- English

- 中文版

FX Outlook: Markets crash. Trade fears realised. What’s next?

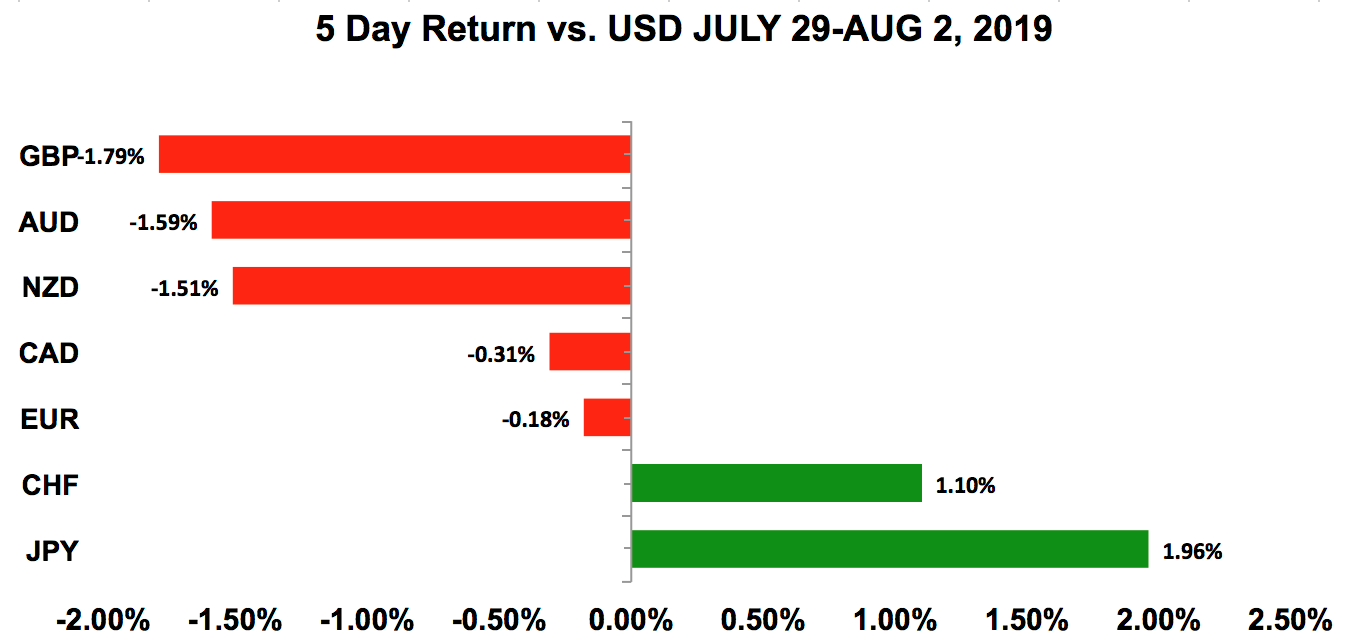

The greatest fear of investors, economists and central bankers were realised when President Trump announced fresh tariffs on China. In response, Beijing pledged to retaliate, saying they refuse to succumb to maximum pressure, threat or blackmailing. The markets are suffering as both sides double down on the trade war. The rapidly deteriorating relationship between the US and China has consequences for many countries, and will necessitate the continued global synchronisation of monetary policies. For the forex market, this means more dovishness for central banks, interest-rate cuts, and broad-based weakness in major currencies.

The US dollar dropped to a year-to-date low against the Japanese yen last week. But risk aversion resulted in major losses for the Australian and New Zealand dollars. AUD/USD fell to a 2019 low, and we expect it to hit a fresh 10-year low at the start of this week. EUR/USD dropped to a one-year low after the FOMC rate decision, but rebounded after Trump’s announcement. US-China trade tensions will remain a big theme this week, particularly for with the Reserve Bank of Australia and New Zealand monetary policy announcements. This latest development pushes both central banks to lower rates.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- Fed cuts rates by 25bp. No immediate need to cut again.

