May 2024 BoE Review: Thumbs Up For A June Cut

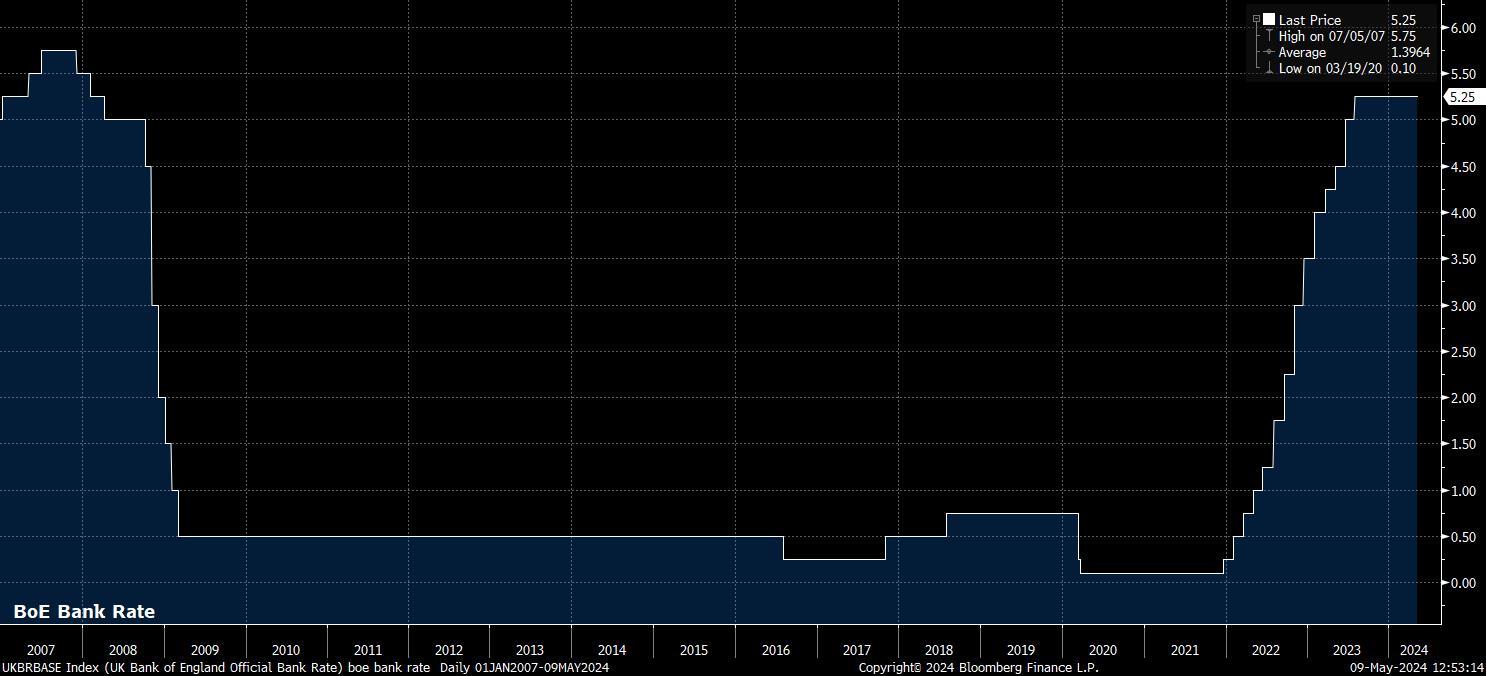

As expected, the Bank of England’s Monetary Policy Committee kept Bank Rate on hold, at 5.25%, at the conclusion of the May policy meeting, in line with consensus expectations, and the outcome that the GBP OIS curve had fully discounted prior to the meeting. Standing pat represents the sixth consecutive meeting at which policy has remained unchanged, with Bank Rate having now stood at a post-GFC high since last August.

With the decision to maintain rates having been fully expected, attention quickly turned to other elements of the Bank’s ‘Super Thursday’ announcement – the vote split, statement, meeting minutes, and latest economic forecasts.

Once again, the MPC was split in its views as to the most appropriate policy action. As with the prior meeting in March, external member Dhingra dissented, in favour of an immediate 25bp rate cut. Interestingly, Dhingra was joined in dissenting this time around by Deputy Governor Ramsden, as some had expected, after recent remarks in which Ramsden noted the downside risks to the UK inflation outlook, while also singling out the UK as a leader in terms of disinflationary progress.

This dissent feels very significant, given that it is highly unusual – though admittedly, not unheard of – for one of the ‘internal’ MPC members to dissent, with the core of the MPC typically voting as a bloc of 5 (Governor, Deputies, and Chief Economist). It seems likely that such a dissent is an attempt to, implicitly, signal that the MPC’s thinking is moving towards when it will be appropriate to deliver the first rate cut. This is a playbook that the MPC have adopted a few times in the past, when signalling the next policy move, without wanting to pre-commit to it.

