- English

- 中文版

The World Health Organisation (WHO) did indeed label the virus outbreak a global health emergency, however, the market is finding solace from the fact they refrained from saying travel restrictions were necessary. Of course, corporates and travellers will make up their own minds here, but the fact the WHO held back from advising foreigners to stay away is a small positive for the perception of China's economics, and certainly relative to what has been discounted into copper and the Treasury yield curve.

The WHO’s main concern resides outside of China, where they are worried about the outbreak of the virus in highly densely populated countries, and cities with less efficient health care systems. This is now what many are watching, with confirmed cases now emerging in countries like India.

China’s data dump has also given us a leg up in risk as well, reminding us that up until the virus gripped markets, China’s improving economics were at the heart of the global economic improvement.

Source: Bloomberg

In the Week Ahead video I touch on AUDJPY 1-week implied vols, which have been contained into 10% and where a break higher would offer a bearish message for equities and alike. That said, we continue to watch USDCNH, especially with the Chinese financial system ready to crank up again, with the prospect of the PBoC flooding the markets with liquidity. As we see, USDCNH is finding sellers into the top of the bear channel and should we see the CNH find further buyers (USDCNH lower) then I could see a situation where AUDUSD moves a tad higher, with risk stabilising in EM FX.

Daily chart of USDCNH

A big if, of course, and when we consider the global economy there are other moving parts to consider such as US ISM manufacturing and N-F payrolls which will be event risks.

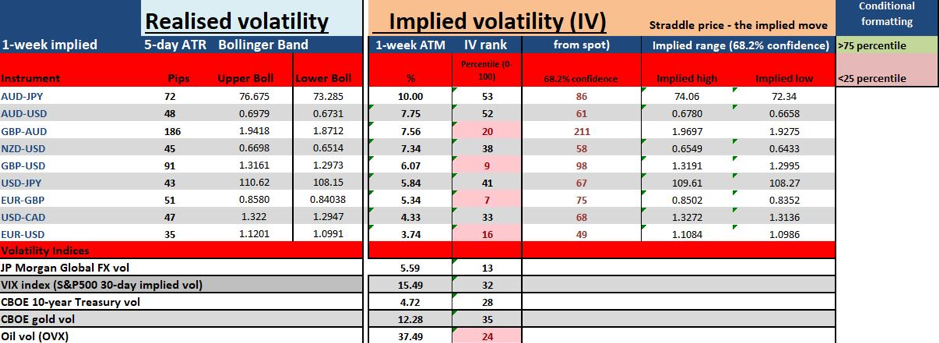

As we see from the Implied vols matrix, vols are a touch higher from last week, something we had anticipated given the dynamics shaping up in the US bond market and while I stay cautious, I will be watching price action and reacting to any possible turn in sentiment. I am watching US politics far more closely this week, with the Iowa Caucus due to start on Monday 8:00 PM EST (12:00 PM AEDT Tuesday). And as highlighted in more depth in the gold outlook video, any situation where Bernie Sanders takes a step closer to the Democrat nominee raises the prospect of traders hedging risk with the likes of gold, JPY and USTs.

Please do click on and watch the video above, which I hope helps prepare traders to best navigate the murky waters ahead.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.