- Personal income 0.4% vs 0.4% expected

- Personal spending 0.3% vs 0.3% expected

- PCE deflator 0.1% vs 0.1% expected

- Pending home sales 2.8% vs 0.5% expected

- Consumer confidence 135.7 vs 125 expected

- ADP employment change 156K vs 150K expected

- Challenger job cuts 43.2% vs 12.8% previous

- ISM manufacturing 51.2 vs 52 expected

- ISM employment 51.7 vs 54.5 previous

- Non-farm payrolls change 164K vs 165K expected

- Unemployment rate 3.7% vs 3.6% expected

- Average hourly earnings 0.3% vs 0.2% expected

- Trade balance -55.2bil vs -54.6bil expected

- Factory orders 0.6% vs 0.7% expected

- University of Michigan Sentiment Index 98.4 vs 98.5 expected

Data preview

- ISM non-manufacturing index: potential downside surprise given lower non-farm payroll growth

- Producer prices: potential downside surprise given lower oil and gas prices

Key levels

- Support 106.00

- Resistance 108.00

USD: Dne and done? Not so fast.

The US dollar would have been one of the strongest currencies this week had President Trump not announced additional tariffs on China. But when he did, the outlook for the greenback completely changed. Some will argue that he made the announcement a day after the Fed decision because he was unsatisfied with the rate cut. This isn’t a stretch, considering that almost immediately after the central bank lowered rates, Trump said, “Powell let us down.” Timing aside, the announcement is a game-changer for the US dollar. Last month, the positive outcome of G20 and continuation of trade talks gave everyone hope that the talks were moving in the right direction, which allowed stocks to climb to record highs. Trump, however, opted to impose an additional 10% tariff on US$300bil in Chinese imports starting next month and “tax the hell out of China” until a deal is reached. He also warned that tariffs could go well beyond 25% on items such as smartphones, computers and children’s clothing. China’s responded hard — they vowed to take necessary countermeasures, and said they wouldn’t “accept any maximum pressure, threat or blackmailing, and won’t compromise at all on major principle matters.” These antagonistic comments are a sign that trade tensions will worsen, and China, along with the entire Asia Pacific region, will suffer as a result. US consumers will feel the pain through higher prices and lower equity values. The profits of US businesses will be pinched further, leading to weaker earnings next quarter, less business investment and hiring.

Trump’s trade war could tip the scale for the Fed. The US central bank lowered interest rates by 25bp for the first time since 2008 last week. Initially, the US dollar rallied because two members voted to keep rates unchanged, while Powell downplayed expectations for a follow-up move. According to Powell, last week’s rate cut was aimed at boosting inflation and insuring against downside risks, because even with global uncertainty and trade concerns, the Fed feels that the outlook for the economy is favourable. Powell went out of his way to focus on the labour market’s strength, recent uptick in retail sales, and overall resilience in the economy. Although he cited some weakness in manufacturing, he also said the economy is as close to its goals as it’s been in a long time. There was no forward guidance in his prepared comments. But during the Q&A session, he said this isn’t the start of a long easing cycle, and they could cut again if the time comes. This is true for not just the Fed but also the Bank of Japan, which maintained its current pace of bond buying.

Investors think that time will come sooner rather than later. Fed fund futures are pricing in a 100% chance of another 25bp cut in September. This is a big change from the 60% chance after FOMC on Wednesday — and is ambitious in our books. If the tariffs are imposed on Sept 1, we’ll see another rate cut this year but probably not until October or December, depending upon how far the markets fall in the next 45 days. But, as we’ve seen on many occasions, anything can happen between now and then. If the markets fall too much, Trump could retract his threat and put the tariffs on hold. We don’t expect a positive turn next week, so the US dollar and risk currencies are vulnerable to deeper corrections. USD/JPY is destined for a drop below 106, in a move that could extend as low as 105.

AUD, NZD, CAD

Data review

Australia

- Building approvals -1.2% vs 0.2% expected

- Q2 CPI 0.6% vs 0.5% expected

- Q2 CPI YoY 1.6% vs 1.5% expected

- PMI manufacturing 51.3 vs 49.4 previous

- Q2 PPI 0.4% vs 0.4% previous

- Retail sales 0.4% vs 0.3% expected

- Q2 retail sales 0.2% vs 0.3% expected

New Zealand

- Building permits -3.9% vs 13.5% previous

- ANZ Business Confidence -44.3 vs -38.1 previous

- ANZ Consumer Confidence -5.1% vs 2.8% previous

Canada

- GDP 0.2% vs 0.1% expected

- GDP YoY 1.4% vs 1.3% expected

- Trade balance 0.14bil vs -0.3bil expected

Data Preview

Australia

- RBA rate decision: no changes in rates are expected, but intensified trade war could make RBA dovish.

