting. In some ways the last rate cut was a green light for further US dollar strength, particularly against the Japanese yen. Looking ahead — with the exception of the Reserve Bank of New Zealand’s monetary policy announcement and eurozone PMIs — there are no other major economic reports scheduled for release this week. This means that the existing trends of US dollar strength and commodity currency weakness could persist to month end.

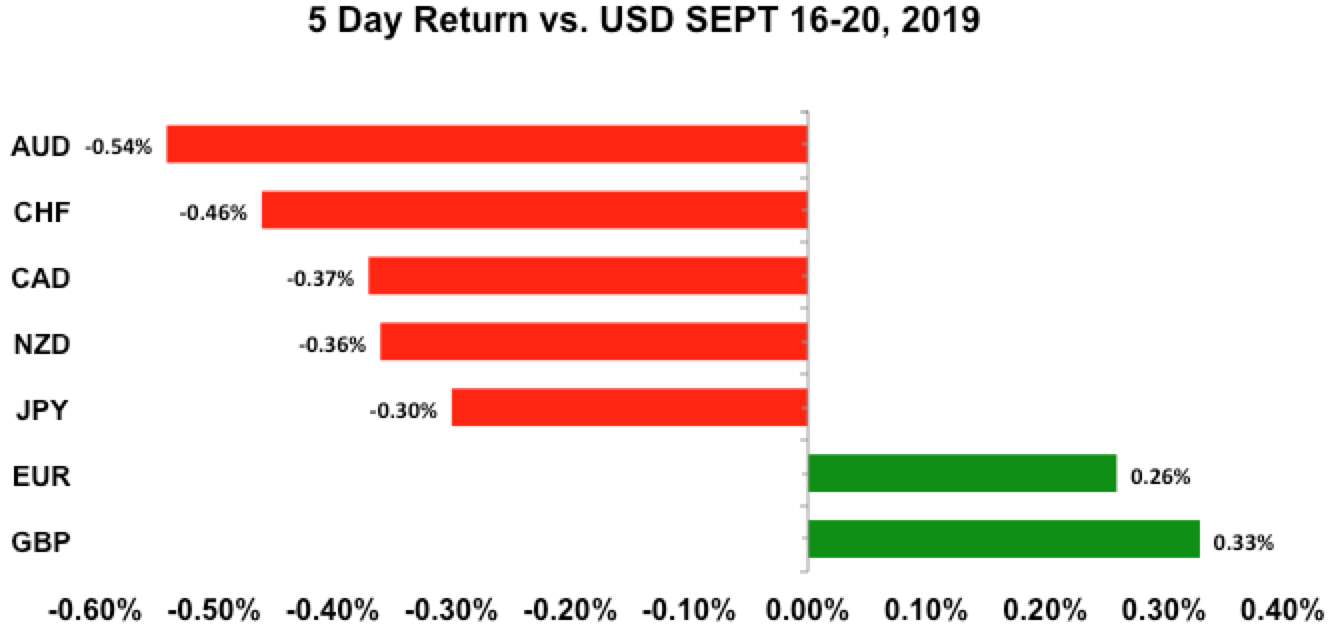

Sterling was the best-performing currency last week, rising strongly after European Union President Jean-Claude Juncker said, “We could have a deal and Brexit will happen.” The Australian dollar was the worst performer, as economic data missed expectations and China cut its US farm visits shortly after US President Donald Trump said he doesn’t need a trade deal before the 2020 elections.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- Fed cuts interest rates 25bp; two dissents

- Empire State manufacturing 2 vs 4 expected

- Industrial Production 0.6% vs 0.2% expected

- NAHB housing market index 68 vs 66 expected

- Housing starts 12.3% vs 5% expected

- Building permits 7.7% vs -1.3% expected

- Philadelphia Fed survey 12 vs 10.5 expected

- Existing home sales 5.39m vs 5.38m expected

- Bank of Japan leaves policy unchanged, hints of October easing

Data preview

- S&P CaseShiller house prices: prices should benefit from lower interest rates

- Conference Board confidence report: Potential strength given prospect of rate cut and uptick in the University of Michigan sentiment index

- New home sales: potential upside surprise given stronger existing home sales, building permits and housing starts

- Q2 GDP revisions: Changes are usually made but difficult to handicap

- Pending home sales: Should be stronger given rise in building permits and housing starts

- Personal income and spending: higher wages not met by stronger spending

Key levels

- Support 107.00

- Resistance 108.50

Hawkish Fed cut drives US dollar higher, but trade tensions loom large

For the second time this year, the Fed lowered interest rates by 25bp, to a range of 1.75% to 2%. This widely anticipated move failed to hurt the dollar because two members voted in favour of steady rates and no easing. The hawkish cut was a big disappointment for President Trump and anyone else that hoped for more aggressive action by the central bank. Fed Chair Jerome Powell remained tight-lipped on future policy changes, adding to the dollar’s gains. But the rally was short-lived because of ongoing trade tensions. USD/JPY fell hard after China cut its US farm visits short. Trade winds are shifting week to week, and they moved back in a southwardly direction after President Trump said he doesn’t need a trade deal before the 2020 election. Vice President Mike Pence also said the era of economic surrender is over.