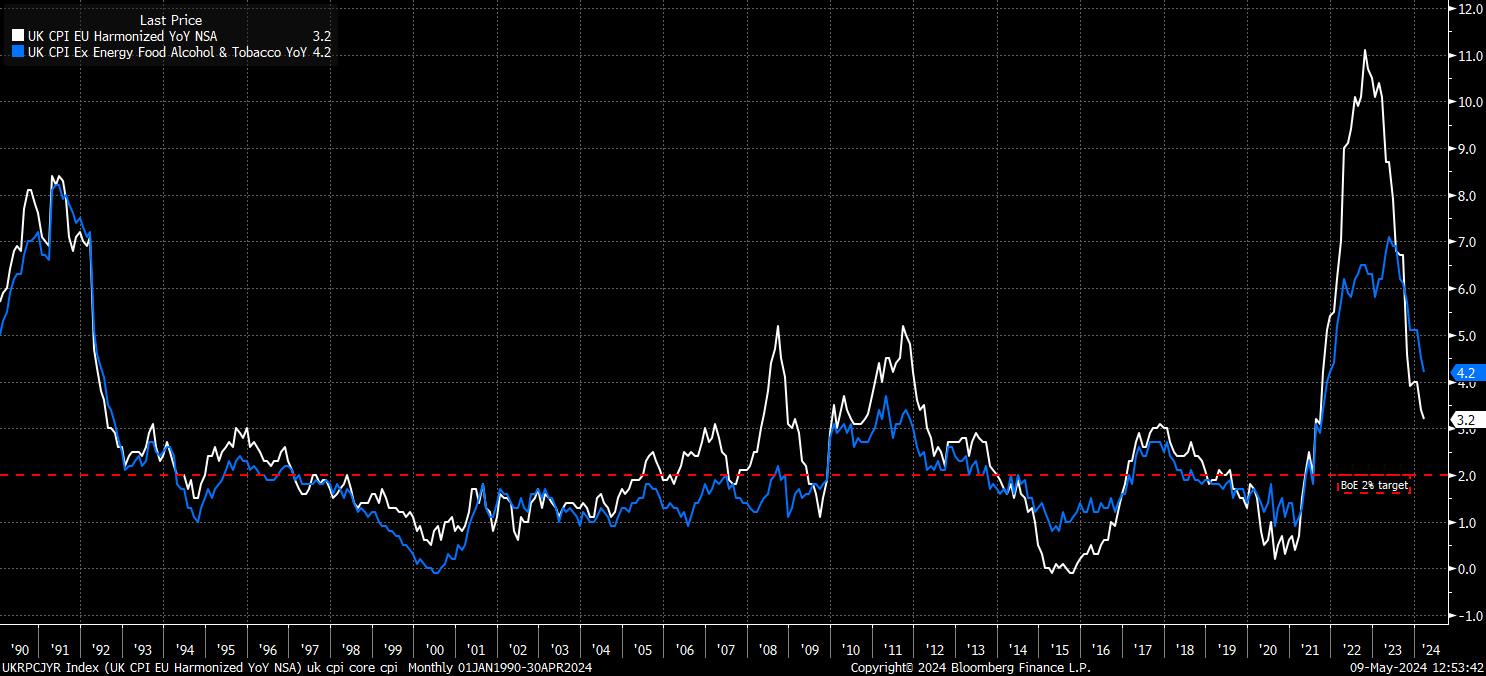

Meanwhile, in terms of the policy statement the MPC reiterated that policy will need to remain “restrictive for sufficiently long” in order to return inflation to the 2% target over the medium-term. The statement also repeated the language from March that policy will need to remain restrictive for an “extended period of time”, though the minutes again alluded to policymakers’ belief that policy will remain restrictive even if Bank Rate were to be reduced.

Perhaps somewhat surprisingly, money markets showed relatively little by way of reaction to the rather dovish vote split, presumably due to the wealth of economic data – 2x CPI prints, and 2x labour market reports – due between now, and the June MPC. The GBP OIS curve continues to price a cut at that meeting as a roughly 50/50 chance, while fully pricing the first 25bp cut by August, and around 60bp of easing by the end of the year.

Turning to the Bank’s latest economic forecasts, inflation, per headline CPI, is expected to fall to the 2% target in the second quarter of this year, as had been foreseen in the February MPR, largely as a result of falling energy prices, before rebounding into 2025. Further out, headline inflation is now seen falling sustainably below the 2% target from the second quarter of 2026.