- PMI services: potential upside surprise as manufacturing activity accelerated

- Trade balance: potential upside surprise given rise in manufacturing PMI

New Zealand

- RBNZ rate decision: Market is looking for 25bp, but could be a tough call.

- Q2 employment report: Labour market conditions are tough to predict this month. Manpower employment index increased, but business confidence dropped and employment component of PMI fell.

Canada

- IVEY PMI: potential downside surprise given drop in prices and retail sales

- Employment change: will have to see how IVEY PMI fares, but slightly firmer numbers expected

Key levels

- Support AUD .6700; NZD .6450; CAD 1.3100

- Resistance AUD .699; NZD .6600; CAD 1.3250

Will RBA and RBNZ cut rates?

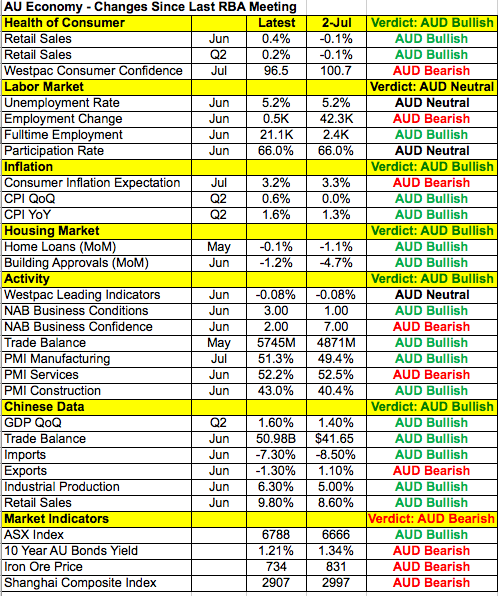

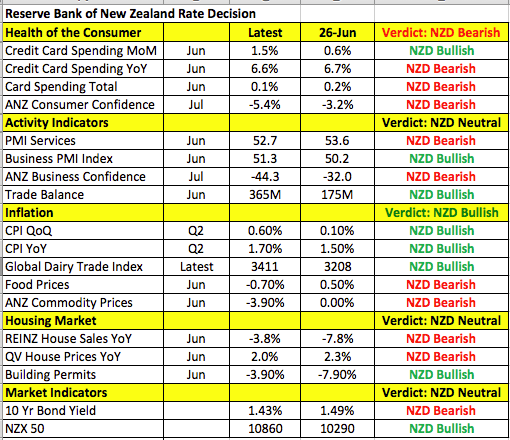

The Australian and New Zealand dollars were hit from all sides last week. The weakness started with US dollar strength, and was magnified by US equity market weakness. The last push lower came on the back of US tariffs. While none of this had to do with Australia and New Zealand directly, the rise in the greenback, as well as return of risk aversion and the tariffs impact their economies through weaker Chinese and global growth. Investors have been selling both currencies aggressively as AUD/USD closed out last week, with the eleventh straight days of declines. There’s been no meaningful rally in NZD/USD since July 19. This week, the Reserve Banks of Australia and New Zealand have monetary policy announcements, and many investors are wondering if the trade tariffs will tip the RBA and RBNZ over the edge. The market is pricing a 25bp rate cut by the RBNZ, but no action is expected for the RBA.

The last time the RBA met, they lowered interest rates for the second time this year to a record low of 1%. RBA Governor Philip Lowe said, “The board is prepared to adjust interest rates again, if needed, to get us closer to full employment and achieve the inflation target.” Economists aren’t looking for three back-to-back rate cuts, because there have been more improvements than deterioration in Australia’s economy since the last monetary policy meeting. Retail sales and inflation are up, full-time employment rose strongly in June, and manufacturing activity is improving. Believe it if you will, but Chinese data also ticked higher. So, based on Australia’s economic performance alone, another immediate rate cut isn’t needed. However, the tariffs on China are a game-changer that will harden the RBA’s dovish bias. Like the last cut, they’ll probably choose to wait until the tariffs come into effect before they ease. But that may not stop the AUD from falling further.