According to the FOMC statement, the labour market and household spending are strong, job gains solid, and economic growth moderate. The Fed acknowledged that exports, however, weakened and noted additional slowdown abroad. That said, these exogenous risks weren’t material enough for FOMC voters Esther George and Eric Rosengren to support easing. According to the dot plot, Fed officials are split on whether additional action is needed. Five members didn’t favour a cut this month; five approved of the cut but see no more easing this year; and seven see one more cut. This divisiveness is the main reason why Powell said the Fed isn’t on a preset course, is highly data dependent, and will look at what’s needed carefully meeting by meeting. He said if the economy weakens further, “more extensive cuts may be needed,” but for the time being more members favour steady policy for the rest of the year. In their small way, future traders agree as rate cut expectations fall to 68% from 100% at the start of the month. The Bank of Japan also left monetary policy unchanged, maintaining their view that accommodation needs to remain in place. They hinted of easing in October, when, they said, “It’s becoming necessary to pay closer attention to the possibility that the momentum toward achieving the price stability target will be lost… The Bank will re-examine economic and price developments at the next (monetary policy meeting), when it updates the outlook for economic activity and prices.”

Last week’s mixed economic reports reinforced the unclear outlook for the Fed. While manufacturing activity slowed in the New York and Philadelphia regions, industrial production accelerated and housing market activity improved. Looking ahead, we expect improvements in most of this week’s economic reports, but the impact on the greenback should be limited.

EURO

Data review

- German ZEW survey current -19.9 vs -15 expected

- German ZEW expectations -25.5 vs -38 expected

- EZ ZEW survey -22.4 vs -43.6 expected

- EZ CPI 0.9% vs 0.9% expected

- GE PPI 0.5% vs -0.2% expected

- SNB leaves rates unchanged and provides relief to banks

Data preview

- German and EZ PMIs: Should be weak given weaker industrial production and factory orders. ZEW current conditions also fell.

- German IFO: will need confirmation from PMIs, but IFO should be softer because of weaker industrial production and factory orders

- EZ confidence: while the ECB’s aggressive stimulus is euro bullish, weaker data should keep sentiment weak

Key levels

- Support 1.0900

- Resistance 1.1100

Euro may stay range bound

Even with monetary policy announcements by the Fed and ECB, EUR/USD has been confined in a range this month. It hit two-year lows on two occasions but bounced strongly off 1.0950. Even the hawkish cut from the Fed failed to yield a meaningful reaction in euro. A lot of this has to do with the fact that both central banks eased this month and are now in wait-and-see mode. The German and eurozone economy weakened significantly this year, but the hope is that the central bank’s aggressive measures will mitigate a deep recession and stimulate the economy. Analysts seem to agree based on the sharp improvement in the expectations component of the German and eurozone ZEW survey. The problem for the euro is that it could take some time before the economy feels the effects of cheap money. This makes this week’s PMI reports, which tell us how various economies have been performing, so important. They could be subdued after weaker German industrial production and factory orders. The levels to watch in EUR/USD are 1.0925 to the downside and 1.11 on the upside. If either of these levels breaks, we’ll see a much more significant trend emerge. Euro will also be sensitive to Brexit news. If there are positive developments on the Northern Ireland border, sterling and euro will rally. Meanwhile the Swiss franc traded sharply higher after the Swiss National Bank bowed to the pressure of banks by providing relief to negative rates.