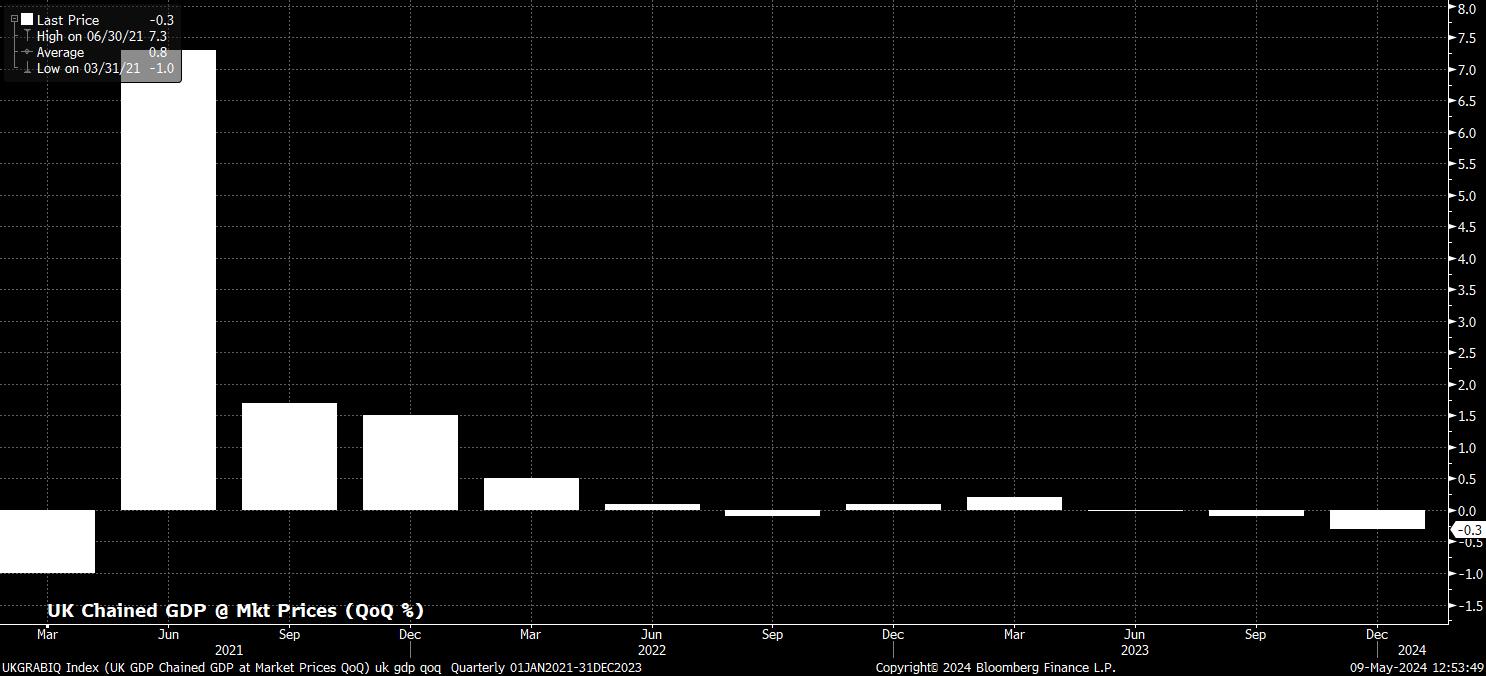

On growth, with the late-2023 recession firmly in the rearview mirror given the UK economy’s strong start to 2024, the Bank now see that recession as having ended, with GDP growth expected at 0.5% this year, 1% in 2025, and at a seemingly over-optimistic 1.25% in 2026.

Lastly, turning to the labour market, the latest unemployment forecast was revised modestly lower compared to that released in February, with joblessness now seen at 4.3% this year, before mostly rising to 4.8% over the forecast horizon, shy of the 5% peak previously expected.

Given ongoing ONS data quality issues, however, with the refreshed Labour Force Survey (LFS) not due to be complete until September, signals stemming from the jobs market remain unreliable, hence developments in the labour market are unlikely to be a particularly significant driver of shifts in BoE policy for some time, even if greater signs of slack have begun to emerge.

At the post-meeting press conference, Governor Bailey sought not to pre-commit to any particular rate path, noting that a June cut is neither “ruled out” nor “planned”. Clearly, the MPC will be guided closely by incoming economic data before the next meeting, with the Governor going to great lengths to stress the importance of two further inflation reports, and two further labour market reports, that will have been released by the time of the next MPC confab.

Despite this data-dependence, Bailey was clear in his belief that it is “likely” that Bank rate will need to be cut over the coming quarters, while also being relatively aggressive in his pushback against market pricing, flagging that it is “possible” rates will fall more sharply than markets currently price. This, of course, opens the door to the possibility of three 25bp cuts this year.

Given the above, it was no surprise to see a relatively dovish cross-asset reaction to the May MPC decision, although market moves were relatively contained on the whole. The GBP softened a touch, with cable dipping around 50 pips, before recovering lost ground. Gilts, meanwhile, rallied across the curve, led by the front end, with 2s ending the press conference around 5bp off pre-decision levels. Finally, London’s FTSE 100 gained some modest ground, briefly notching a fresh intraday record in the process.

In conclusion, the BoE’s reaction function from here is clear. If inflation continues to fall in line with expectations, then the first 25bp cut is coming in June. On the other hand, if data surprises to the upside, then the MPC will likely wait until August before beginning to normalise policy. Either way, beyond the first cut, a relatively cautious pace of easing is likely, with quarterly 25bp cuts a reasonable expectation, resulting in a total of 75bp of cuts this year, and Bank Rate ending 2024 at 4.50%.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_2024-05-09_12-54-00.jpg)