The RBNZ, on the other hand, could lower interest rates. The last time they cut was in May. When they met in June, they said, “Lower interest rates may be needed given the downside risks.” They were worried about the global outlook, domestic demand, house prices and business investment. Taking a look at these same measures, spending has weakened since the last month, house prices fell further, the global outlook deteriorated significantly, and, with the new tariffs, business investment is likely to contract further as business confidence falls to a one-year low. The arguments are there for a rate cut and, based on the decline in NZD/USD, investors have priced the move in. So, the main question is whether the RBNZ sees the need to take interest rates down to 1% later this year. We think they’ll have no choice but leave the door open to more easing. The language of their monetary policy statement will, however, give us a better sense of how close they’re to lowering rates again.

USD/CAD shrugged off stronger GDP and trade data to rise to a high of 1.3265 last week, on the back of risk aversion. In the week ahead, it may be difficult for loonie traders to ignore Canada’s economic performance, because IVEY PMI and the employment report are far more market-moving than monthly GDP and trade. At the same time, there are no major US economic reports scheduled for release to distract the currency’s flows.

BRITISH POUND

Data review

- Bank of England leaves rates unchanged and cuts GDP forecast

- Mortgage approvals 66.4K vs 65.8K expected

- Gfk Consumer Confidence -11 vs -13 expected

- Nationwide house prices 0.3% vs 0.2% expected

- PMI construction 45.3 vs 46 expected

Data previews

- PMI services and composite: Even though consumer confidence increased, manufacturing activity was unchanged.

- Q2 GDP: potential downside surprise as trade balance improved slightly, but retail sales were significantly weaker in Q2

Key levels

- Support 1.2000

- Resistance 1.2200

Bank of England leaves policy unchanged and cuts growth forecasts

The BoE voted unanimously to leave interest rates and their asset purchase program unchanged last week. They also lowered their GDP forecast for 2019 and 2020, but raised their inflation forecasts. Their projections don’t include the possibility of no deal, and is based on the central bank lowering interest rates 25bp by early 2020. According to the central bank, there’s a lot of uncertainty that could lead to a wide range of paths. But if their forecast is met and a smooth Brexit occurs, that’d mean gradual rate hikes. BoE Governor Mark Carney’s comments weren’t as upbeat as the Quarterly report or monetary policy statement. He acknowledged that the chance of a no-deal Brexit has risen, felt that financial conditions remain volatile, and warned that trade tensions are having a larger-than-expected impact on the UK economy. As a result, underlying growth is now below potential, with investment likely to fall further in the third quarter. Sterling shrugged off these concerns, because even with Carney’s comments, investors were encouraged that rate hikes are still on the table for the BoE. Looking ahead, UK PMIs and GDP are scheduled for release this week, but sterling should take its cue from the market’s appetite for US dollars. If the greenback continues to fall, we could see a near-term bottom in GBP/USD, with the pair moving back up to 1.23.

EURO

Data review

- GfK Consumer Confidence 9.7 vs 9.7 expected

- Economic confidence 102.7 vs 102.6 expected

- German CPI 0.5% vs 0.3% expected

- German retail sales 3.5% vs 0.5% expected

- German unemployment change 1K vs 2K expected

- EZ GDP 0.2% vs 0.2% expected

- EZ GDP YoY 1.1% vs 1% expected

- EZ CPI core 0.9% vs 1% expected

- German manufacturing PMI revised up to 43.2, from 43.1

- EZ PPI -0.6% vs -0.3% expected

- EZ retail sales 1.1% vs 0.3% expected

Data preview

- EZ PMI revisions: Revisions are hard to predict, but changes will be market-moving.

- German industrial production and factory orders: potential upside surprise given upward revision in German PMI

- German trade balance: potential upside surprise given upward revision in German PMI

Key levels

- Support 1.1000

- Resistance 1.1200

Euro: A laggard Before ECB

The outlook for the euro is a challenging one. The single currency ended last week unchanged against the US dollar, despite better-than-expected retail sales, as well as inflation, manufacturing and confidence numbers. After hitting a one-year low post-FOMC rate decision, Trump’s tariffs sent EUR/USD higher. The pair is driven exclusively by the lack of demand for US dollar. But the trade tariffs aren’t good for the eurozone, and that’ll be important to remember. Euro is a risk currency, and the sharp sell-off in stocks should have driven it lower. The European Central Bank is also expected to unleash an aggressive round of easing next month, and their resolved will be hardened by the trade tariffs. The euro should underperform and, while EUR/USD rallied towards the end of last week, the risk is still to the downside because Europe will be hit harder than the US by trade tensions.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.