BRITISH POUND

Data review

- Bank of England leaves rates unchanged and says Brexit delay hurts growth

- Rightmove house prices -0.2% vs -1% previous

- Consumer price index 0.4% vs 0.5% expected

- Consumer price index YoY 1.7% vs 1.9% expected

- Producer price index output -0.1% vs 0.2% expected

- Producer price index input -0.1% vs 0.2% expected

- Retail sales -0.2% vs 0% expected

- Retail sales ex autos -0.3% vs -0.3% expected

Data previews

No major data

Key levels

- Support 1.2300

- Resistance 1.2600

Deal or no deal? For Cable, 1.2500 will tell the story

The BoE left monetary policy unchanged last week and warned that the Brexit delay will hurt growth. Nonetheless, Cable hit fresh multimonth highs on continued optimism regarding Brexit negotiations. Late last week EU President Juncker sounded more conciliatory when he said, “We can have a deal,” and “Brexit will happen.” He said a “no-deal Brexit would be catastrophic,” and he was “doing everything he can to get a deal.” Yet, the news out of Brussels was that there were no new proposals from the UK. As we noted last week, we believe that Irish border sovereignty will be sacrificed for the sake of Brexit, as British Prime Minister Boris Johnson and his allies realise that unless they accept the EU terms there may never be a Brexit at all.

The Northern Ireland border issue was always a political sideshow with no economic benefit to the Brexiteers. The far bigger prize of leaving the EU while remaining in the customs union has already been secured in negotiations, and, if Mr. Johnson doesn’t accept that deal, he’ll be forced to ask for an extension as mandated by Parliament law. This in turn will likely turn into calls for a second referendum, which the Brexiteers could easily lose. Thus, the sudden pickup in diplomatic activity between the UK and EU, and UK and Ireland, suggests that Mr. Johnson and his allies are merely looking for some face-saving gesture on the Northern Ireland border issue so that they can complete the Brexit deal.

The general sense of the market is that Johnson is playing for time, and no serious efforts may happen until after the party conferences this week. The UK Supreme Court will also be ruling on the constitutionality of the prorogation of Parliament. Should Johnson lose that case, the chance of a hard Brexit spin-out will likely decline. Still, at this point the whole Brexit deal has come down to the Northern Ireland border issue. The Brexiteers realise that if they want to exit, they’ll need to scrap sovereignty claims one way or the other. Cable continues to perform well, but the 1.2500 - 1.2600 zones are proving to be more stubborn resistance with lots of overhead supply from months past. We don’t think the pair has much upside left if the political state of play remains unchanged.

AUD, NZD, CAD

Data review

Australia

- Reserve Bank of Australia says it’d ease monetary policy further if needed. Risks to global economic outlook are to the downside.

- House price index -0.7% vs -1% expected

- Westpac leading index vs -0.28% vs 0.15% previous

- Employment change 34.7K vs 15K expected

- Unemployment rate 5.3% vs 5.2% expected

- Full-time employment change -15.5K vs 34.5K previous

New Zealand

- PMI Services 54.6 vs 54.8 previous

- Westpac Consumer Confidence 103.1 vs 103.5 previous

- Q2 GDP QoQ 0.5% vs 0.4% expected

- Q2 GDP YoY 2.1% vs 2% expected

Canada

- Existing home sales 1.4% vs 1.3% expected

- Manufacturing sales -.13% vs -0.1% expected

- CPI MoM -0.1% vs -0.2% expected

- CPI YoY 1.9% vs 1.9% expected

- Retail sales 0.4% vs 0.6% expected

- Retail sales ex auto -0.1% vs 0.3% expected

Data preview

Australia

- No major economic reports

New Zealand

- RBNZ rate decision: no changes in interest rates expected

- Trade balance: potential upside surprise given marginal improvement in manufacturing activity

Canada

- No major economic reports

Key levels

- Support AUD .6700; NZD .6200; CAD 1.3200

- Resistance AUD .6900; NZD .6350; CAD 1.3350

No action expected from RBNZ

All three of the commodity currencies traded lower last week, with the Australian dollar leading the slide. Economic data from Australia and New Zealand were mostly disappointing, with the unemployment rate in Australia ticking up on the back of full-time job losses. According to the latest report, 34.7K jobs were created in August — more than double expectations. However, all of the job growth was in part-time work, as more than 15K full-time jobs were shed. This is never a healthy mix for the labour market. But the negative impact on the Australian dollar was exacerbated by the uptick in the unemployment rate. The RBA left interest rates unchanged at their last meeting but admitted that the risks to the global economic outlook is tilted to the downside. In the minutes released last week, they said they’d ease monetary policy further if needed. The jobs report is a worrying sign that could push the RBA into action if it persists and is accompanied by a slowdown in service and manufacturing activity. We expect further losses in AUD/USD in the coming week, with the pair vulnerable to a test of its August lows below 67 cents.

