- English

- 中文版

The Daily Fix: Aussie earnings and Apple guidance take centre stage

This condition would dictate that Britain would fall in line with EU standards on certain considerations, such as labour market conditions or environmental rules - so it makes little sense to be truly aligned and in their minds, shackled, here. Either way, GBP bulls want to see homogenous dialogue, sunshine and lollipops, as the two sides try and thrash out terms for the future relationship that is not quite the case just yet.

GBPUSD has attracted the flow in the last few hours, although its light and at this stage the pair is barely holding the 1.30 figure and Friday’s low of 1.3001 - a break here takes the pair into 1.2950. GBPCAD sellers are having a good day of it so far, with the CAD benefiting from a further 0.5% gain in crude into $52.33, although crude futures trade has been unsurprisingly light ahead of the early close, and we now await the re-set. GBP traders will be focused on tonight’s UK jobs data (20:30 AEDT), where the ILO unemployment rate change and claimant count could be good for a few pips either side and it shouldn’t be a material concern for those holding GBP exposures over the numbers.

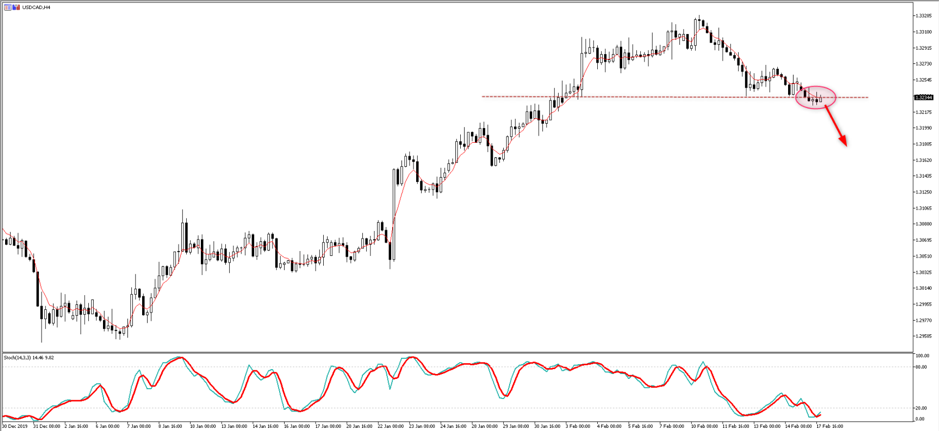

USDCAD looks interesting, with the four-hour chart showing price moving into a session low of 1.3224 and breaking below the 1.3234 floor, which is now being re-tested – if the sellers kick this one lower from here it could be quite telling and open up a move into 1.3150 area. EURCAD remains the solid short, as does EURMXN, which has been the carry trade favourite, given the high real yield on offer in Mexican bond markets. EURUSD has predictably done very little, although we look into upcoming European trade with the closely-watched ZEW survey due at 21:00 AEDT. The market believes the ‘expectations’ survey should weaken a touch to 21.5 (from 26.7), with the ‘current situation’ survey expected to move a touch lower to -10 (-9.5).

EUR shorts are numerous and crowded these days, so we need new news to feed the beast, so should we get a better number (less bad) then it may be good for a 20-30 pips upside move in EURUSD. The 5-day EMA has defined the trend lower since 5 February, so until price can print a daily close above here, then traders will be leaning against this average to ride this bearish trend lower. That said, it feels like the big move has played out for now and we are at risk of some scrappy sideways price action for the next few days, with the market then perhaps taking another leg lower when we get some rather pathetic EU/German manufacturing PMI numbers on Friday.

Consider the Italian MIB (closing up 1%) and Spanish IBEX (+0.7%), as both command attention, despite often getting overlooked by traders in favour of the German DAX - both are grossly overbought but are the strongest indices out there at this juncture. If European markets are any kind of guide for Asia, then we should be in for a positive open, although, after the 2.3% rally we saw yesterday in the China CSI 300 and 0.5% in the Hang Seng, we may have used up our goodwill, although any weakness seen in the open may offer a buying opportunity given the solid liquidity-inspired rally since 3 February.

Daily chart of the MIB

The ASX 200 should see small buyers, with Aussie SPI futures sitting up 7-points, and again we look to see if the bulls have the impetus to take us through the double top at 7145. That said we are watching Nasdaq and S&P 500 futures (open at 10:00 AEDT) given Apple have just announced they won't meet their March guidance – given what we’ve seen from Foxconn in China should we be surprised?

A big day of corporate earnings means the limited offshore leads will give investors a chance to look more readily at BHP’s 1H20 numbers, which are due shortly, with the market expecting a solid reduction in net debt, while EBITDA should rise by 8-10% (against the PCP), with a sharp focus on its capital return, with the market sensing a dividend of 71c declared. COH is also another market darling, although it has a beta of 0.99 with the ASX200 and overlap the chart of the two and see they move in alignment.

The AUD will be the focus today, with the RBA February meeting minutes due at 11:30 AEDT. The minutes themselves shouldn’t be a volatility event and the rates market shouldn’t move to any great capacity. We know the RBA are on hold for the time being, with the unemployment rate needed to move into and above 5.3% to compel the bank into easing again, hence the weight the market will be putting on Thursday employment data, where the U/E rate is expected to tick up to 5.2%, with 10,000 net jobs created (below the 12-month average of 20,900). Until rates markets reopen we see just a 7% chance of a cut in the March RBA meeting, 22% in April, 37% in May with June a coin toss. The full cut is now priced through to October.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.