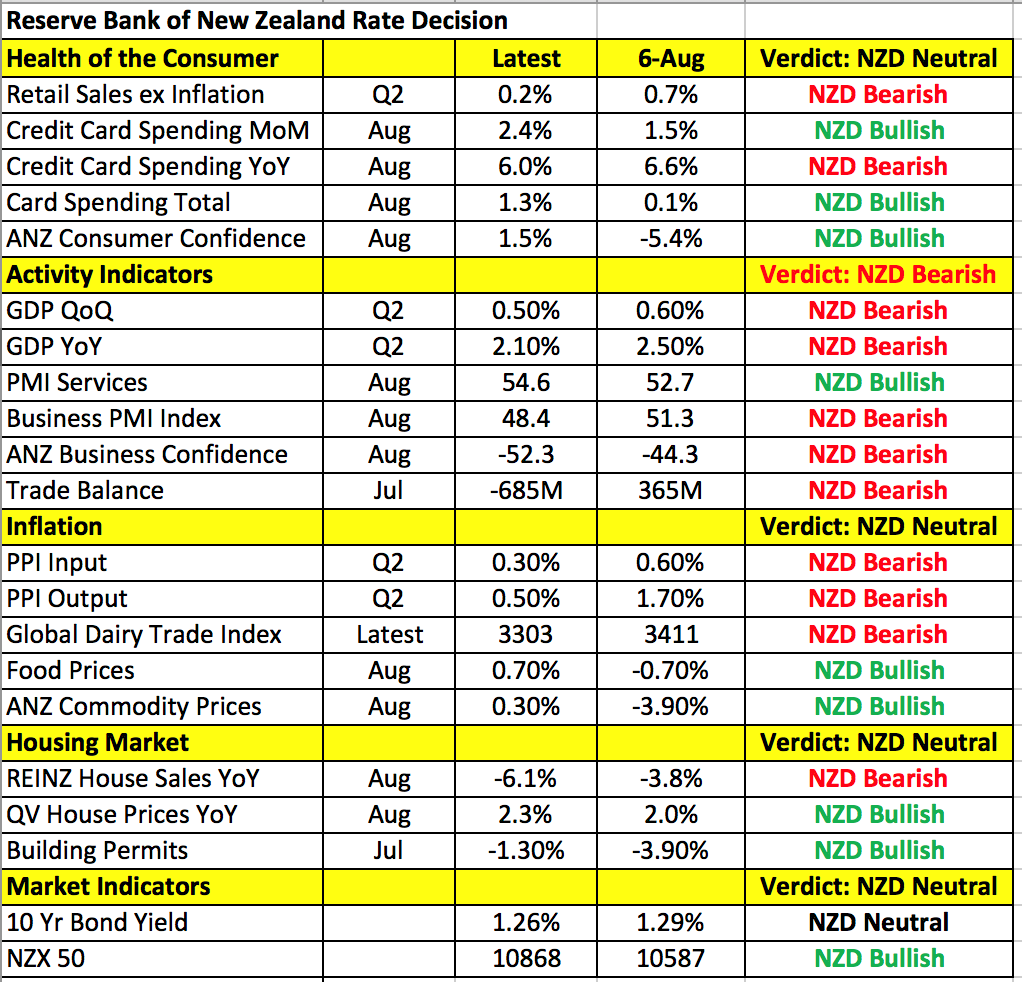

New Zealand data also fell short of expectations, with Q2 GDP growth, service sector activity, and consumer confidence weakening from the previous period. The RBNZ has a monetary policy meeting this week, and no changes are expected from the central bank. After surprising the market with a 50bps rate cut in August over the forecasted 25bps, the RBNZ won’t be in a rush to ease again. While the central bank suggested that further easing may be in store as the neutral interest rate declined, back-to-back rate reductions isn’t necessary. For the RBNZ, their greatest concerns are lower GDP growth, rising headwinds, and easing demand for New Zealand’s goods and services. Since August we’ve seen mixed spending numbers, weaker manufacturing, softer GDP growth, a surprisingly large trade deficit, and lower inflation. Yet, housing data improved along with consumer confidence. For NZD, the question won’t be whether the central eases but on the tone of the monetary policy statement. If it’s unquestionably dovish, NZD/USD will extend to 10-year lows. But any hint of optimism — and the deeply oversold currency could reverse sharply higher.

USD/CAD traded higher four out of the last five trading days. The weakness mostly had to do with oil, which came off its highs. Despite the Bank of Canada’s optimism, the latest Canadian economic reports were disappointing, with inflationary pressures easing and retail sales growth slowing. The BoC may be the least hawkish central bank, but the cracks in Canada’s red-hot economy is beginning to show.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.